A Potentially Flat Rate Environment May Not Translate to a Flat Cost of Funds

May 1, 2019

Shortly after the Fed met a few weeks back, some credit unions likely breathed a sigh of relief. Deposit pressures were building and the cost of funds seemed positioned for a sharp increase. But with almost perfect timing, in came the Fed indicating no further rate increases in 2019. While many have changed their market rate expectations, it is important not to go on cruise control. Regardless of what happens to market interest rates, the cost of funds may still be on the rise.

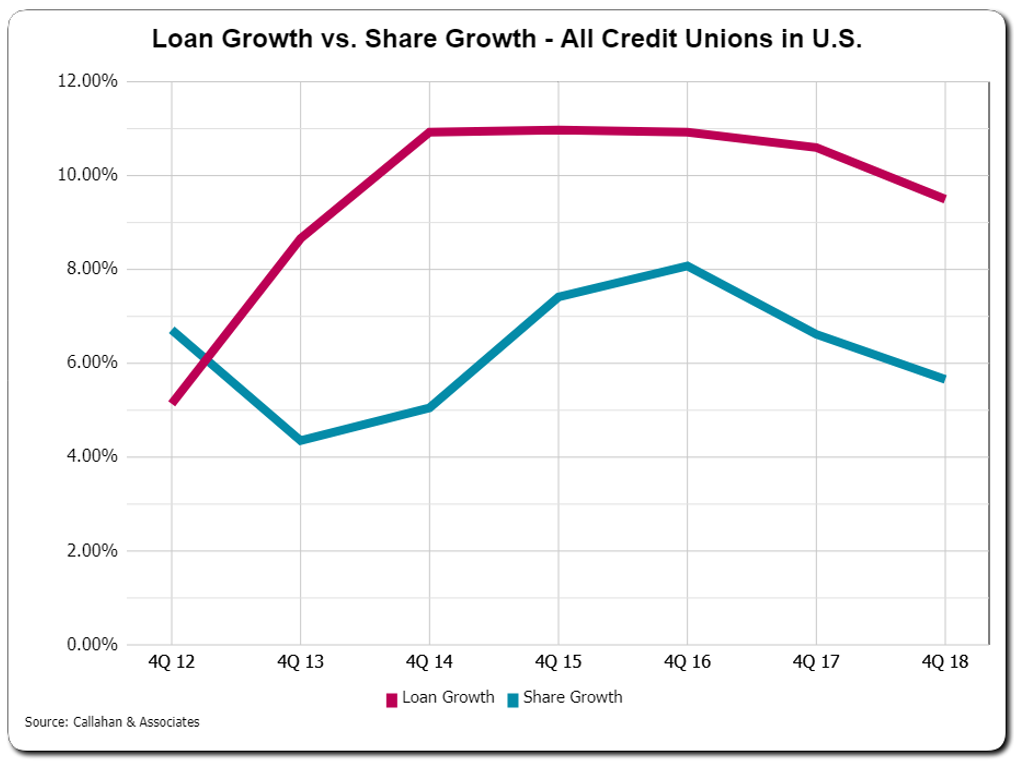

The primary contributor for a potential rise in the cost of funds is a continuation of recent liquidity challenges. Sure, market interest rates play a key role in the cost of funds, but liquidity, or lack thereof, also has a significant impact. As shown in the graph below, loan growth has vastly outpaced share growth in recent years. This trend has caused some credit unions to dig deep into the liquidity toolbox for solutions.

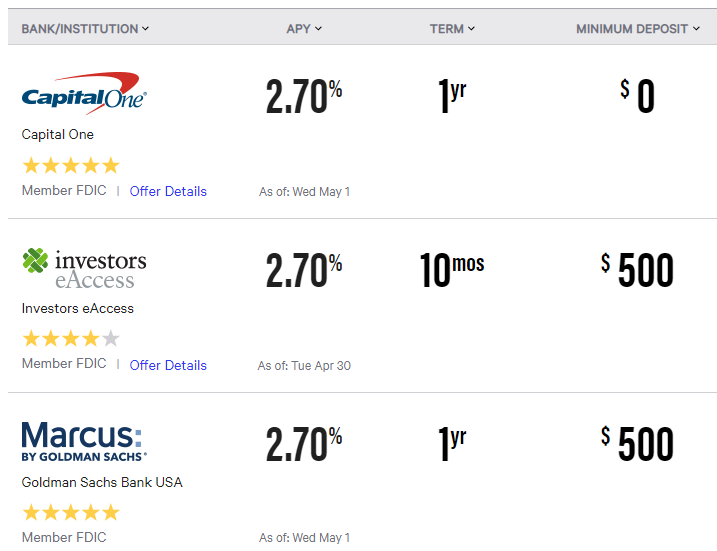

Based on the types of what-if scenarios requested from credit unions, member certificate promotions continue to be a popular liquidity tool to help replenish liquidity. While member certificates can be a quick alternative, it can come at a cost. Liquidity challenges have pushed certificate rates higher and in many cases, certificate rates are higher than Treasury rates.

Source: CD Rates for May 2019, Bank Rate, 05/01/19

While there are plenty of credit unions feeling good about their deposit rates and overall liquidity position, remember that high deposit rates from other institutions could cause members to move.

It is not just liquidity and high cost liquidity solutions applying pressure to the cost of funds. Credit unions have also recently been performing what-if scenarios increasing money market rates. Why would money market rates increase if market interest rates are not increasing? Part of the reason could be described as “catch-up” from being able to lag the increase in market interest rates. As short-term rates increased from essentially 0% to 2% the past few years, many credit unions were able to hold non-maturity deposit rates relatively flat over that period. As market rates potentially settle in at 2%, some catch-up may follow.

Potential increases in money market rates and ongoing liquidity pressures are just a few considerations currently impacting the cost of funds. Changes in technology, member behavior, and the overall economy will likely introduce a new host of factors in the future. While uncertainty remains, the key is in helping decision-makers understand that a potentially flat rate environment may not translate into a flat cost of funds.

We are seeing strategically-minded ALCOs and management teams view this as an opportunity to reassess their strategic positioning with respect to meeting short and intermediate funding needs.