Borrowing Options – Return and Risk Considerations

September 6, 2023

|

|

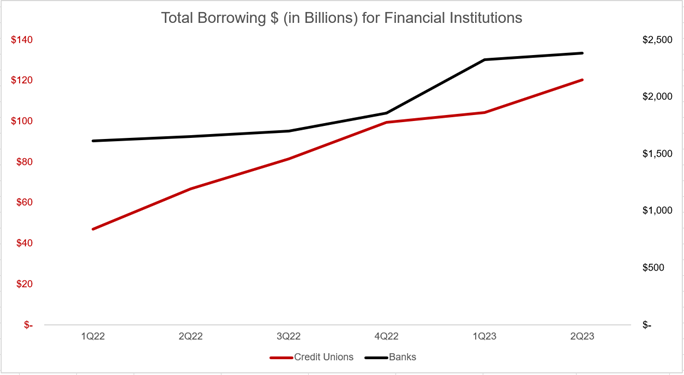

5 minute read – It’s no surprise that borrowings have increased significantly over the last year. With non-maturity deposits shrinking, institutions have been filling the gap with borrowings.

As more borrowings are being added and used more actively, it is important to keep a few points in mind. *

First, borrowing strategically can be a good move for institutions. For some, there can be historical mindsets around “we do not borrow” and seeing borrowings as an indication of financial instability. However, borrowings are a helpful and important tool for managing liquidity and interest rate risk, both of which are present in the current environment.

Second, it is important to continually understand your borrowing position and your remaining capacity. This may sound straight forward but while there is liquidity pressure now, it can be easy to lose sight of how remaining borrowing capacity is impacting the financial institution’s ability to respond to future liquidity events. Said differently, usage of borrowings today may limit a financial institution’s capacity to address an unforeseen external event should it need to access funds quickly.

To help understand this, decision-makers can start by revisiting the contingency funding plan and the institution’s identified liquidity scenarios. If the solution to your contingent liquidity event includes adding borrowings or is solely depending on borrowings, then it is critical to understand the potential magnitude of reliance on 3rd parties and adjust as needed.

Third, understand thoroughly the impact of the borrowings being added and how they will help achieve your objectives. Clarity on objectives from preserving the lowest cost of funds possible today, locking in liquidity for a particular length of time, or reducing interest rate risk/stabilizing earnings across a range of environments. There are many choices of borrowings from bullets, amortizing, or options that can be called or put. For each path considered, it is important to clearly communicate to decision-makers in the organization the risk/return trade-offs.

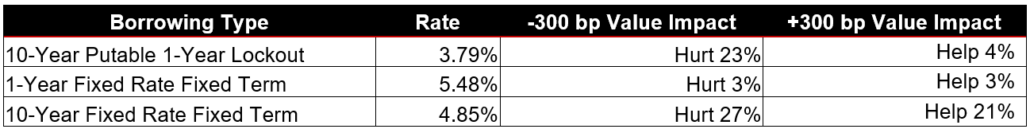

Let’s take a deeper dive by evaluating a 10-year putable (at the lender’s discretion) with a 1-year lockout. Thinking of the objective, why would an institution choose this option? In this case, they may just need the money for a year and think rates will stabilize or increase a little over the next year. Given the inverted yield curve, recently a financial institution could get a 10-year putable for 3.79%* vs. paying 5.48% on a 1-year term borrowing. What’s clear is that the institution is trying to save money in the short term.

This is where understanding the broader risk/return picture is important and potentially confusing. Because the putable can behave like both a 1-year and a 10-year term borrowing, the comparison of risk and return is not straightforward. If rates go down, the putable will behave like a 10-year term borrowing whereas the putable will behave like a 1-year term borrowing if rates go up.

In down rate environments, the institution would have been happier with a 1-year borrowing even though they were paying ~170 bps more because they could add lower cost funding after the borrowing matures. Looking at the economic value impact, the putable borrowing hurts about 23% compared to 3% of the 1-year term borrowing. So the 1-year potential benefit turns into 10 years of risk.

Note, when comparing the putable to a 1-year fixed term, if rates were to go up, the putable would have the same length but some additional benefit due to the lower rate.

The risk to a structure of locking in 10 years of commitments could be a material hurt if rates go down. Often for that risk, a purchaser would want more upside which you see in the example of the 10-year fixed term because it shows material benefit if long-term rates were to go up more.

The reality is that a putable is designed to provide benefit in a very narrow band of rates for a short amount of time. However, financial institutions can and should understand this by gaining clarity on what level of rates there would be a benefit to the putable versus a fixed structure. Testing the borrowings in your ALM model can help financial institutions see this. Note that looking at a 12-month static income or NII simulation will not help decision-makers understand the trade-offs because the optionality does not start until 1 year out.

The message here is not that putable borrowings are bad – the lower rate does add some benefit especially as the cost of funds continues to rise. The message is to be clear on the financial institution’s needs and objectives and then work through to fully understand the risk and return trade-offs of the borrowings being added. Below are questions that can help financial institution’s think through the considerations and other factors in advance:

- What is the objective for adding borrowings?

- How should interest rate risk be considered as well as liquidity when evaluating the borrowings?

- What are other funding alternatives and how do they compare to the borrowings being considered?

- If there is optionality, in what range of rates is the borrowing a “good deal” for the institution?

- If rates change and the optionality of borrowing is triggered, what are the options to replace the funding?

- How does potential timing of the optionality in the borrowing line up with other funding pressures, such as other borrowings maturing or member CD promos coming due?

Again, borrowings can be an important and strategic tool for liquidity and IRR management. It is important for financial institutions to think through their objectives and the potential impacts the borrowings are adding.

*All rates are based on FHLB Chicago Rate Indications from August 18, 2023

*All data is from Callahan and Federal Reserve Board from August 18, 2023