Strategic Thinking: An Approach to Strategic Planning

March 13, 2024

|

|

8 minute read – Each year we work with hundreds of financial institutions, helping them think through their business model for today and into the future. Because of the successes we’re seeing, we thought it would be helpful to outline processes and habits that can help strengthen the thinking among leaders and Boards across the industry. By focusing on ways to strengthen thinking, particularly on how decision makers in your organization are thinking, you can position your organization to be better able to examine multiple perspectives then expand, revise, and build on them.

Once a year planning sessions are not enough. Let’s start high-level by framing what an approach to strategic planning through strategic thinking might look like. More and more, we find that once a year planning sessions aren’t enough to keep up with the pace of change. Our clients have found tremendous value and relief by shifting away from a singular planning session where many big decisions are made to include regular strategic thinking discussions throughout the year so that when big decisions need to be made, they feel more prepared. This cadence allows ample time for identified stakeholders to gather and research necessary data and business intelligence to help inform the strategic decisions when the time comes.

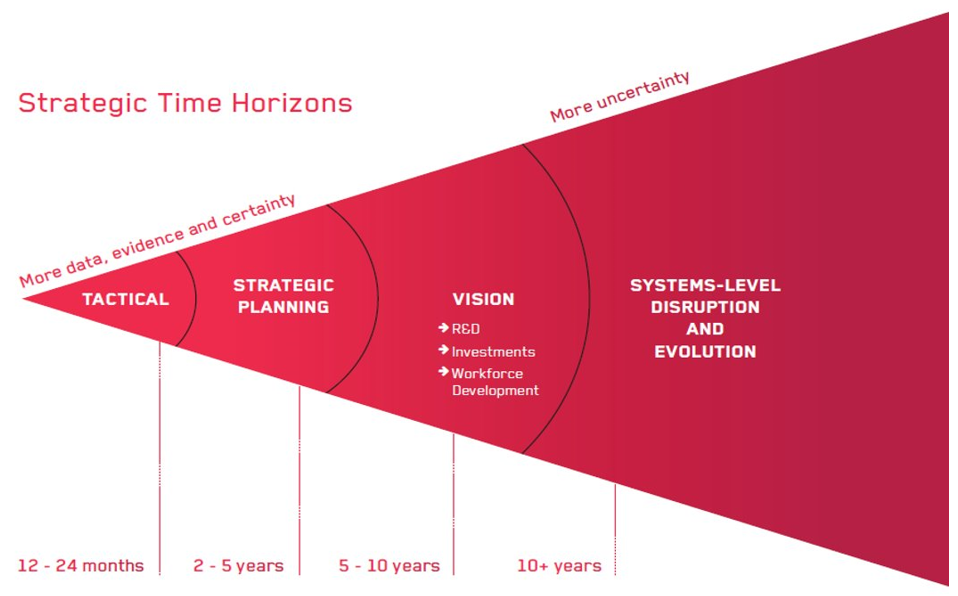

This graphic, from futurist Amy Webb, is reflective of the timing of the type of thinking and planning we encourage our clients to engage in. The further into the future, the more it is about exploring what-ifs and potential scenarios without making decisions.

By expanding the more traditional strategic planning process to include strategic thinking opportunities throughout the year, teams are better able to build awareness, have alignment, and pivot quickly while staying focused on the strategic view. Practicing strategic thinking can take a multitude of forms but here are some specific tools that can help initiate these types of discussions.

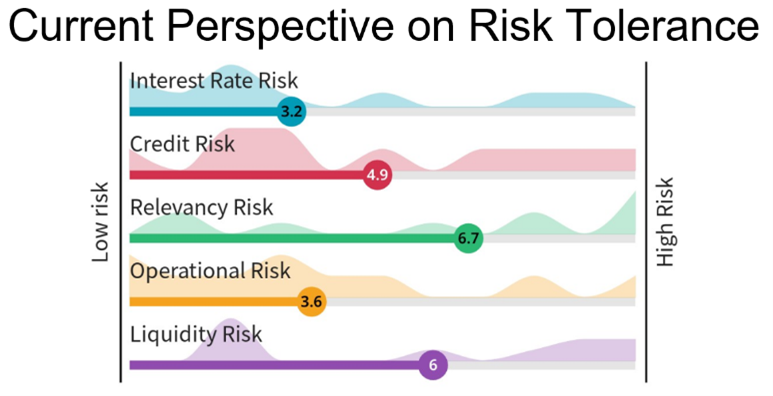

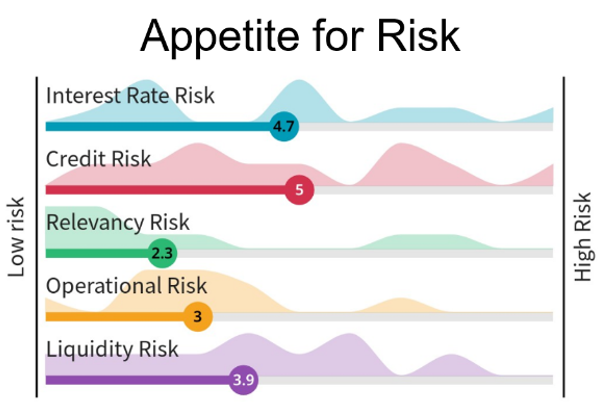

- Align Board and leadership team’s tolerance for risk. Taking time to complete a visual check-in – like the example shown below – and engaging in a follow up discussion can help your team understand individuals’ risk tolerance across a range of areas and ask what steps you can take today to help set you on that path. This can also be an opportunity to ask why. Risk tolerance is often a reflection of people’s previous experiences, or lack thereof, so engaging in conversation is a pivotal component. While there isn’t a strict timeline for this conversation to happen, we recommend making this a routine part of your team’s conversations either annually or semi-annually or whenever big environmental changes happen as these can affect people’s sense of risk.

The areas of risk included below are examples only. Depending on the labels you decide, categories of risk could mean many different things. Take time to gain clarity so everyone is assessing from the same understanding – when your organization defines relevancy risk what does that mean? For some, it means AI and technology, and for others it reflects branding.

We find it beneficial to consider both the average answers and the range of responses; in this visual example, the mountains illustrate respondents’ answers and indicate that respondents are not aligned. By exploring why respondents have varying assessments and appetites, you can engage in discussion to better determine how to approach your future path and develop cohesion among stakeholders.

- Review the Business Model Clarity questions.

- Why? Clarify the driving purpose of your organization. Why do you exist?

- Who? Who is your target market? What segments of the market should be the strategic focus of your business?

- What? What is your value proposition? What should you do/offer that your target market will find valuable and will motivate them to do business with you?

- How? How will you deliver on that value proposition better than your competitors? What do you do/have internally that is unique?

Similar to risk tolerance, gaining understanding and alignment on these questions can help guide your approach to opportunities and challenges your institution faces as the world around us continues to change. Additionally, like the risk tolerance conversation, you may not need to have this conversation more than once or twice a year, but every member of your decision-making team should be able to articulate these ideas so that they help drive your decisions.

- Adjacent markets matter. Think beyond the financial institution and beyond the typical 3-5 years of a strategic plan. Look for emerging trends – what’s happening in other industries? Many financial institutions are striving to be the easier place to do business, citing the personalization and accessibility that is becoming the expectation across industries. Taking time to step outside of the financial industry and looking at what is happening in other business sectors can help you understand what is influencing consumer’s perceptions of what is “easy” and what’s table stakes.

These conversations can be shorter in length and might incorporate some pre-work or prereading. Consider making these routine practices among your team – scheduling monthly or bi-monthly meetings to have these kinds of conversations can help you stretch your strategic thinking and create cohesion in your team.

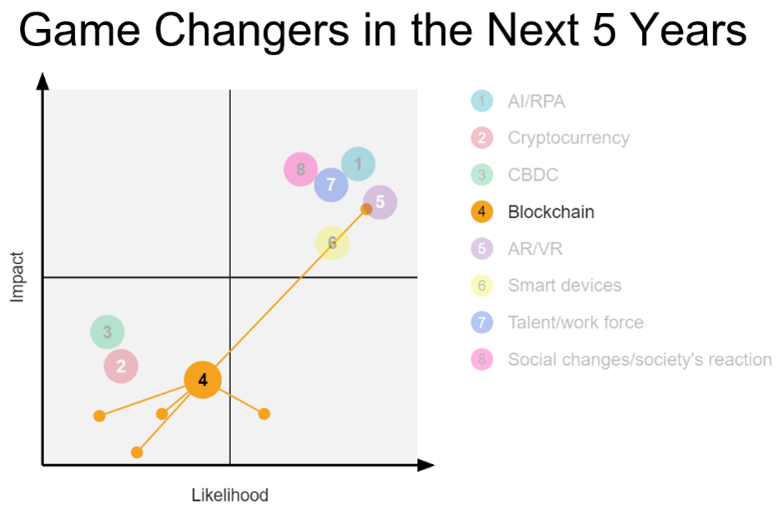

- Game changers. Another conversation to have might be as simple as identifying potential game changers of the next 5-10 years and getting a sense of what kind of likelihood and impact your team thinks these might have. By thinking without committing, teams can feel freer to explore a wide range of what-ifs without feeling restricted by the consequences of decision-making. These conversations might happen in conjunction with thinking about adjacent markets – use this exercise as a means to identify potential topics to prioritize in your strategic scenario thinking practices.

Each organization’s perspective on potential game changers can be quite different but the image below is an example of what you might include.

A scatterplot can aggregate strategic planning session participants’ thoughts on what might be game changers, the likelihood these things will happen, and the degree of impact they anticipate these might have on their financial institution and consumers. Some survey platforms also illustrate the range of individual answers which can be key in facilitating discussion.

- Always come back to your core purpose. As you will probably notice through your regular strategic thinking practice, lots of shiny new technology and opportunities will come and go. In much the same way that being clear on your risk tolerance can help guide these conversations, understanding your why as an organization can act as a compass amid a rapidly changing world. Ask yourselves, how do you keep your purpose front and center as thinking deeply becomes a path towards action – while not all thinking needs to become action, remembering your purpose can help you filter what opportunities are in line with your business model.

The way you approach strategic planning and the thinking behind it needs to evolve if you hope to stay competitive in this changing world. Even in organizations that are happy with their strategic plan, leaders are excited to utilize these conversations as a tool to think strategically about the future and continue to build their capacity for thinking. If you can make engaging in thinking that stretches your perceptions a key and continuous component of your strategic planning process, then your ability to optimize your business model, timely, will increase tremendously.