Are Investments Now Yielding More Than Indirect Autos?

May 9, 2018

For many credit unions, taking a serious look at indirect auto profitability is long overdue. Two years ago it was easier to make the argument that indirect autos were a better financial alternative than a like-term investment. Now, the issue is more complicated as investment yields have increased far more than auto yields in the last couple of years.

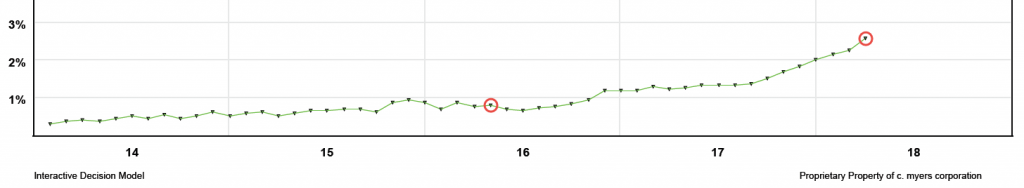

Auto pools often have average lives of about 2 years, so for example purposes, a 2-year investment will be used as a point of comparison in this analysis. Since April of 2016, the yield on a 2-year Treasury has increased about 170 bps.

Historical Government Interest Rates

How much has your credit union increased auto rates over the last 2 years? In working with credit unions all over the country, we have observed that many institutions have only increased their auto rates by 50 – 75 bps over that period of time.

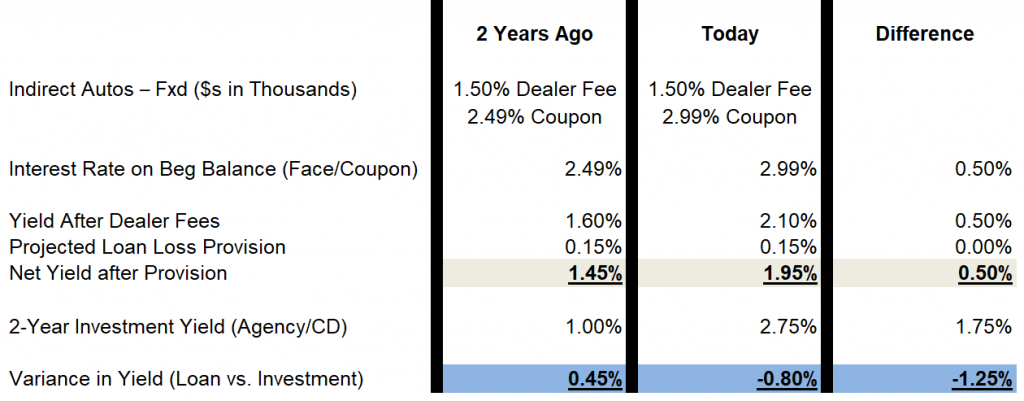

The example below is using a coupon rate of 2.99%, which is based on the rate many credit unions are currently offering. While dealer fees often range from 1 – 2%, a fee of 1.50% is used for example purposes. Note that different levels of dealer fees will impact the answer. After factoring in dealer fees and a loan loss assumption of 15 bps, the net yield is 1.95%. Compared to a 2-year investment yielding 2.75%, a credit union would be giving up 80 bps of earnings.

It wasn’t always like this. A couple of years ago, a typical “A” Paper rate might have been 2.49%, and like-term investments would have yielded closer to 1%. So, even after factoring in dealer fees and credit losses, the spread to a like-term investment was a positive 45 bps.

Amortizing Dealer Fees Using “Level Yield” Methodology

While profitability is important, there is more involved in making decisions regarding pricing and asset concentrations than simply comparing to an alternative investment. Consider:

- The indirect auto example above does not include the expense of collections, underwriting, or managing the dealer relationships, which can vary materially from credit union to credit union

- In the event of a slowdown in the economy or continued pressure on used auto values, the auto loans could have additional credit risk exposure beyond the 15 bps used in the example

- Loan profitability versus investments is particularly relevant to indirect autos, because it is difficult to engage members through the indirect channel. We commonly hear that only 3 – 5% of indirect members utilize other credit union services. Once the loan is paid off they generally move on. If you can’t convert those indirect members into fully engaged members of the cooperative, what is the business case to originate these loans at a relative loss?

- Your credit union could have the same discussion on direct loans, but there might be a reason to offer lower rates from a member service perspective

- Steps you could take to improve the profitability of indirects. Many credit unions are worried that if they raise rates too much, they will lose the dealer relationship and have a hard time earning that business back. If your credit union is in that position, key stakeholders should at least understand the trade-offs, and how much revenue is being given up by continuing to compete aggressively in the indirect space

- You may need to have a different evaluation of indirect loans made to existing members, as the indirect channel is often viewed as a member service for existing members

If you know, or believe, your credit union is in the position of making unprofitable indirect auto loans, it is time to revisit your strategy around this delivery channel. It’s possible that in the near future auto rates will increase enough for this to become a less pressing issue. It is also possible that this will have to be dealt with for a while. Build and execute your game plan now to ensure that if income is going to be lost, it is a conscious decision.