Optimize Your Margin Without Taking On More Credit Risk

July 29, 2020

5 minute read – It’s true that lower market rates are beyond your control, but it may be possible to make up some ground on the loan-to-asset ratio by doing more with the opportunities you’re already getting.

When profitability becomes a focus, cost cutting measures are common – and often appropriate. At the same time, it’s important to realize that it’s not possible to save your way to a viable and vibrant business model. There is no silver bullet, but incremental changes throughout the structure can add up to a real difference.

Applications for loans that are approved but do not fund are lost opportunities. Increasing the funding of approved applications, even by small percentages, can contribute to stronger earnings. Additionally, the actions you take to increase the funding are almost certain to improve the consumer’s experience.

Increased funding is often accomplished through faster decisioning, clearer communication, and creating fewer hoops for the consumer to jump through, to name a few.

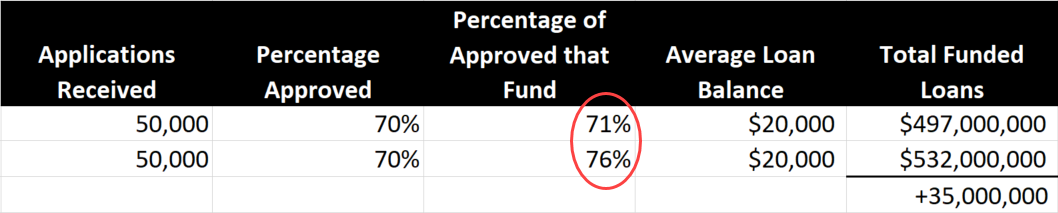

Take an example of a financial institution that approves 70% of the consumer loan applications it receives. Of the approved applications, it funds 71%. If the average loan balance is $20K, that equates to $497M in booked loans for every 50,000 applications received.

If the percentage of approved loans that fund can be nudged up by 5%, the result is an additional $35M in booked loans for every 50,000 applications received – without bringing more applications in the door or touching underwriting standards.

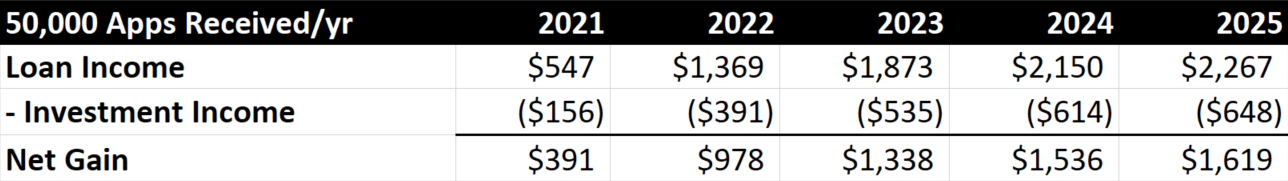

To estimate the positive impact on revenue, assume that the additional loans have a net yield of 3.5% and the investment alternative yields 1%. Also assume that the loans come on evenly throughout the year, plus we’ll factor in loan runoff (60-month loans with 20% CPR). If this institution receives 50,000 applications per year, the loans would bring $391K more in revenue to the bottom line in the first year than if the funds were in investments.

And the effect increases over time as some of the loan balances added in the first year are still providing income in later years.

Dollars in Thousands

As you work to offset financial pressures, resist zeroing in on operating expense to the exclusion of other opportunities. The improvements that you would make to achieve the gains shown bring positive short-term and long-term impacts by increasing revenue and creating a better experience for your consumers, which may increase the likelihood that they’ll do business with you again in the future.