Data Reveals Lost Revenue Opportunities

May 11, 2022

|

|

5 minute read – One of our podcasts focuses on the importance of growing top-line revenue. With so many competing priorities, strategic teams need to seek balance in the initiatives they take on to ensure that revenue growth initiatives receive high priority.

Revenue growth can be generated in many ways, but one source that has the potential to pay off quickly is growing loans by booking more of the opportunities you’re already getting. Making changes that increase the number of funded applications can make a significant impact on revenue in the short and long term.

Incomplete and Abandoned Applications

Dive into your data to investigate the points in the application where people are quitting. This can provide great insight into the sources of friction. Some systems and vendors make it difficult to get this information, but it’s worthwhile to push for the data.

Armed with the quit points, go through the application process yourself with a critical eye and the mindset of someone who is not an expert in financial services. Something that is even slightly confusing can cause online applicants to jump ship for one of the many other lenders at their fingertips.

Competitors have made applying for a loan incredibly easy, asking as little as possible of their customers. People may quit if the application goes on too long, asking too many questions. The mindset for digital applicants is very different from the in-person applicants of the past. A series of questions that might have felt like a conversation in person can feel tiresome and intrusive when applying digitally.

Declined Applications

Approvals and declines must happen within the organization’s appetite for risk, but the data can point out inconsistencies and missed opportunities. Look for differences where you would expect to find similarities. Similar loan types for similar credit scores would typically result in similar approval ratios. Look by channel (online versus contact center versus phone), underwriter, originator, and branch.

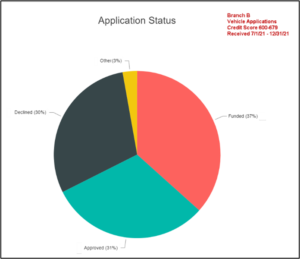

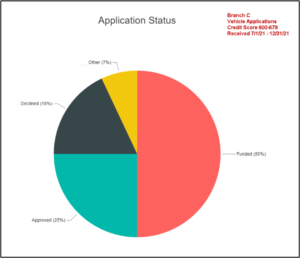

This organization needs to understand why Branch B declines 30% of vehicle applications with credit scores of 600-679, while Branch C only declines 18% (and funds a lot more of them). They could start by slicing the data by originator and underwriter and using that as a springboard for deeper conversations to understand the differences.

Approved Applications That Don’t Fund

After you’ve gone through the effort to approve a loan, the payback doesn’t come unless the customer says yes. Your data can tell you how often the effort is wasted. It can also tell you how long different phases in the process are taking, how the trends vary for different loan types, and whether correlations can be made to branches, originators, channels, underwriters, or credit score.

As you dig in, you may find some of these common points of friction:

- Too slow to give the customer a decision for processing and funding. It has become SO easy to apply somewhere else if things aren’t moving fast enough

- Unclear next steps

- Difficult process, too much documentation or paperwork

- Left a voicemail, sent an email, or communicated in some other way that this consumer doesn’t prefer

- Offer isn’t good – rate or amount

- Product features are lacking

See our blog on using the power of “Why?” for more ideas on identifying potential issues and capturing some of the lost opportunities.

Fixing Hiccups

Taking action on your findings is often technically simple. Some of the biggest impacts are the result of changing old business rules that have been carried forward and providing clear guidance on steps that are no longer required. Improving even one or two friction points can pay big dividends into the future. Plus, the effects are near-term and may produce additional benefits like greater efficiency and improving the customer and employee experience.

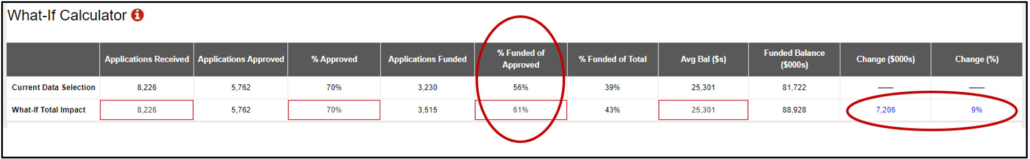

As you consider using resources to work through these issues, it helps to quantify the potential for increased revenue. Once you know your baseline performance, you can do what-ifs on approving or funding more applications. This institution is looking at direct vehicle loan applications. By funding 5% more of the approved applications, they could book 9% more in loan balances in this category.

Booking more of the loan applications you already receive is just one way to grow your top-line revenue. We haven’t even touched on the vast array of other possibilities. Spend some time thinking about this as a team and utilize your data to help with the analysis. With so much to do, make sure enough focus is devoted to growing top-line revenue.