Are Unprofitable Loans Creating a Liquidity Challenge?

February 20, 2019

Liquidity remains a relevant topic, and we have written several blogs recently dealing with this important issue: Deposit and Liquidity Concerns and Is Your Certificate Promotion Doing What You Want?. Some places are seeing liquidity tighten due to outflows in deposits, though for many credit unions liquidity pressures are being driven primarily by growth in loans. However, is that loan growth helping the credit union achieve its desired goals? Consider the following, is the loan growth allowing the credit union to reach into new markets that will help accomplish longer-term strategic objectives? Is it allowing the credit union to serve a larger segment of the existing membership? Are the loans profitable?

As we review that last question of profitability with our clients, the answers can be surprising. A lot of time and effort goes into originating loans, so no one wants to hear that their credit union may be booking unprofitable loans, especially if adding those loans is creating additional stress and expense by magnifying a liquidity challenge.

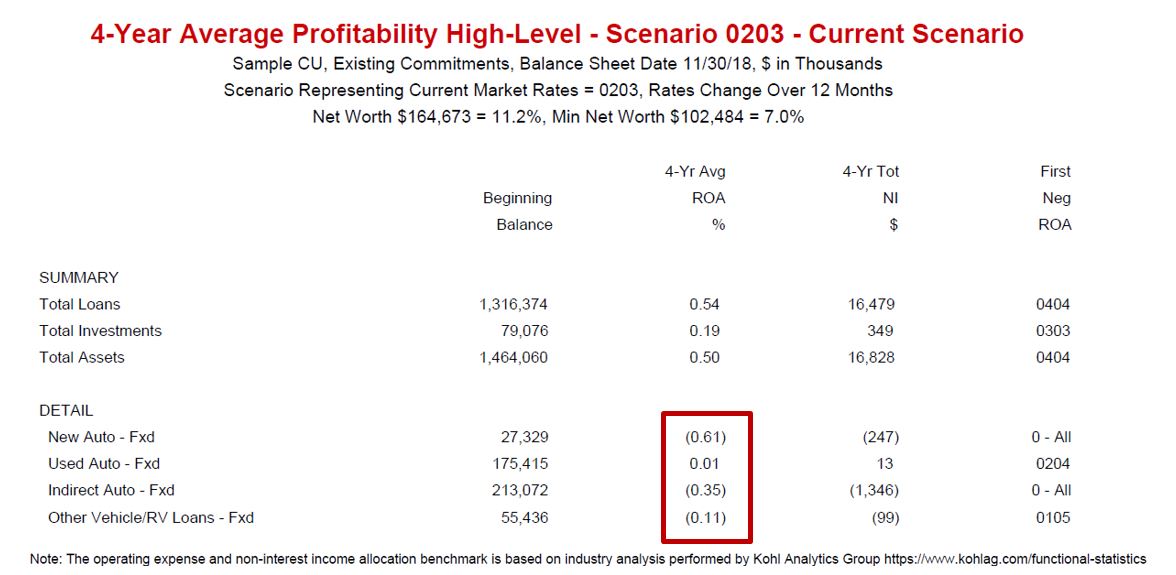

The credit union in the analysis below has tight liquidity, and the pressure is increasing. In the last 12 months the loan-to-asset ratio increased from 86% to 90% as loan growth continued to outpace the growth in deposits. The profitability analysis includes just a handful of the credit union’s specific loan types. The ROAs noted below cover a 4-year time frame in the current market interest rate environment. Note that this report can be produced for dozens of other market rate environments. Of particular concern to this credit union is the performance of their auto and RV portfolios. These are large categories for the credit union at about 32% of total assets combined and represent the bulk of the credit union’s growth in recent years.

A challenge for this credit union is that this issue is not going to resolve itself quickly through the normal course of business. This is because the average rate on new consumer loans (based on recent production) is only marginally higher than the current yields that are resulting in negative income. So 6 months from now, the picture is unlikely to have changed materially unless the credit union takes action.

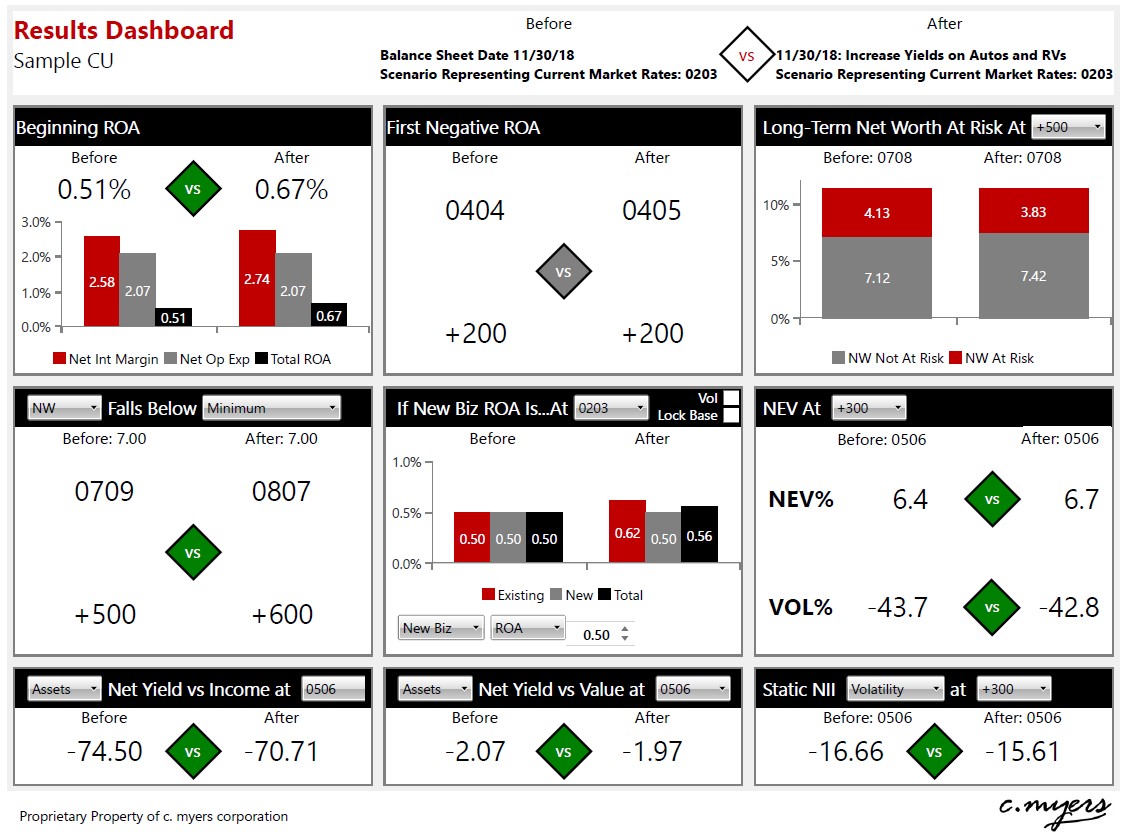

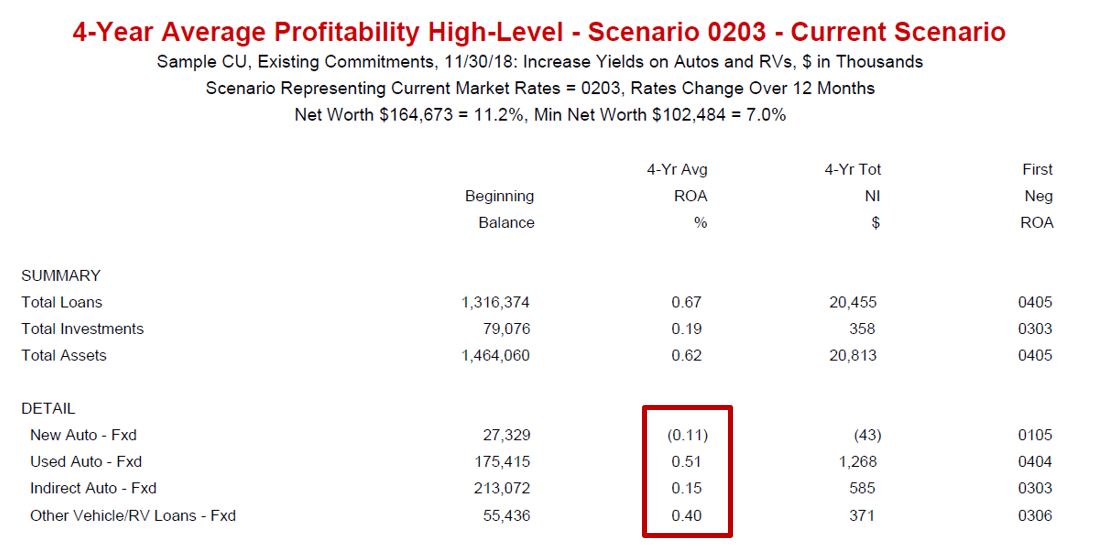

So what should they do? There are several potential alternatives. One strategy could be to adjust loan rates more aggressively with the goal of slowing growth over time to help the credit union roughly maintain its current loan-to-asset ratio (as opposed to it continuing to increase). In the scenario below, the auto and RV rates were increased 50 basis points (bps). All other loan rates were unchanged. From a big picture risk perspective, the results dashboard below shows what this could look like compared to the current base analysis. Note that every metric is improved over the base simulation.

This would also move most of the auto and RV categories into a positive earnings position. Increasing rates could still result in some loan categories remaining unprofitable, but if growth slows, liquidity should improve.

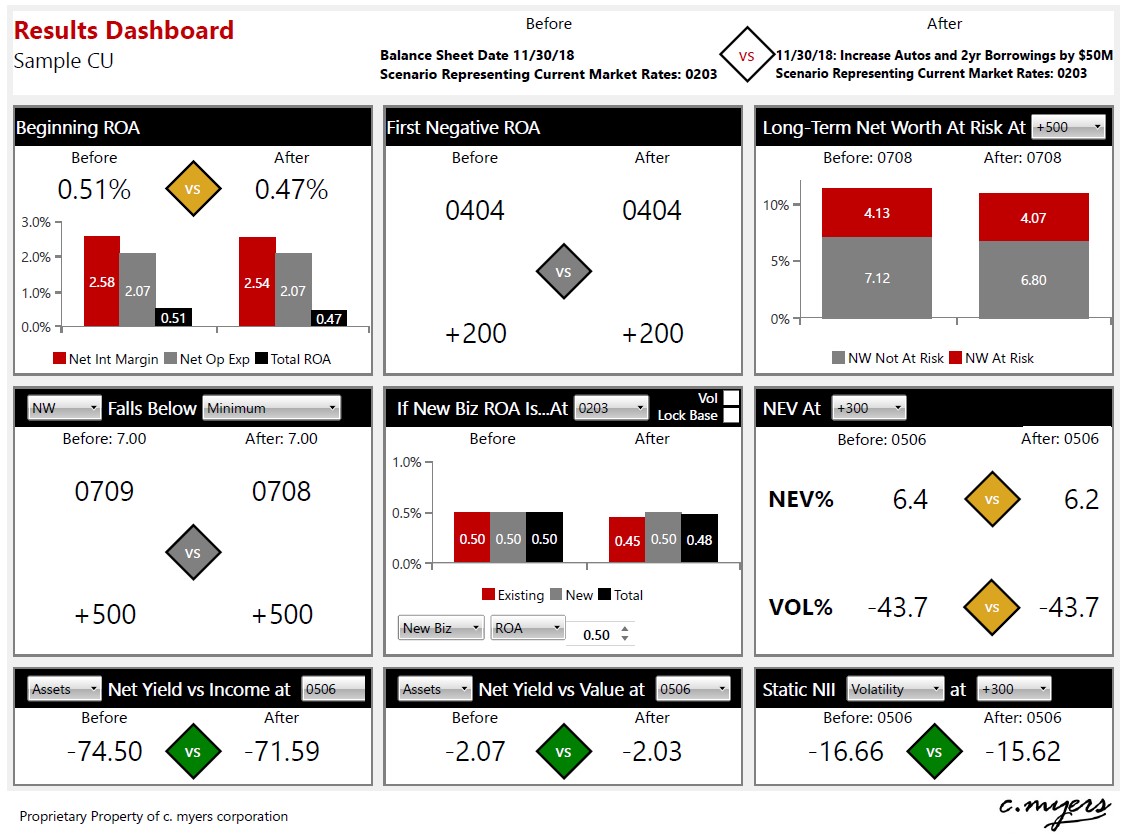

Another alternative could be to continue aggressively booking auto and RV loans, and buy time from a liquidity perspective by leveraging the credit union’s balance sheet and net worth by adding borrowings. In the scenario below, a total of $50M in autos and RVs was added at a yield 10 bps higher than the base case, funded with $50M in 2-yr borrowings. The results show that some of the key metrics are weaker compared to the base case, and the credit union has used $50M of its available borrowing capacity.

So what steps should this credit union take? While the results may seem clear, it is complicated as there are many nuances with these kinds of decisions. Having the appropriate analytics to help answer questions like these is a great place to start. However, engaging in strategic conversations with the key decision-makers is just as important. Potential questions could be:

- What are the risks of each path?

- How could each path impact members, employees, dealer relationships, or overall financial position?

- How could each answer be impacted if things don’t go as planned?

These are just a few of the questions that should be considered, among others. Whether or not your credit union has liquidity pressure, understanding profitability is important business intelligence. When liquidity is challenged, having and using that information is even more critical.