Monitoring Future Risk Is More Critical Than Ever

July 19, 2023

|

|

4 minute read – Risk often comes in pairs, and right now, interest rate risk (IRR) and liquidity risk are the dynamic duo putting pressure on financial institutions’ balance sheets. In looking at paths to address these risks, the options don’t always look that great. In some cases, they may create other issues with earnings and capital and impinge on the organization’s ability to move forward strategically at the needed pace.

Giving the balance sheet time to heal

An approach to consider is to be patient and let your balance sheet heal. An immediate concern from decision-makers might be that being patient looks an awful lot like doing nothing. They worry that examiners won’t like it. Also, the Board and leaders may not be comfortable being passive and feel an understandable desire to “get ourselves out of this situation quickly.”

But the key is that being patient is not doing nothing; on the contrary it’s an active process that requires analysis and monitoring. Given enough time, many sources of IRR and liquidity risk will resolve themselves, but leaders need to understand whether they have the time. This requires a two-step process that includes effective analysis that illustrates whether giving the balance sheet time to heal is a viable option, and beefed-up monitoring to ensure the healing is on pace as the future unfolds.

Step 1: The time horizon for pain – target financial structures bring clarity

To start, see what the interest rate risk and liquidity position will look like at a point in the future if the budget comes true. The budget contains detailed projections for at least the next year or two for a reasonable view into the future. Using year end balances, model a target financial structure that shows the IRR and liquidity positions one or two years down the road.

With this information, decision-makers can evaluate whether patience and giving the balance sheet time to heal is a viable path: How does the model’s assessment of IRR and liquidity look at that point in the future? Is the financial institution better prepared for market rate volatility, or did the financial institution increase its risks? How do the results compare to our policy limits and guidelines? How satisfied are we with the direction and speed of progress? Understanding that positioning today and weighing options with the Board and Management are incredibly valuable.

Step 2: Strong ongoing analysis and monitoring

After the target financial structure analysis, regardless of whether the decision is made to be patient or take action, closely monitoring the IRR and liquidity situation of the current balance sheet as the future unfolds is critical to make sure the results are following your desired path.

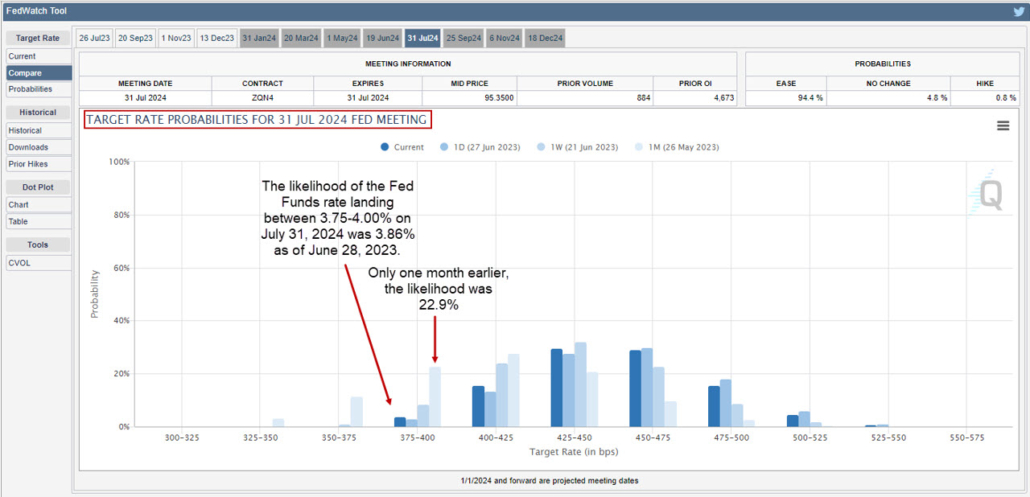

Things are happening fast. Expected changes in interest rates are still fluctuating, which means that a range of interest rate environments should be modeled for better decision-information.

Given how quickly the environment is changing, many institutions are moving to beef up their monitoring of current IRR and liquidity to monthly simulations, sometimes just for a short period of time, to make sure they are staying on top of their risk. As part of monitoring the situation going forward, returning to Step 1 periodically for an updated view of the time horizon for pain may also be called for. Strong ongoing analysis and monitoring allows decision-makers to understand their risk position sooner and move quickly to identify options and take action as needed.

In addressing the one-two punch of liquidity risk and interest rate risk, careful evaluation of the available options, including the option to give the balance sheet time to heal, is the necessary first step. A wrong decision in this challenging environment can be very costly, both in terms of dollars and opportunities. But on the flip side, the impact of good decisions is potential material improvement in earnings, risk, and strategic progress. It is necessary to look beyond traditional methodologies to address this risk environment and provide the intel you need. Analysis that looks to the future to help in understanding the time horizon for pain, along with frequent monitoring of the actual changing risk profile, are critical pieces of decision-information that are invaluable when making the best decisions for your institution.