Should We Hold or Sell Our Mortgage Production?

August 19, 2020

7 minute read – This question is one of the top 3 ALM questions we get asked daily. As we help decision-makers answer this question, we emphasize that doing the math and ALM modeling is the easier part.

Before deciding whether to hold or to sell, several questions should be answered. For starters, what is our short- and intermediate-term outlook for liquidity, and do we have room to take on interest rate risk?

To keep this blog relatively short, our starting point for this example is that the financial institution has plenty of liquidity to hold mortgages and their interest rate risk profile is solid.

Because this decision has many short, intermediate, and possibly longer-term implications, C-Suite members, beyond the CFO, need to have clarity on potential implications. They need to understand that making and selling mortgages can boost current earnings and net worth, but put pressure on future earnings, especially if rates stay low for a long period of time.

This point is very important to recognize. People often forget that they fast-forwarded the income when they sell. They then get disappointed in future earnings performance, which unfortunately has strategic implications. They see lower earnings and often the response is to cut expenses by pulling back on strategic initiatives that drive relevancy and the competitiveness of the business. This can turn into a vicious cycle and ultimately lead to lower performance and more risk taking.

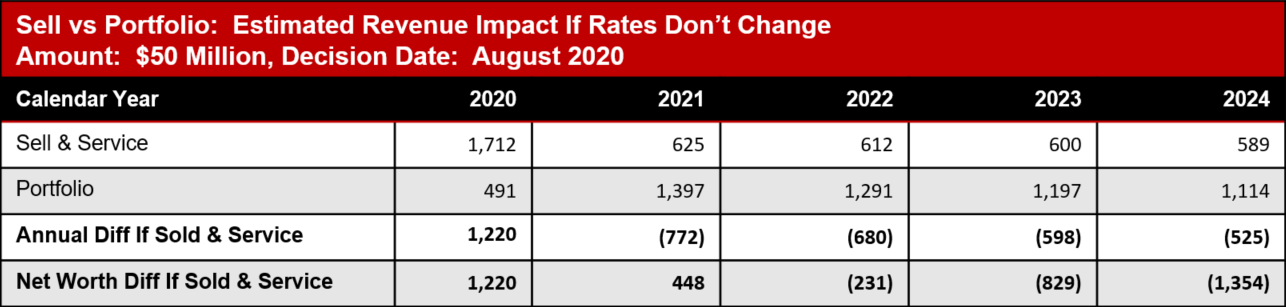

To help punctuate this point, the following example outlines the math over an extended period of time. The institution is evaluating, in August 2020, whether to portfolio or sell $50M of mortgage production. They expect to be able to sell the mortgages for a 3% gain and would retain servicing. These types of gains may be short-lived and play a key role in the financial results.

As you look at the results, remember that the math is the math. What is key, is the mindset of the decision-makers.

$ in Thousands

After accounting for the gain, servicing, and investing the funds, the $50M sale adds roughly $1.7M to the income statement in 2020.

Alternatively, holding $50M of mortgages in portfolio results in roughly $500K of benefit to the income statement in 2020.

The financial institution is roughly $1.2M better off in 2020 by selling the $50M in August production.

So what is the breakeven point of holding vs selling? That depends on how you use the liquidity from the sale of the mortgages.

In this case, the breakeven point is about 24 months. Which means they would generate more earnings over the next 24 months if they decide to sell today. For some, that can make the decision to sell and service an easy one.

You can see the cumulative benefit through 2021 is about $450K more from the decision to sell, rather than portfolio. This would add an additional $450K of net worth.

Mindset check: Keep in mind, while the math shows better cumulative return through 2021, there is a potential mindset challenge that may be faced in 2021. The actual revenue in 2021 is about $770K lower if you don’t have the mortgages on the books.

The lower earnings in 2021 could happen while the other pressures are mounting. Many boards and management teams use earnings in a calendar year as a measure of success.

Keep in mind, this example isolates the decision faced in just one month. It is likely that this decision will be faced for many more months, so the impact to net worth, cumulative earnings, and fiscal earnings could be material for years to come.

There are compelling reasons to portfolio mortgages and to sell. There is no substitute for framing this decision in light of strategy, future revenue streams, and having a firm grasp on your ALM position.