Are Net Interest Income (NII) Simulation Pricing Assumptions Producing Optimistic Results?

June 13, 2018

We perform many model validations each year. In most income simulations, it is assumed that all new volume loan rates will move at 100% of the change in market rates. However, recent trends show that the “typical” new volume assumptions used by many credit unions are not representative of what is happening. This can cause a credit union to overstate their loan income.

Over the last 2 years, a 100% pricing assumption has not held true for consumer loans. Our recent blog post looked at the difference between 2-year Treasury rates and average auto rates.

As market rates have risen, consumer loan rates have not kept up. For example, the 2-year Treasury rate has increased about 170 bps over the last 2 years, while auto rates have generally increased 50-75 bps over that same period of time. At many credit unions, other consumer loan rates, such as credit cards and unsecured loans, have not moved at all.

For many, based on recent experience of roughly a 200 bps increase in market rates, betas on key loan categories have actually been in the 0% to 50% range – far short of the assumed 100% beta.

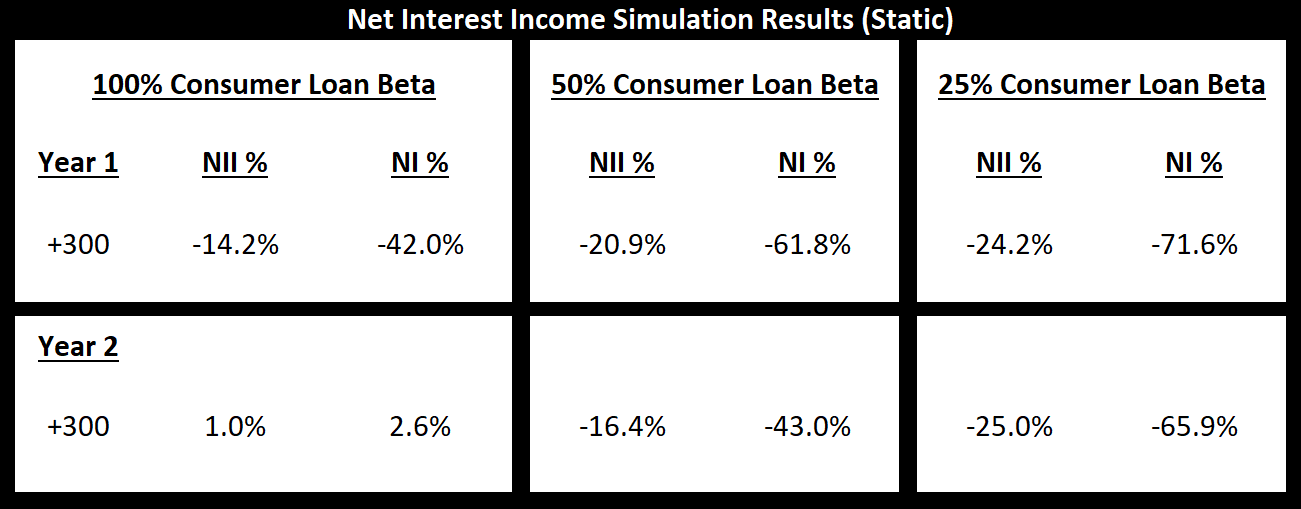

The following table shows how much loan pricing assumptions can impact static income simulation results for a real credit union. Depending on the assumption, Year 1 +300 bps net interest income (NII) % volatility ranges from -14% to -24%, which could cross limits in some policies. The +300 bps net interest (NI) % volatility moves from -42% to -72%, which could also cross some policy limits. And as you can see below, Year 2 is even more sensitive to this assumption.

If you are relying on static NII simulations to quantify risk, then it is a good idea to test different betas on loans to understand your credit union’s sensitivity to this assumption. This would be particularly important if your credit union has not been increasing new volume rates as fast as market rates have changed.

Note that loan pricing assumptions on new volume are not required for long-term risks to earnings and net worth simulations or for NEV. In managing a credit union there is certainly a place for estimating what you might be able to earn on new business, but be careful about the potential sensitivity to what is assumed in a risk simulation.