602-840-0606

Toll-Free: 800-238-7475

contact@cmyers.com

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

CFOs Harness Real-Time Forecasting to Drive Long-Term Value

Featured, Financial Planning, Strategic Planning Blog Posts4 minute read – CFOs have shared with us that their leadership teams are increasingly eager to identify which organizational initiatives truly move the needle, especially as they navigate uncertain times together.

Recognizing this growing interest, we’ve been working alongside CFOs to develop strategies that keep their teams focused on high-impact areas without overwhelming them with excessive details.

Below are just a few examples of the collaborative approach we are helping CFOs take with their C-Suite as the importance of multiple-path, multiple-year forecasting increases.

Through our collaborations, we’ve found that fostering open conversation and engagement is an effective first step.

Setting the Stage for Meaningful Dialogue

As CFOs embark on this journey, we often suggest reminding the C-Suite of a few key points:

Leveraging Collective Insights

To spark productive discussions, we’ve helped CFOs implement simple surveys as a foundation for conversation. In a recent project involving over 100 financial institutions, we gathered diverse perspectives on expected growth rates for the next three years. The range of responses provided a rich starting point for strategic dialogue.

Transforming Insights into Action

Using our interactive forecasting model, we’ve assisted CFOs in translating these perspectives into potential financial outcomes. By running multiple real-time scenarios, starting with average projections of the C-Suite as well as exploring the various ranges, we help teams identify critical growth areas for both immediate and long-term focus.

This approach, which one CFO described as “a fast scientific experiment,” enables leadership teams to unite around a proactive, value-driven strategy rather than merely reacting to daily pressures, as they unfold.

Anticipating and Preparing for Challenges

A significant benefit of this forecasting approach is its ability to visualize potential stresses before they materialize. We’ve guided teams through thinking about mitigating options in advance, helping them prepare for various risk scenarios.

The Power of ‘Rehearsing Tomorrow, Today’

Many CFOs we’ve worked with have found that combining real-time, multiple scenario forecasting with collaborative C-Suite engagement creates a powerful approach to developing and prioritizing opportunities and risk mitigation options. They often refer to this process as “rehearsing tomorrow, today” – a way to proactively shape their organization’s future.

In conclusion, while every organization’s situation is unique, we’ve found that this collaborative approach to real-time forecasting and strategic discussions can be a game-changer to thrive in today’s complex financial landscape.

7 Practices for Building Successful Execution in Your Institution

Featured, Strategic Implementation Blog Posts6 minute read – Turning visionary strategies into tangible results requires not just planning, but the disciplined execution of your most critical projects.

In our work with financial institutions of all sizes and unique business models, we’ve identified seven practices that lead to successful execution, as well as opportunities to prevent potential missteps and ensure success. These seven practices are ingrained in institutions that have mastered strategic implementation to the point where it becomes second nature, woven into the very fabric of their organizational culture.

1. The foundation of successful execution lies squarely within the strategic planning process. It’s imperative that your strategic framework is meticulously designed to forge a clear connection between your strategic initiatives and overarching goals, aligning them seamlessly with budgetary considerations, desired financial outcomes, and available resources, beyond just humans. This integration not only ensures that your initiatives are financially viable, but also empowers your organization to harness its resources effectively, driving impactful results and enabling a cohesive path toward achieving your strategic vision.

2. Gaining support and buy-in from senior leadership – even the best strategic process is ineffective without the support and commitment of senior leadership. It is essential for top executives to actively engage with and follow the strategic process, setting an example for the rest of the organization. When leadership visibly demonstrates their commitment, it encourages others to do the same, fostering better coordination across the institution. Although senior leadership typically helps determine the institution’s strategic direction, strategy often breaks down as it is communicated throughout the organization, making it crucial to clearly and regularly articulate strategic objectives and their rationale, so that daily decisions and tasks are aligned with the institution’s strategy. This alignment ensures that strategic decisions made throughout the year are consistent and well-integrated.

3. When considering additional projects that fall outside the strategic plan, it’s essential to first assess where your resources are currently allocated. This understanding is crucial for making informed decisions about whether to proceed with new projects and determining the appropriate timing for their execution. Senior leadership must use the strategic plan as a decision-making filter to evaluate the impact of any new initiatives, particularly since they can strain already limited resources.

4. If you’re not regularly checking in – minimally on a monthly basis – on the progress of your strategic projects, you risk missing key opportunities to clear roadblocks that could impede your strategic goals. Regular check-ins ensure not only that your objectives are being met, but also that they stay aligned with the overall strategy. For example, these meetings allow for essential discussions about priority projects, enable timely adjustments as new information arises or timelines shift, and address challenges with vendors. Without these regular meetings, you lose the chance to explore the best solutions for overcoming obstacles that could affect your most critical strategic initiatives.

5. While it’s crucial to avoid constant adjustments to your strategic plan, there are times when changes are necessary. Flexibility doesn’t mean abandoning the plan; it involves finding new ways to achieve goals when circumstances shift. Whether driven by market changes, internal resources, or external pressures, leaders must pivot their approaches while remaining focused on ultimate objectives. This may involve adapting tactics or adjusting timelines, all while preserving the strategic vision and ensuring continued progress in a dynamic landscape.

6. Often throughout the year, new ideas surface across different areas of the organization that may require a project approach that shifts the priority of resources. When these ideas and projects surface, it is essential to use the strategic plan as a decision filter. Adding mid-year projects that are simply “shiny objects” can cause a whiplash effect, lowering team morale. Similarly, underground projects, which often bypass the agreed-upon process, can grow in scope and cause unnecessary strain on resources. Both types of projects – whether shiny or stealthy – need to be carefully vetted to ensure they align with your strategic goals. As part of this discussion, you must also consider which other projects will be postponed or stopped, recognizing that your resources are finite and must be used effectively to move the institution forward strategically.

7. During project planning, teams often overlook the project demands across critical departments like marketing, training, compliance/risk, or finance, leading to last-minute scrambling to ensure the needed resources are there. To avoid this, it’s essential to vet all department needs thoroughly in the planning phase, ensuring that necessary support is identified early. Similarly, departments may assume they can complete a project independently until they realize they require additional resources such as hardware, software, staff training, external vendors, or customer messaging. Given that most projects are cross-departmental in nature, it’s important to approach the planning phase with the expectation that you will need resources from other departments, and plan accordingly to keep projects on track and within the desired timeline.

Strong strategic implementation is what ultimately brings a well-crafted plan to life. The seven practices outlined above are key to ensuring that your institution not only executes its strategic goals effectively but also embeds these practices into the organization’s fabric. If your institution needs a strategic implementation kickstart, we can begin with an assessment to get you moving in the right direction towards becoming great at execution of your most important strategic projects and building it into the DNA of your institution.

c. myers live – 2024 Key Strategic Planning Themes

Featured, Strategic Planning PodcastsWith the busy season of Strategic Planning upon us, common themes are emerging from our client sessions. In this episode of c. myers live, we discuss some of the critical conversations institutions are having across the industry. From growth strategies and financial performance, to the ever important focus on cultivating talent, we dive into themes that should be part of every strategic conversation this year.

About the Hosts:

Adam Johnson

Adam, CEO and one of c. myers’ owners, leads a client-focused team of 50+ professionals who are passionate about helping our clients position themselves to remain relevant, sustainable, and differentiated. In his long tenure at c. myers, Adam has been a key contributor to the philosophy and design of c. myers’ proprietary financial models and ALM processes. He helped design c. myers’ approach to assessing business models and strategic planning processes, and serves as the strategic guide for the Process Improvement and Strategic Implementation business lines.

Learn more about Adam

Brian McHenry

As one of c. myers’ owners, Brian works daily with CEOs and C-Suite teams to help them identify and prioritize necessary changes to continuously adjust their business models and remain highly competitive. When working through the strategic process, CEOs regularly praise Brian’s calm communication style and ability to authentically engage anyone he interacts with. Brian’s expansive knowledge of the financial services industry, combined with his dedication to being on the leading edge of emerging consumer behavior trends, enables him to help decision-makers address tough business issues and explore creative solutions as they link their vision, strategy, and desired financial performance.

Learn more about Brian

Other ways to listen to c. myers live:

Real-Time Financial Forecasting: The Fed Is on the Move

ALM, Economy, Featured, Financial Planning Blog PostsQ: When the Fed has significantly cut rates, how many times has the yield curve shifted in parallel?

A: ZERO!

What does this mean for you?

In a world filled with uncertainty, this is one thing you can count on. So, don’t rely solely on parallel shifts in the yield curve when modeling. Expand your analysis to capture more realistic scenarios.

It is important to show other decision-makers the financial outcomes depending on the shifts in the yield curve. Technology has advanced so that this dynamic is easy and fast to model.

In days gone by, this would have taken hours of hard labor to show the potential financial outcomes of yield curve shifts, especially over a time horizon of more than 1 year – hence the simplifying assumption of parallel shifts. See the graphs below as a reminder. They show the change in the yield curves since January 2020.

Here are just a few scenarios being requested by decision-makers to understand the range of possible outcomes:

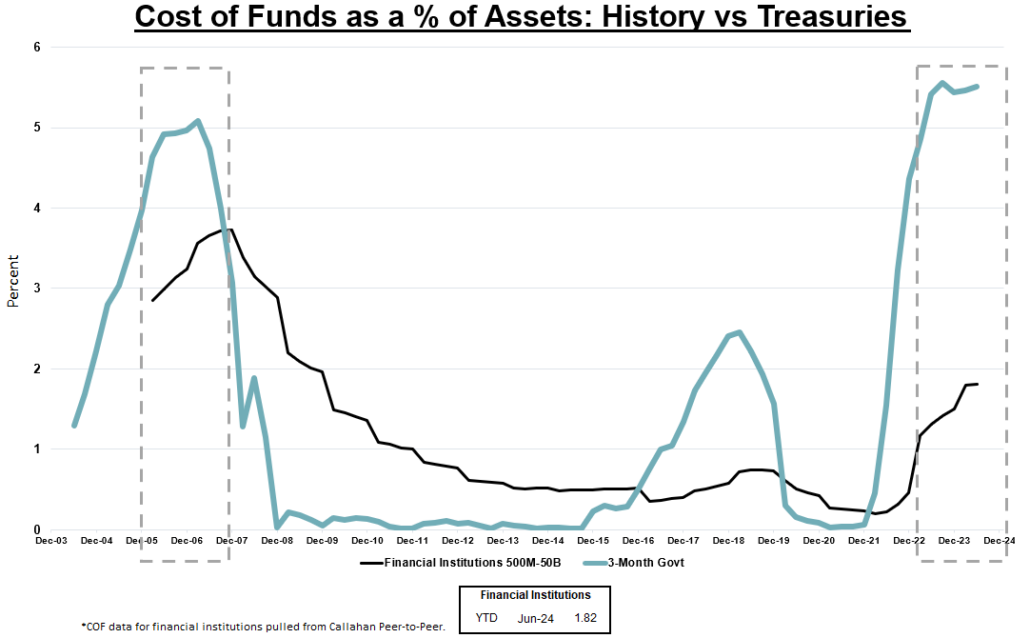

1. What if as rates come down, we experience FOMO on CDs, (like we have when mortgage rates ticked up) and our CD demand increases, putting more pressure on COF, before it declines? Learn from history, many financial institutions experienced this the last time rates were around 5% (2006-2007).

2. What if the yield curve continues to flatten? Long-term rates come down, refinancing kicks in significantly, and our COF does not decline the way we anticipated?

3. Same situation in number 2, but people don’t refi with us, and we have to invest?

4. What if our business lending hits a rough patch with respect to credit risk? As a result, do we respond by tightening our standards and volumes decline?

5. What if number 3 and 4 happen simultaneously?

6. What if our organization experiences a big mortgage refi boom – what portion should we hold or sell?

7. How do we hold up in the Fed stress tests?

8. What if the Fed cuts rates much faster than we anticipated and our prepayments on loans accelerate significantly beyond expectations? How might we need to adjust our KPIs to accommodate?

9. What if we need to achieve our KPIs by materially lowering our expected yields? Is the trade-off of volume vs rate worth it?

10. What if the situation in the Middle East causes inflation to ramp back up?

These scenarios can be run in front of the entire C-Suite team in a matter of 1-4 minutes. This can result in the decision-information being shared with the Board so everyone could be on the same page with respect to a range of potential scenarios and financial outcomes. This helps the organization be much more agile in optimizing their financial structures for many reasons. One key reason is a significant increase in appreciation for all the moving pieces.

Each quarter, take your current financial structure and run these scenarios to see how the outcomes can change. As appropriate, also add any significant emerging trends.

Leadership and Boards value what they refer to as real-time financial information. Some of them equate it to the push notifications they receive from their financial institutions and wealth-management advisors. It keeps them forward-looking.

Project Management – Avoid These 2 Common Misconceptions

Featured, Strategic Implementation Blog PostsBecoming an organization that is good at project management is not simple. While the basic concepts of project management are easily understood, there are a myriad of reasons why those concepts are not consistently and effectively put into action. Here are 2 of the most common misconceptions that get in the way:

A project management tool is invaluable for tracking tasks and clearly showing when projects are in trouble, but it can only do that when task statuses are reported realistically, and without undue optimism.

2) A good project manager will make us good at project management. Good project managers can be an important key to effective project management, but don’t expect automatic success. The greatest project manager won’t be able to shift the organization’s practices without the support and active involvement of senior leadership.