A New Kind of Balancing: Navigating the High Wire Act as Balance Sheets Adjust to Higher Rates

January 3, 2024

|

|

7 minute read – Great news! The elevated rate environment provides financial institutions (FI’s) an opportunity to take advantage by putting new assets on their books at higher rates as existing lower yielding assets roll off. By itself, this helps improve their net interest margin (NIM). However, the other side of the balance sheet is also adjusting to higher rates – hence the balancing act. These 6 key questions can help financial institutions navigate these waters and better position themselves for financial success as well as prepare for regulatory examinations.

How long is your balance sheet – Do you know how much of your existing assets are expected to run off in the next few years?

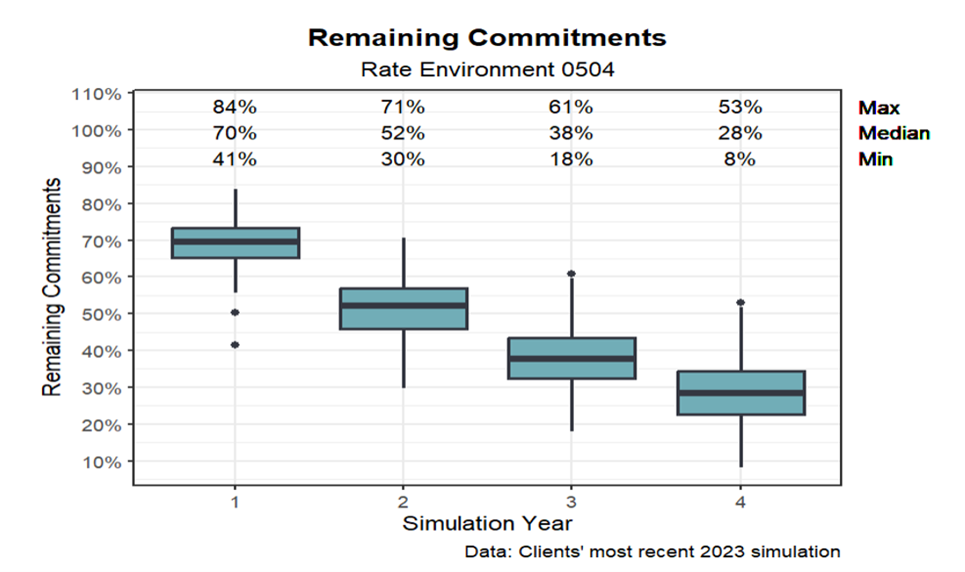

This is a question that all FI’s should know the answer to and one that regulators expect FI’s to understand. The table below shows empirical balance sheet data from a wide range of our ALM clients, and it indicates the average amount of existing assets that will be on their books a year from now is about 70%. But some have approximately 84%, while others have as low as 41% of their existing assets remaining after 1 year. This creates a vastly different picture for those financial institutions when it comes to opportunities to add new assets at today’s higher rates. For example, if your organization has a longer balance sheet, it suggests that you may need to be more selective when you are considering new assets to add.

The disparity in the different lengths of balance sheets continues with the average after 2 years at 52% of existing assets remaining. The longer balance sheets have 71% and the shorter balance sheets have 30% of the existing assets remaining on the books after 2 years. If rates were to fall, the assets added at today’s higher rates could provide better returns compared to future potential assets, but a longer balance sheet limits the opportunities to add those higher-yielding assets.

What specific assets are you targeting?

When considering what assets your financial institution is targeting as possible additions, the length of your balance sheet should be factored into the decision-making process. FI’s with longer balance sheets should generally be more selective in terms of the types of assets they consider because they have fewer dollars rolling off their books to redeploy in the form of new business. It is critical to evaluate the profitability profile of new loans relative to expected future COF and credit losses as well as any related operating expenses. This is not the time to take the approach that any loan is a good loan to add, particularly if your liquidity position is tight.

What is your current and expected liquidity position? Do you have enough liquidity capacity remaining for unexpected circumstances?

The previously large amounts of excess liquidity in the industry have mostly dried up. It is important to not only know your existing liquidity position, but also to clearly understand your cash flow low points for the next 12 months. Beyond simply identifying the liquidity low points, you then need to ensure your liquidity is adequate to cover your stressed event scenarios. This may require you to take actions to bridge liquidity deficits with a clear understanding of what sources you would utilize in order of priority. If your FI has already significantly reduced its overall level of liquid assets, what is your plan to build liquidity levels back up? Consider drawdowns on other sources of liquidity such as borrowing lines and whether those borrowing lines are adequate to cover your stressed scenarios. Taking the time now to ensure that your borrowing line collateral is as up to date as it can be is helpful to maximize the size of the available line. It is better to take that action in advance than to try to do so when your liquidity starts to get stressed. It is prudent to maintain a deep reserve of potential liquidity sources to deal with cash flow stress events.

How are your funding sources and the related costs changing?

Most financial institutions are seeing declines in non-maturity deposits (NMD’s) as consumers seek higher returns in response to this elevated rate environment. NMD’s are declining at FI’s at a pace of over 10% annually according to industry data. Funding sources are shifting primarily towards certificates of deposit (CD’s) and borrowings. Typically, borrowings and CD’s are a much higher costing source of funds, thus pushing COF higher for FI’s.

What is your projected COF for the next year or more and how much longer is upward pressure on COF expected?

As FI’s finalize forecasts and budgets for the coming year and beyond, expectations are for COF to continue to rise for some time. Now as more economists and the Fed are starting to project the potential for market rates to begin to move back downward, some FI’s envision their COF moving down in lockstep with market rate movements. However, there are reasons why financial institutions should anticipate continued upward pressure on their cost of funds, even after market rates start to recede, as they strive to strike a balance between competition and profitability. When rates fall, competitive pressure could keep deposit rates high, contributing to a sustained elevated COF. In addition, longer-term CDs and borrowings may remain on the books for years, in some cases. Furthermore, history indicates that high consumer demand for CDs may accelerate after rates begin to fall, much like a final mortgage refinancing wave after mortgage rates begin to rise.

Recap and Final Thoughts

The effective management of assets and liabilities is paramount for FI’s in an environment with elevated rates which brings a series of challenges and opportunities. This should prompt a strategic assessment of your balance sheet and demands an agile approach to navigate the turbulent waters. To plot a course through this complex landscape effectively, FI’s must employ an approach that balances the need to remain competitive with the imperative of maintaining profitability. This path can look very different at each FI depending on answers to the questions for consideration such as: balance sheet length, liquidity position, COF upward pressure, etc. Adaptability, foresight, and having an in-depth understanding of answers to the questions above can help FIs thrive in a challenging environment and position themselves for success.