4 minute read – We often see that people focus on investment labels (e.g., 3-year callable bond, 5-year callable bond, or 15-year MBS) when making investment decisions. This blog contains food for thought as you consider different investment alternatives.

As we have said many times, your individual investment decisions should always be made in light of your overall investment strategy, and how your investment strategy can support optimizing your balance sheet and desired strategic flexibility to serve your customers.

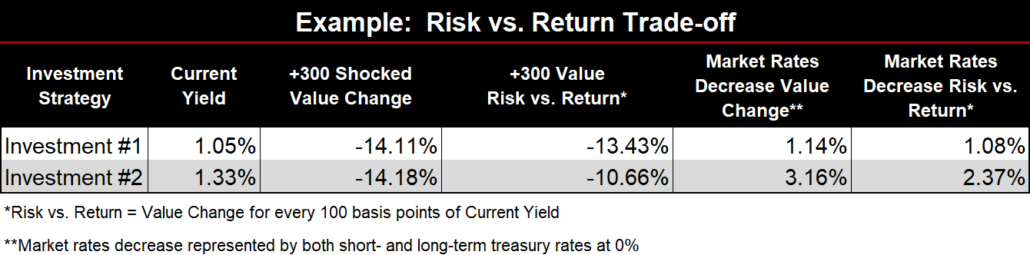

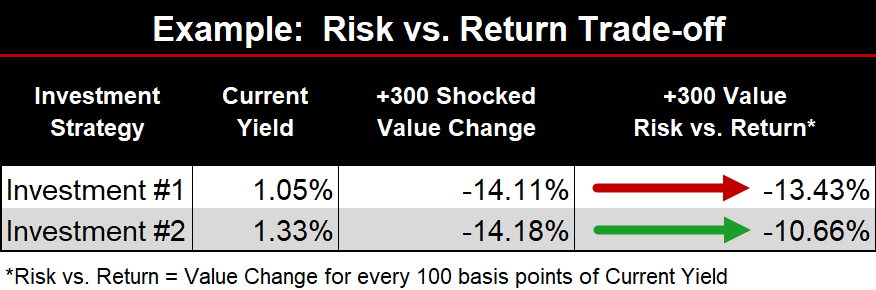

To illustrate, the table below contains two different investments – investment strategy #1 and investment strategy #2. While the investment descriptions or labels have been intentionally removed, each strategy’s current yield, value change, and risk vs. return trade-offs are shown.

As noted below, the risk vs. return trade-off ratio represents the change in volatility for every 100 basis points (bps) of current yield.

Based on the results in the table, have you been able to determine the type of investment behind strategy #1 and #2?

It may come as a surprise, but strategy #1 is actually a 5-year callable bond with a 1-year lockout and strategy #2 is a 15-year mortgage-backed security (MBS) passthrough.

There are many different types of callable bonds, each carrying with it unique risks. However, there is often an assumption that a 3-year final term, or in this example a 5-year final term, doesn’t have much interest rate risk. Or at least, surely as market interest rates rise, there is less risk than an MBS with a final maturity 15 years from now. This assumption is often referred to as label risk. While it’s true that the 5-year callable bond has a shorter final maturity than a 15-year MBS, the amortizing nature of the MBS can result in similar changes in value in a +300 scenario.

After considering the current yield of strategy #1 and #2, the +300 risk vs. return for every 100 bps of yield is more favorable for this specific MBS.

This is not to suggest the team should only focus on MBS investments. There are unique risks that come with MBS, such as premium risk, making it important to test a range of prepayment speeds.

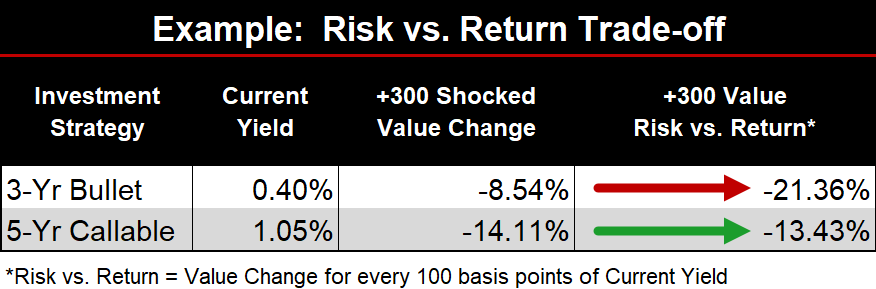

Understanding risk vs. return has always been important, but narrowing margins have made it more crucial. Another example that has come up recently for many decision-makers relates to the importance of revenue/yield. In the previous example, the callable bond had a less favorable risk vs. return trade-off compared to the MBS. However, how does the same 5-year callable bond compare to a 3-year agency bullet in a +300 bp rate shock?

The table above helps show that the callable bond has nearly double the +300 decline in value, but earns an extra 65 bps today. This results in a much more favorable +300 risk vs. return ratio compared to the 3-year bullet. While revenue is important, careful consideration is required. Being potentially locked into longer-term investments comes with a risk that might not fit the risk appetite for every team.

The goal with the examples above is not to advocate for a particular investment type, but rather to remind teams that investment labels often don’t tell the whole story. Take the time now to test, strategize, and form a clear picture of how different investment strategies can support optimizing your balance sheet – not only for today, but for potential environments in years to come.