Considerations for Profitable Used Auto Lending

August 25, 2021

|

|

6 minute read – If you have shopped for a vehicle recently, you know supplies are tight and prices are high. Used auto values increased roughly 40% from July 2020 to July 2021, and while the rate of increase slowed dramatically in July of this year, used auto prices are still extremely high by any measure. This has created a unique environment for lending, and it could be changing the credit risk landscape for a period of time.

6 minute read – If you have shopped for a vehicle recently, you know supplies are tight and prices are high. Used auto values increased roughly 40% from July 2020 to July 2021, and while the rate of increase slowed dramatically in July of this year, used auto prices are still extremely high by any measure. This has created a unique environment for lending, and it could be changing the credit risk landscape for a period of time.

No one knows what will happen with used auto values over the next year or two, but it is certainly possible that the price of used autos could decrease substantially, especially if the supply of new vehicles begins to catch up. Loans being made at such high market values creates the potential for larger losses if values come back down and loans are charged off.

Many of the institutions that we work with do not anticipate an increase in the probability of default, but believe that if defaults happen, the losses could be much larger. This is NOT a suggestion to stop booking used auto loans, but rather that the risks need to be clearly identified, tested, and communicated to decision-makers.

Questions to address include:

- Are used auto loans priced effectively for the risk we’re taking?

- How much could losses increase before used autos are no longer profitable?

- How does the marginal ROA contribution compare to other alternatives such as investments?

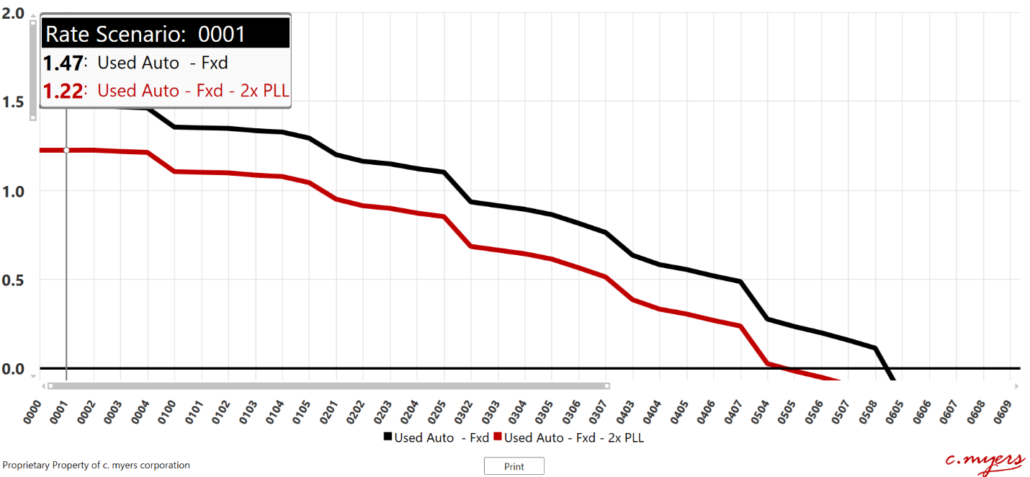

Consider an example comparing the marginal return on assets (ROA) of used autos at a 3% average yield with “expected” credit risk of 25 basis points (bps), to the same pool of used auto loans but where the credit risk is doubled (increasing to 50 bps). Not surprisingly, the higher provision for loan loss (PLL) reduces average profitability by about 25 bps across all simulated rate environments. The used autos with the lower provision would remain profitable until market rates hit 6%, compared to market rates at 5% for the loans with higher losses.

Comparison of Marginal ROA

Note: the 4-digit codes across the bottom of the graph represent different market rate environments. The first 2 digits represent short-term government rates (3-month Treasury), while the last 2 digits represent long-term rates (10-year Treasury)

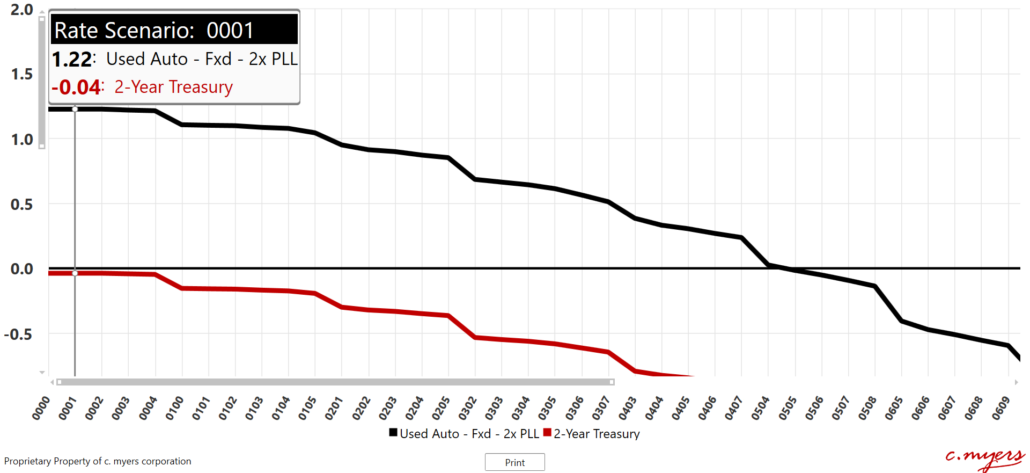

Compared to an investment with a similar average life, even the used autos with the higher PLL are still much more profitable. The following report compares marginal profitability of the used autos with the higher PLL to a 2-year Treasury. Note that even with PLL at 2X the base level, the marginal ROA of the autos is more than 126 bps higher than a 2-year Treasury. And PLL would have to increase to a total of about 175 bps before the autos are breakeven with the 2-year Treasury.

Comparison of Marginal ROA

Note: the 4-digit codes across the bottom of the graph represent different market rate environments. The first 2 digits represent short-term government rates (3-month Treasury), while the last 2 digits represent long-term rates (10-year Treasury)

There are other considerations, such as:

- Loan losses on used autos often start to appear within 12-18 months of issuing the loan. If used auto prices fell further, and faster than normal, some borrowers might make an economic decision about whether to continue paying and that could impact when loan losses start. Also consider whether this would necessitate doing anything differently from a monitoring and collections standpoint.

- Given the potential for increased credit risk exposure, maintaining a higher allowance for loan loss could help cover the potential for credit risk for those loans being made today and could help smooth out earnings over time.

- Discuss whether this should cause your institution to rethink loan-to-value requirements. Even if you decide to not change a thing because of your desired competitive positioning, there is tremendous value in the discussion. Regardless of what decisions you make, it is a good idea to document your rationale, as memories can be short.

- What other loan categories are being impacted by these trends? For some institutions, RVs are also becoming a loan type that is getting extra attention for many of the same reasons.

- Finally, consider a broader discussion with your team about other lending or revenue opportunities your institution could contemplate in this unique environment.

Anytime the market changes this much, in a relatively short period of time, it is a good idea to step back and consider the impacts these trends could have today and going forward. External forces continue to evolve rapidly, which creates the necessity to have these types of discussions more often. This helps decision-makers proactively balance being competitive today with having strategic flexibility in the future.