Decay Rates – A Critical ALM Modeling Issue That Can’t Be Ignored

January 11, 2023

|

|

5 minute read – As rates have increased materially, and liquidity pressure continues to build, leaders will continue to be faced with high-impact decisions that can have longer-term consequences. Reliable and timely financial decision-information is a huge component of a successful decision-making process.

This blog on decay rates is the first in a series addressing critical ALM modeling issues. There is a lot of information here, so pull it up on the big screen for a better view.

Problem: When conducting EVE/NEV simulations, the focus on the relative rate environment is overrated. This focus can result in a misinterpretation of how assumptions are being applied, and heavily influences the results.

Solution: Dig deep into your decay rate assumptions to ensure that the actual current rate environment, which changes over time, is being considered. This is a hard, yet critically needed, shift in ALM modeling mindset and is only one of many examples regarding assumptions that need to be reviewed.

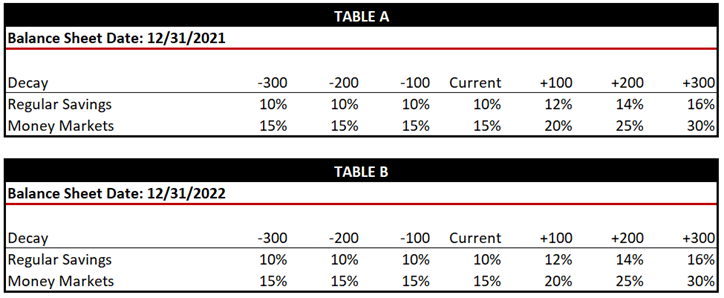

This concept can be a little harder to visualize so we have added some tables to help. Tables A and B are simple examples of the format we often see when doing model validations.

Are the assumptions consistent?

No. While on the surface they look the same, if you dig deeper, they are not. Keep in mind that as of December 2021, the current 3-Month Treasury was about 0.1%. At the end of December 2022, it was around 4.40%. This fact is easy to miss because there is no statement of what the current environment actually is.

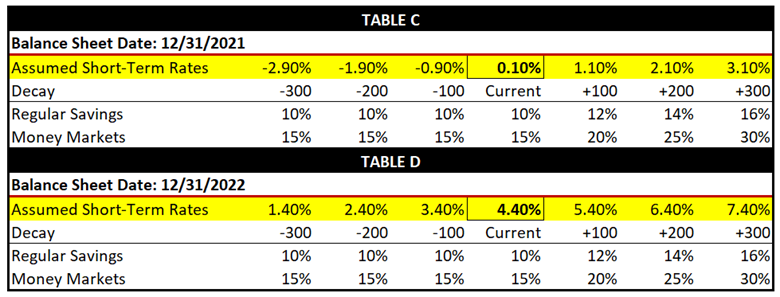

To illustrate why the actual rates do matter, we added a row of information to Tables C and D that most models don’t address. The inconsistency becomes much clearer.

Focus on the highlighted lines to see inconsistencies in the assumptions.

- For example, the December 2021 simulation shows the assumed decay rates for money markets in a +300 is 30%. The +300 in this simulation is short-term rates at 3.10%.

- In December 2022, current rates were around 4.40%, which is materially higher than the simulated 3.10% rate in December 2021.

- Even though actual current rates are much higher, the decay rates don’t reflect the potential impact that higher rates could have on a member’s advantage to withdraw funds. In this example, the December 2021 simulation is using a 30% decay rate for money markets in +300, but in December 2022, when rates went up more than 300 bp, the model is still using a 15% decay rate for money markets. This view helps to highlight inconsistencies.

Just a few considerations as you review your assumptions for reasonableness:

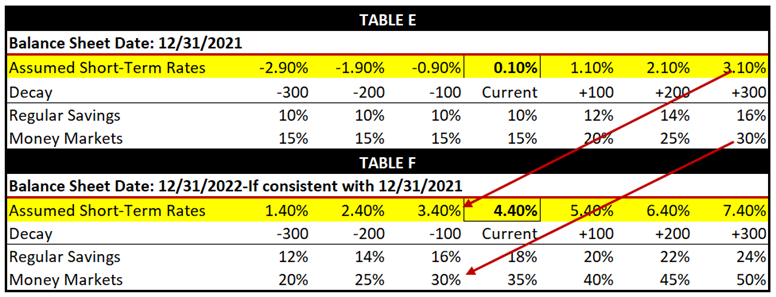

- To help correct the flaw in traditional shock tables, shift the assumptions over. Notice the red arrows in Tables E & F. This isn’t an exact science but it will show the impact of keeping comparable assumptions that don’t contradict each other for the similar levels of rates.

- Liquidity pressures are increasing: take a look at FHLB advances through Sept 2022. This is one of many indications that there is a potential for increasing decay rates in the current environment. This potential should be factored into simulations.

- New assumptions should be developed as new shocks are taking rates to 5%, 6%, or 7%. Imagine how desirable a 7% CD would be to many consumers and businesses.

- Don’t forget that in 2019, prior to the pandemic, a top source of concern was funding – cost and access.

Problem: Many decision-makers think that the decay tables used for EVE/NEV apply when simulating risks to earnings and capital. Unfortunately, many models do not link the decay rates when simulating risks to earnings and capital, which can understate the risk. This approach is essentially saying that the consumer does not care what rates they are paid. This does not make sense.

Ask yourself: What is the rationale to incorporate decay rate assumptions when doing EVE/NEV simulations, and not when simulating risks to earnings and capital? Remember, liquidity has become a bigger topic in many C-Suite and board discussions. It is important to clarify for stakeholders which ALM results that you review incorporate the risk of withdrawals/decays and which results do not.

As we said in the beginning, reliable financial decision-information is critical to thriving in this type of environment. We run thousands of risks to earnings, capital, and EVE/NEV simulations and what-ifs each year.

This blog just scratches the surface of considerations facing finance teams today. Stay tuned for more tips on providing reliable financial decision-information.

We understand timing is critical and finance teams need to move fast. Please feel free to call us if you have questions on the information provided in this blog and/or just can’t wait for our upcoming blogs.

You may also be interested in: