FinTech Lending – Don’t wait for strategic planning to have this strategic discussion

May 26, 2016

While some FinTech lenders may be struggling, credit unions should not assume the threats are going away.

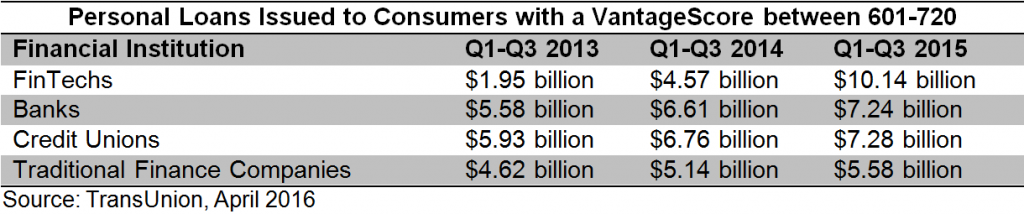

FinTech lenders have taken a huge bite out of the lending pie. Consider the following:

It is no secret that FinTech lenders have recently taken a big hit. However, even if Lending Club, Prosper, or OnDeck are not long-term survivors, the value proposition they championed will likely be carried on and taken to a higher level by other FinTech companies, banks, or credit unions. The largest banks in the United States are paying attention to the trends.

In a recent interview, the CEO of JPMorgan noted that while there is nothing “mystical” about what marketplace lenders are doing, they are filling a fast-growing niche, and have effectively reduced the “pain points” for consumers seeking to borrow and invest.

Credit unions should proactively engage in strategic discussions around the implications, good and bad, of FinTech lenders. Consider questions such as:

- What is driving consumers to online lenders?

- What can your credit union do to ease your members’ pain points when it comes to the loan application and funding processes?

- For many consumers, a big pain point is speed. Another is mountains of paperwork and documents to sign. Some marketplace lenders have very short applications and can decision loans within minutes, not hours or days, while having much faster funding

- Or perhaps it’s privacy? Chatting with someone online can have a different feeling than sharing sensitive financial data in a face-to-face setting

- What does your credit union need to do today, to ensure relevancy and sustainability, as the competitive environment changes at lightning speed?

These are just a few of the many questions that should be asked during strategy discussions. While in this blog the focus was on loans, don’t forget there are many strategic disruptors in the world of payments.