c. myers live – Pricing and Withdrawals: Critical ALM Issues

February 2, 2023

In this episode of c. myers live, we discuss critical ALM modeling issues that impact decision-making, in this challenging environment. We recently wrote a blog about a specific ALM modeling issue, with respect to decay rates. This podcast builds on this critical conversation and works to simplify a complex set of financial concepts through discussion.

The show notes below go hand-in-hand with this episode of c. myers live.

We’re delving into capturing consumer behaviors surrounding deposits with modeling assumptions to produce better decision information.

The Changing Environment

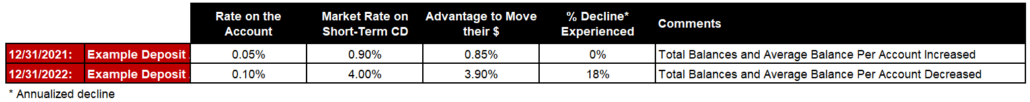

Consider what happened in 2021, when total deposit balances and average account balances increased for most institutions and account types. Contrast that with what is happening now that market rates are higher.

Think about it from the consumer’s perspective and the concept of the advantage to the consumer to move their money to another product or institution:

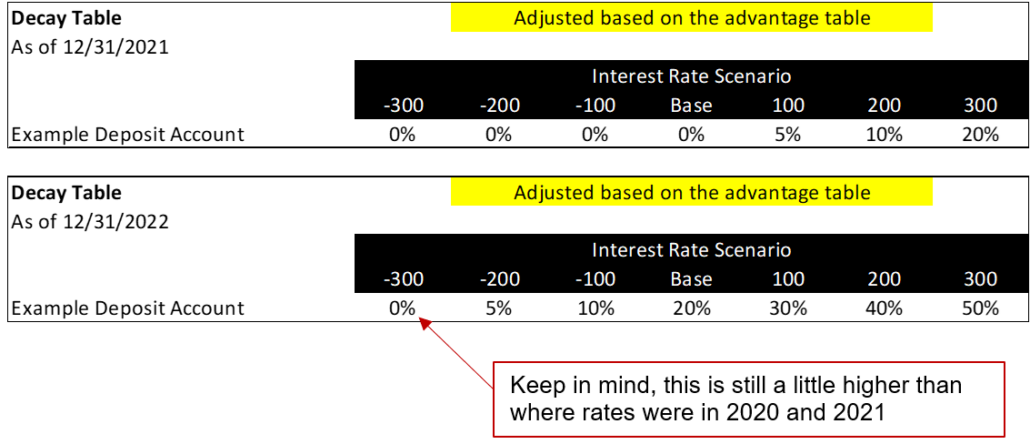

This illustrates that consumer behavior is different when the advantage increases (18% decline in balances versus 0%), yet the following example of decay rates is typical of what is found in many models and does not reflect any change in behavior between 2021 and 2022.

If your model looks roughly like these two simple examples, then it would assume 10% withdrawals in the starting position and 20% in +200, even though current rates are a lot higher and provide a much larger reason to move.

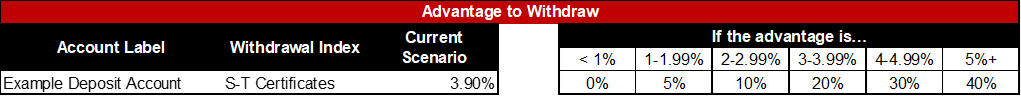

Linking Withdrawals/Decays to the Advantage

Remember that the advantage in December 2021 was 0.85% and for December 2022 it was 3.90%. A single table like this, for the rate environment in December 2021, would result in an assumption of 0% since the advantage is less than 1%. Then in December 2022, since the advantage to move money increased, the table would automatically shift the “Base” situation to be 20% withdrawals. Note, a table design like this connects the rate paid in each environment and the alternative for the customer to move their funds. The shift of +200 or +300 in December 2022 would automatically show more risk of liquidity pressure (cost of liquidity) than a +200 or +300 would have shown in 2021.

What could you do if your model doesn’t have this ability? It is not ideal, but you could keep a side table storing your assumptions from an advantage perspective, since that can be a major motivator for moving deposits. Then as the environment changes, update the assumptions in the model to mimic the table you have on the side. For example:

Don’t focus on the specific numbers in the examples, as the numbers vary by institution and account type.

Note that to simplify the example, we only showed one deposit type. Most institutions have many deposit types. Additionally, as mentioned in the podcast, we recommend breaking material deposit types into balance tiers that may have different behaviors.

The Financial Impact of Decays/Withdrawals

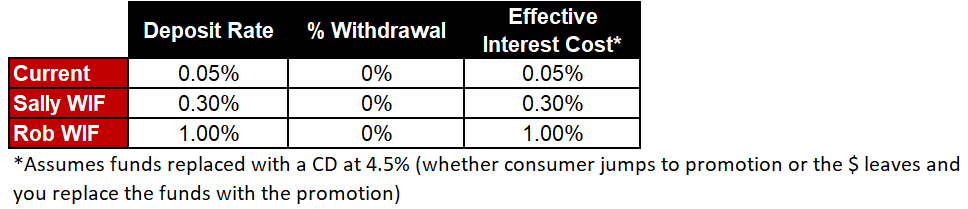

Keep in mind, there are many strategic implications to consider with deposit pricing, including your desired brand, target market, value proposition, competitive environment, and long-term goals, to name a few. It is also important to understand the math of what the potential impact could be and connect it to the strategy to help understand trade-offs and alternatives.

In the podcast, Rob and Sally gave an example of a category that has $1 Billion in deposits. To make the numbers even simpler, the tables below are for a deposit category that has $100 Million in deposits.

If decays/withdrawals are not incorporated in earnings impact: Typical Static Balance Sheet

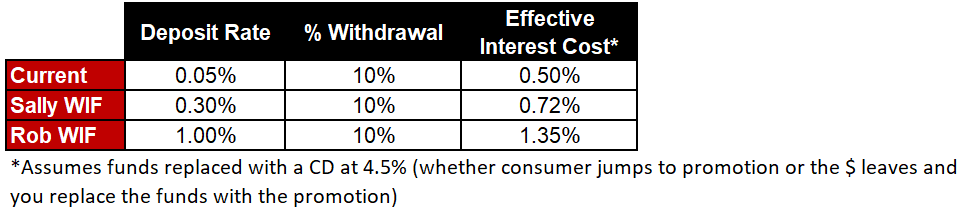

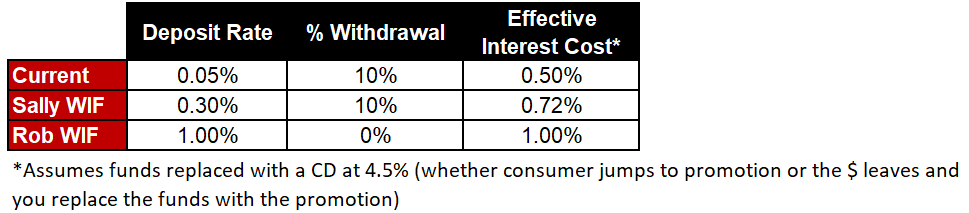

If current experience is 10% decline, and the simulation assumes the decline does not change when paying higher rates:

If current experience is 10% decline, and you think paying 1% would stop the outflow, but paying 0.30% would not change behavior:

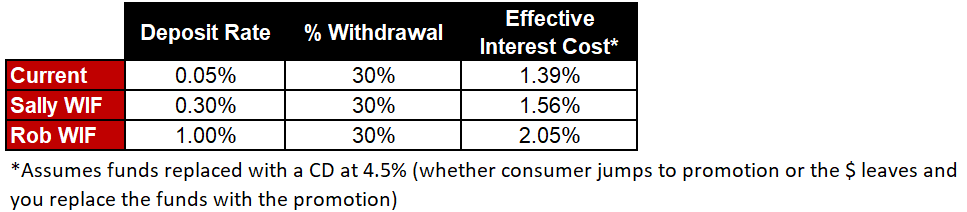

If current experience is 30% decline, and the simulation assumes the decline does not change when paying higher rates:

If current experience is 30% decline, and you think paying 1% would stop the outflow, and paying 0.30% would slow some of the outflow:

Any decision to change non-maturity deposit rates on a category that has material balance is a big decision, as it will have an immediate impact on earnings. As mentioned earlier, there are strategic, philosophical, and financial reasons to consider when evaluating a change. The key is to ensure that the financial impact being modeled is representing the expectations or concerns that decision-makers are working to address.

Modeling Decay/Withdrawal Rates in the Income Simulation

Many models do not apply decay/withdrawal assumptions to the income simulations; they only use those assumptions for economic value results. If this is the case, then additional work should be done to model the earnings impact of withdrawals when modeling pricing changes.

Without decay/withdrawal assumptions, any increase in deposit rates will cost the institution the amount of increase without any potential for an offsetting behavior, such as less movement to higher priced funding sources.

- Workaround for Dynamic Simulation: Run a what-if with the pricing changes and change the target balance(s). If you’re increasing rates to slow the decline, then adjust the deposit balances to reflect how much more you think may stay in the account. You may also adjust the amount of funding from higher priced products or borrowings, if appropriate.

- Workaround for Static Simulation: This is more complicated. Your base simulation needs to have an account in the starting position representing the amount of funds that are expected to move to higher rate products or that would need to be replaced. When increasing rates to slow the decline, run a what-if with the new pricing and adjust the balances in the deposit account by putting the amount back that you think would stay in response to the pricing change. You may also adjust the account that represents higher cost funding, if appropriate.

If you’re wondering if the extra work is worth it, think about it this way. If you truly believed that the consumer with funds in deposits doesn’t care about rate and won’t ever change their behavior, then there wouldn’t be a reason to pay anything on the account and it would be better to use that earnings impact on another area that could increase your value proposition.

About the Hosts:

Sally is a founder of c. myers corporation and one of five owners. Driven by a deep commitment to helping financial industry leaders and regulators for more than two decades, her guidance has shaped c. myers’ focus on helping clients create opportunities and approach problem solving from a scalable perspective. She has also been a strategic force behind the development of c. myers’ financial models.

Sally is a founder of c. myers corporation and one of five owners. Driven by a deep commitment to helping financial industry leaders and regulators for more than two decades, her guidance has shaped c. myers’ focus on helping clients create opportunities and approach problem solving from a scalable perspective. She has also been a strategic force behind the development of c. myers’ financial models.

Rob, President and one of five c. myers owners, has been instrumental in delivering on the vision of enabling leadership teams to have relevant and reliable financial decision-information at their fingertips, so that they can accelerate their strategic impact in providing value to their markets. Clients find the speed of the decision-information, whether at the enterprise level or drilling into what is driving profitability at a category level, combined with Rob’s quick mind and critical thinking, to be invaluable.

Other ways to listen to c. myers live: