Should Your Credit Union Book Fixed Rate Mortgages?

November 20, 2019

4 minute read – Nationally auto sales are starting to slow, which is making vehicle loans more difficult to come by for many credit unions. At the same time, mortgage rates are hovering near record lows. The result is that many credit unions see a lot of opportunity in originating mortgages, and are trying to determine an appropriate level to hold in their loan portfolios. There are many things to consider when making long-term balance sheet decisions, the focus here has been narrowed to a handful of key issues in evaluating a mortgage portfolio strategy.

Profitability

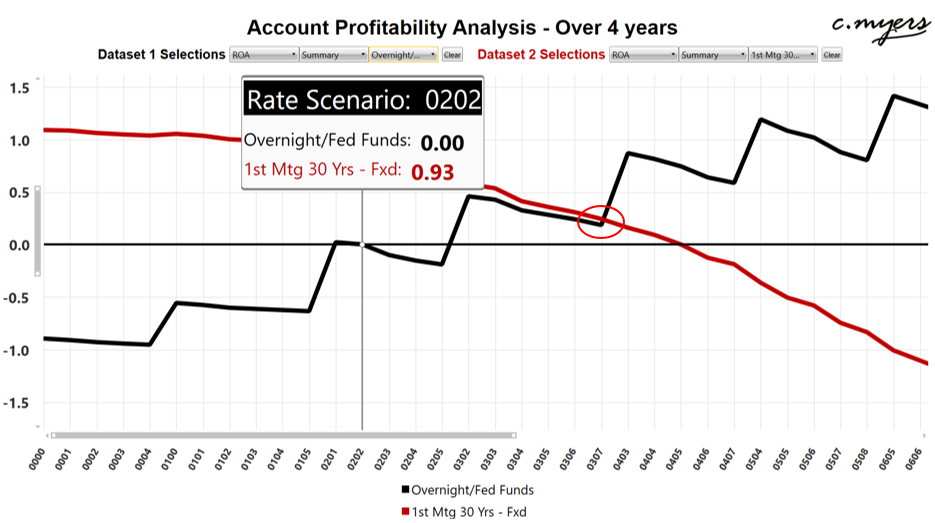

Understanding profitability is a key component to optimizing your credit union’s financial structure. If your credit union is going to keep fixed mortgages in the portfolio, over what range of rates could they be poised to produce positive earnings?

The example below looks at the profitability of 30-year fixed mortgages originated at a rate of 3.90% compared to overnight investments for a sample credit union. Over 4 years in the current rate environment, the mortgages would be profitable and would produce an average ROA which is 93 basis points (bps) higher when compared to overnights. If rates decrease, that spread widens. If short-term market rates increase to about 4% or higher, the overnights would begin to earn more than the mortgage loans.

When we discuss profitability with our clients, an important consideration is what kind of change in market rates is relevant for them as they evaluate balance sheet decisions? While a credit union might have policy limits set at the +/-300 or a +/-400 bps rate environment, from a business planning perspective, they might be more concerned about rates moving within a narrower range, say 200 bps. Defining the rate expectation is an important step in this evaluation process.

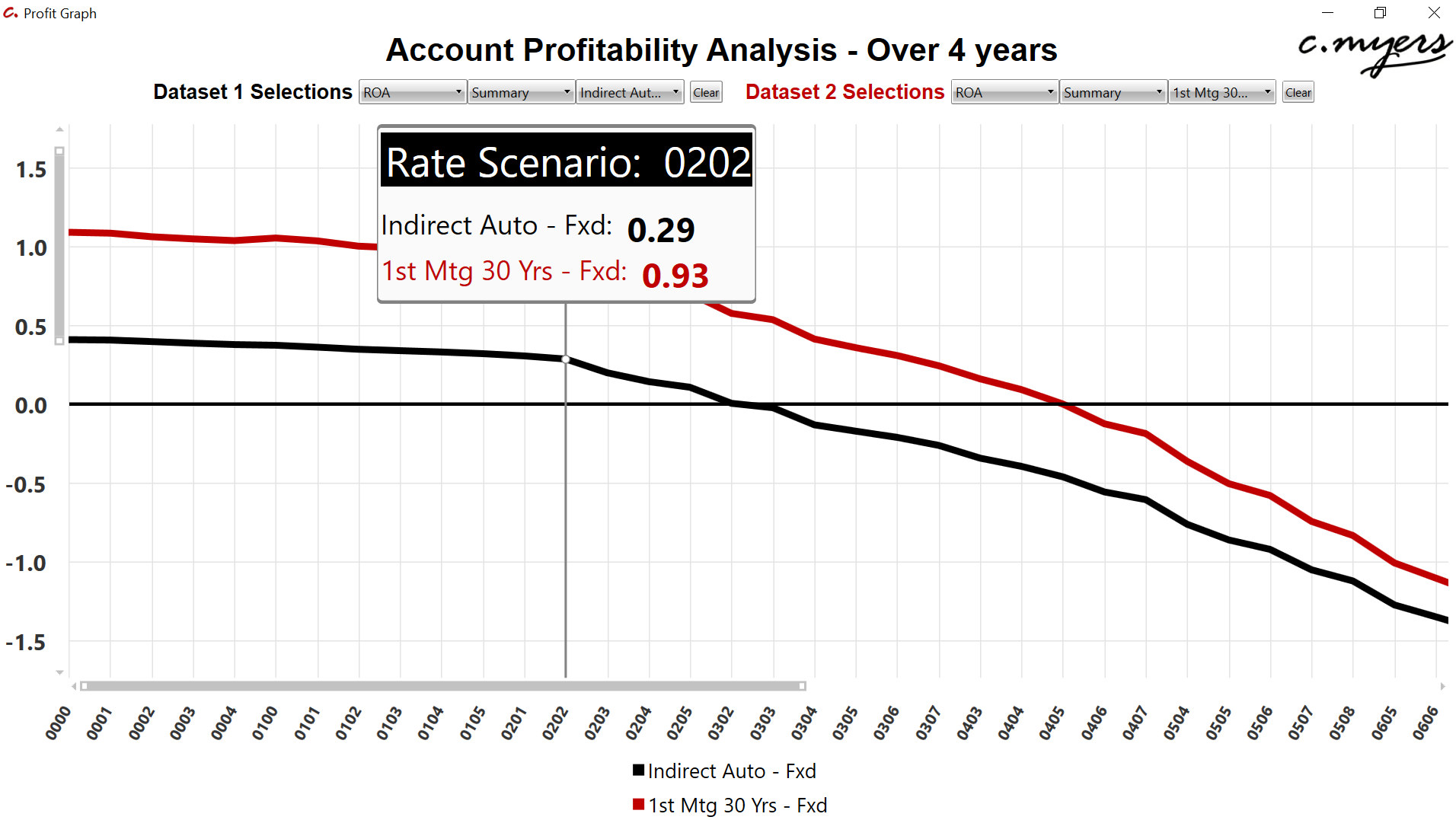

If we compare to another significant loan category, such as indirect autos, the 30-year fixed mortgages for this credit union actually produce stronger earnings over 4 years until short-term market rates hit 8% (note: the report below was cropped at 6% short-term rates for ease of viewing). Discovering that fixed rate mortgages were more profitable than indirect autos over a broad range of rate environments could lead to another set of important strategic questions around loan pricing and credit union loan portfolio strategy.

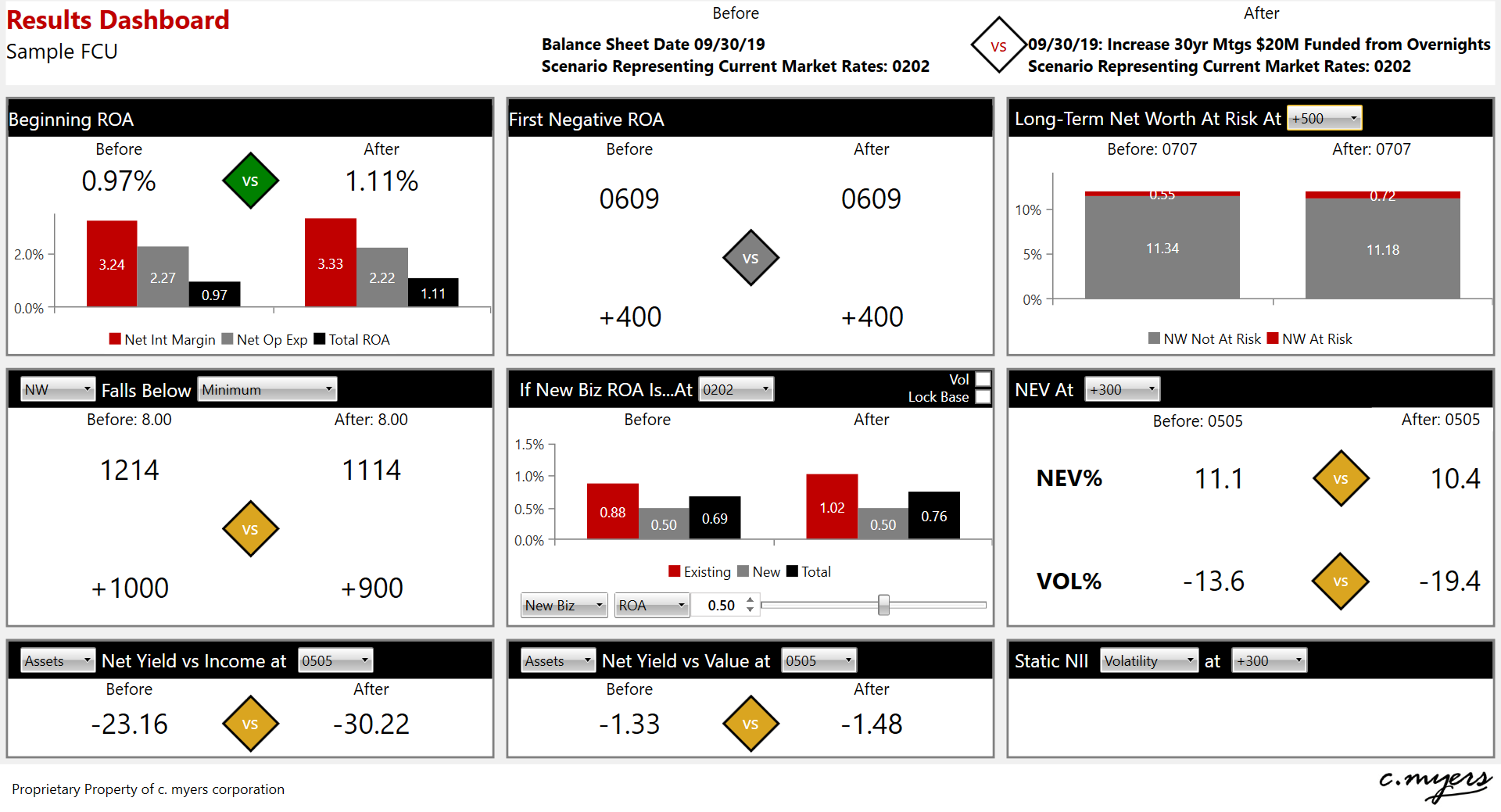

Risk Appetite

Another consideration is your institution’s overall risk appetite. From an aggregate risk perspective, is your credit union in a position to handle growth in fixed rate mortgages? If the same credit union increased 30-year fixed mortgages by 4% of assets and funded them from overnights, it would add more net worth at risk as rates rise, as well as increasing NEV volatility from -13.6% to -19.4% in a +300 instantaneous rate change. However, this credit union would still be well within its policy limits for both net worth and NEV.

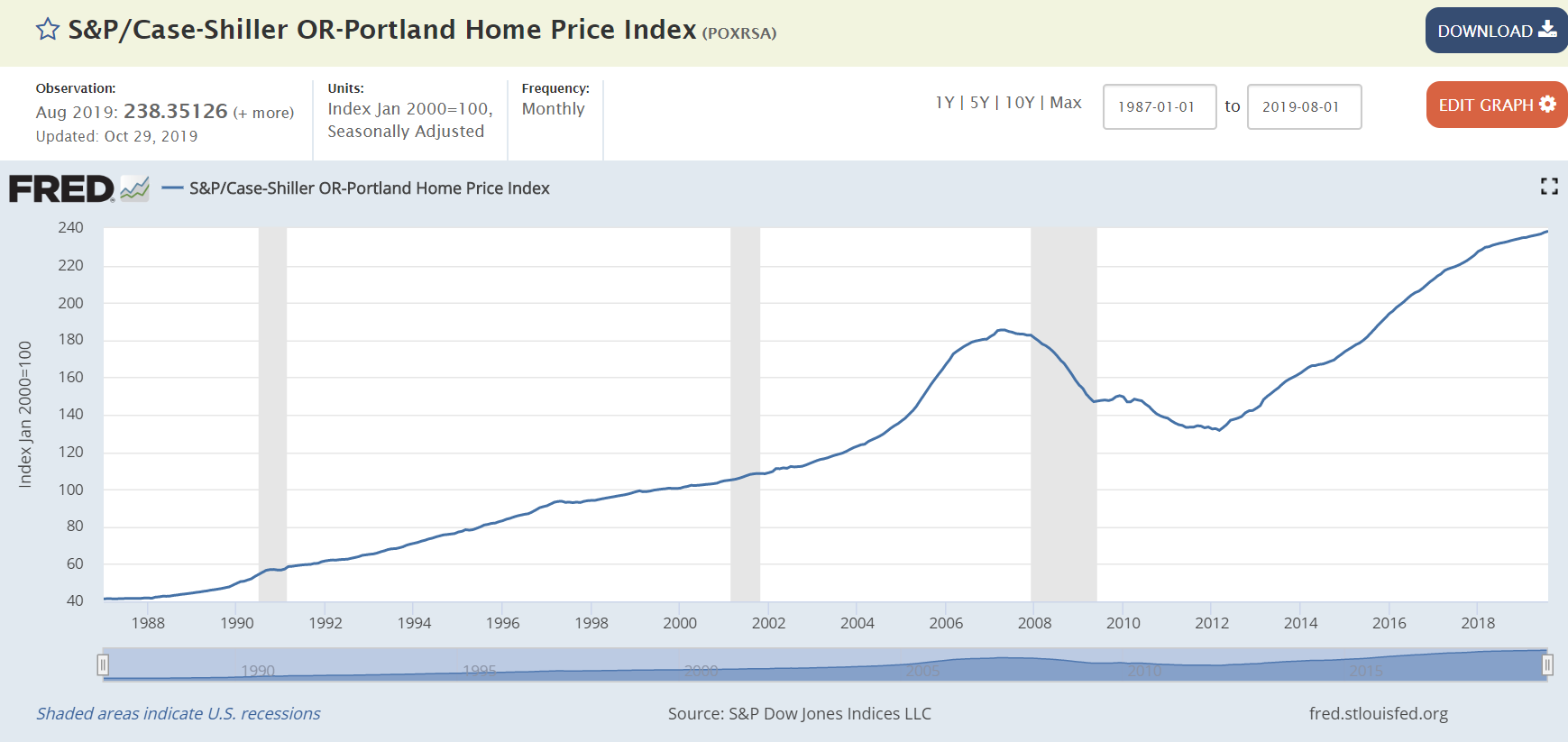

Credit Risk

It is easy to forget it was only about 10 years ago that the US economy suffered through the most dramatic recession since the great depression. Home values in some markets were cut in half. Since that time housing prices have rebounded in many areas, but the sustainability of those housing prices in some markets is a question. For example, home values in Portland, Oregon have increased about 81% since 2012. If home values pulled back in your markets, how could the profitability of mortgages be impacted, and what kind of aggregate exposure could your credit union face?

While this blog focused on just a handful of asset types, strategically optimizing the loan portfolio is more than just mortgages, indirect autos, and overnights. Other products, such as unsecured loans or credit cards, can be much more profitable than mortgages. However, it is often a question of volume and opportunity. It is frequently much more difficult to increase profitable unsecured loans than it is to grow mortgages, though that does not mean credit unions should not try! Even increasing more favorable loan categories by 1% or 2% of assets can have a positive impact on earnings today, while also producing a more favorable risk profile over a range of different rate environments. The desired financial structure is going to be different for each credit union, based upon a wide range of business model types. Making sure your team has solid decision information that provides triggers for asking the right questions is the first step in optimizing the balance sheet, and the overall business model.

Note that while the profitability results in this blog are based on a real credit union, every place is unique. As such, the answers for your credit union are likely to be different.