Planning for Lower Rates? How Much Flexibility Can Your Cost of Funds Provide?

June 26, 2019

While there is no guarantee market rates will head back down, there sure are a lot of signs pointing in that direction. It is not just the inverted Treasury yield curve getting all the attention either. The CME FedWatch Tool indicates a growing expectation the Fed Funds rate will decrease from its current target range of 2.25-2.50% by the end of the year.

As the potential for lower market rates increases, so is the focus from credit union management teams. It has been over 10 years since short-term rates have decreased and many credit unions are dusting off their rusty skills to better understand the financial impact. There are plenty of considerations in dealing with a declining rate environment, but a good place to start and the focus here will be on the cost of funds (COF).

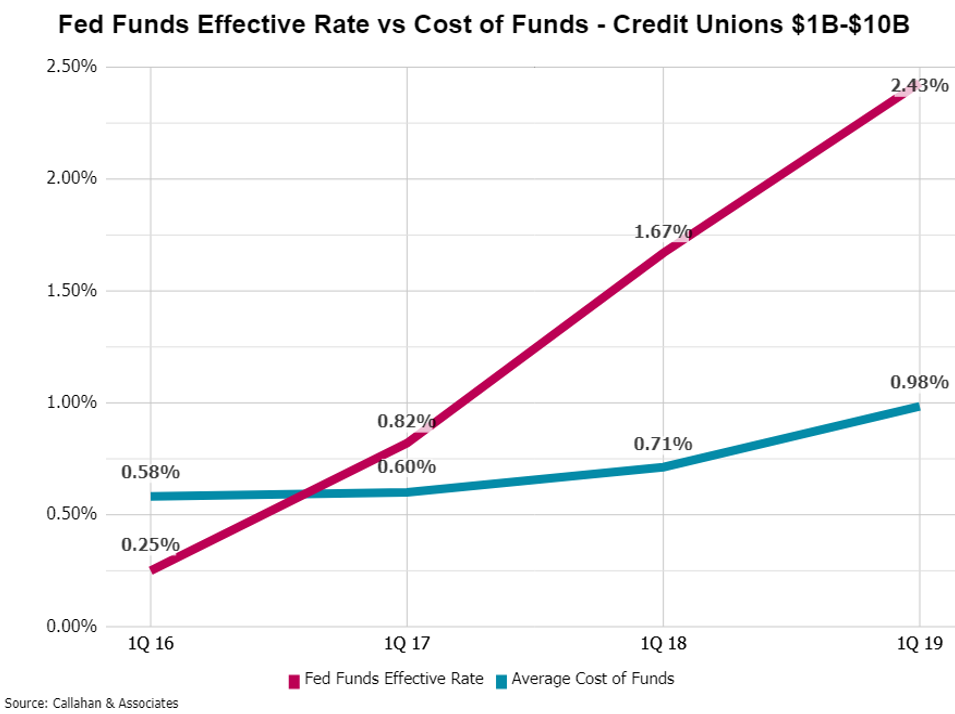

To better understand what might happen to the COF and ultimately earnings in a declining rate environment, first consider what happened to the COF over the past few years as the Fed Funds rate increased roughly 200 basis points (bps).

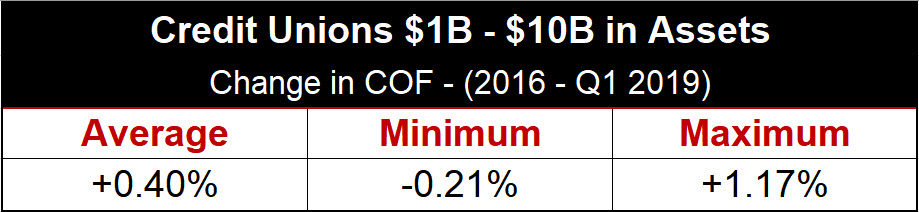

Over the past three years, many credit unions have benefited from the COF lagging the increase in short-term market interest rates. In fact, as short-term market interest rates increased roughly 200 bps, the average COF for credit unions $1B-$10B increased only 40 bps. The relatively small increase in COF as rates increased has many credit unions wondering how much they can count on the COF helping out if rates head back down.

The answer to this question will depend on each credit union’s unique strategy. Some credit unions may find there is ample room for the COF to decline while others could determine the COF is essentially floored at current levels. In analyzing the 300 plus credit unions between $1B and $10B, there is a wide range of experience, ranging from a -0.21% decline to a +1.17% increase.

Understanding what happened to the COF when rates were on their way up is an important piece of the puzzle. Another key piece is the mix of liabilities. The opportunity for members to earn higher rates, coupled with liquidity challenges have led to a changing liability mix for many credit unions. The addition of member certificates or term borrowings can restrict the ability of the COF to reprice down in a declining rate environment.

As lower rate environments get more attention, decision-makers want to be armed with viable options. Understanding what happened as rates went up and the corresponding structural changes is a great liftoff point.

As decision-makers gain these insights, they can identify and test various options they may have if short-term rates were to decline. Seeing, early on, risk/return trade-offs of various options, gives decision-makers time to think about how they can best align the actions they may need to take with their strategy.