Budgeting Your Cost of Funds Won’t Be Boring This Year

October 31, 2018

Some have described 2018 as a sweet spot, benefiting from some higher yield opportunities while not having to pay much extra on non-maturity shares.

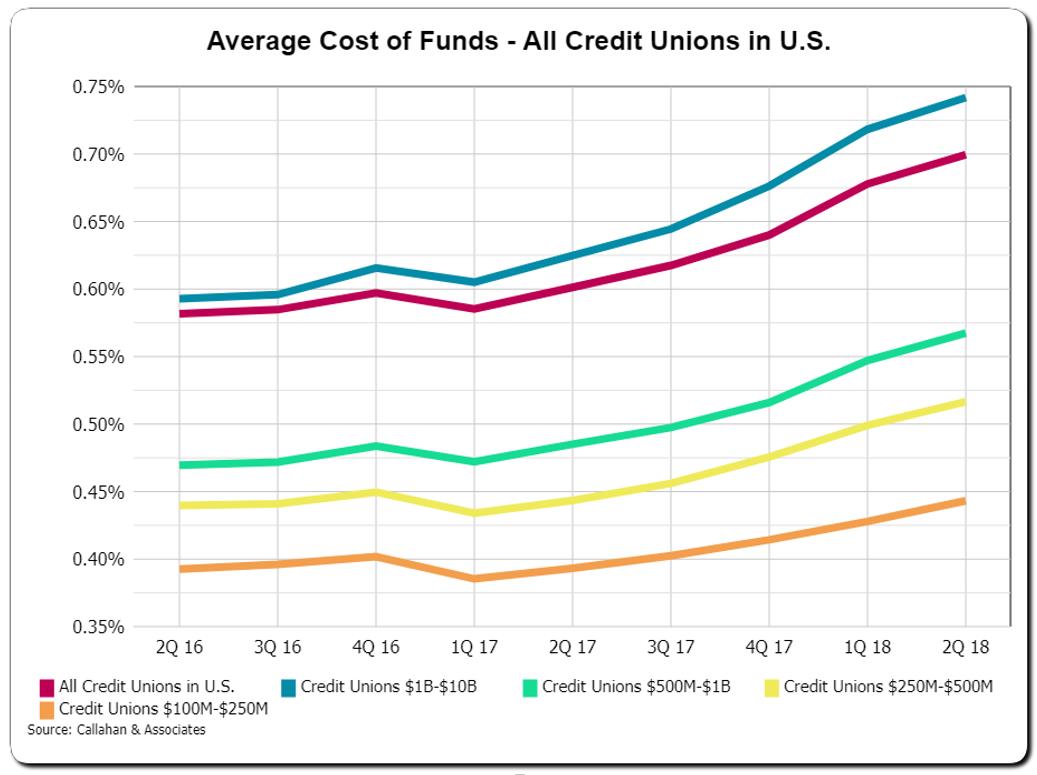

As short-term market interest rates have increased nearly 200 basis points in the past two years, most credit unions have seen the cost of funds increase only 5-10% of the change in market rates.

But how long can credit unions count on the cost of funds increasing only a fraction of the increase in market interest rates?

Based on the type of what-if requests c. myers has been receiving of late, perhaps not much longer. Many credit unions have recently pointed to members paying closer attention to other, higher rate alternatives for their deposits. As a result, recent what-if requests have largely been focused on various deposit acquisition and retention strategies.

This is why it is so important for credit unions to pay close attention to the budgeted cost of funds. If the credit union is not budgeting for an increase in the cost of funds, it is something the ALCO needs to discuss and understand. If the budgeted cost of funds is increasing, understand by how much and supplement your budget with what-if scenarios.

C. myers is currently in the process of helping many credit unions with their 2019 budgets and encourages testing the following deposit related what-ifs:

- What-if the credit union has to increase money market rates higher than otherwise expected?

- What-if regular shares and money markets withdraw or shift to more expensive rate sensitive options?

- What-if that certificate promo you’re planning on for 2019 cannibalizes some of the regular shares?

- What-if short-term rates and the cost of funds increase while the yield curve flattens, putting additional pressure on the margin?

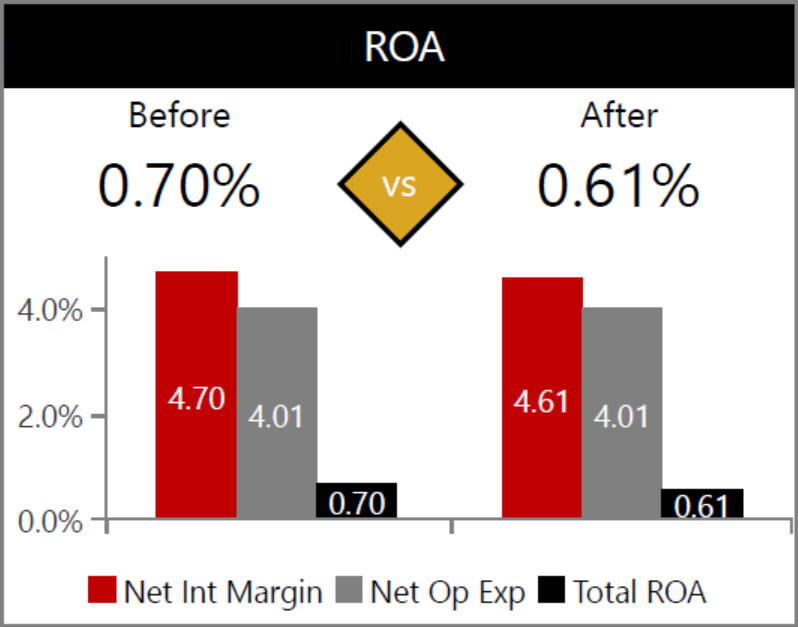

The results of such what-ifs can be an eye opener, especially for those that aren’t involved in the numbers on a daily basis. For example, consider a credit union testing what-if money market rates increase to 0.90%, still well below current money market mutual fund rates.

Obviously, having to increase money market rates will decrease the ROA but by how much? A quick visual like the one above can go a long way to helping communicate the impact of various paths.

At the end of the day, budgets are filled with assumptions and uncertainty. At some point, you have to blend your best thinking with the uncertainty and move forward. Before making a decision, consider that what occurred to the cost of funds in 2017 and 2018 may not continue. But most importantly, test out different what-ifs in advance and create an easy way to communicate the impact to decision-makers. Showing decision-makers a range of outcomes can help to reduce surprises if things don’t go as planned.