HELOC Considerations in a Rising Rate Environment

April 19, 2017

With the recent increase in short-term interest rates, specifically Prime rate, many credit unions are taking a closer look at the impact of higher rates on their HELOC portfolios. Anything is possible when it comes to future market interest rates but a continued increase in Prime means members will have higher interest rates and higher payment amounts. This begs the question, how much of a payment increase can members handle?

To help answer this question, a simple exercise can be performed in Excel. Come up with an approximation of the average HELOC balance. Depending on geography and the type of membership, this answer can vary widely. In some metro markets, credit unions have found their average HELOC balance to be close to $100,000. Even if the average HELOC balance is lower than this, consider the fact the member may have student loans or credit cards that are also potentially affected by an increase in Prime. For purposes of our example, assume an average HELOC balance of $75,000.

To keep the example simple, consider just the HELOC interest payment, not even building in principal paydown. This is important to acknowledge because many HELOCs from the real estate boom (2005-2007) are at the end of their 10-year draw period. This could add considerable pressure to the monthly payment, as some will start paying down principal at a time when interest rates might be going up.

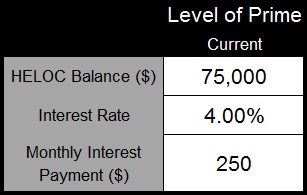

Prime is currently at 4.00%, which results in a monthly interest payment of $250 based on a balance of $75,000.

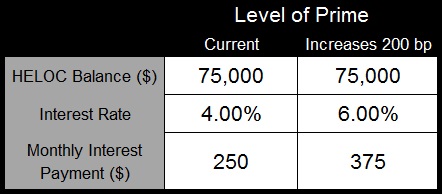

If Prime continues to increase, have a discussion and try to answer the question, could the member afford another 200 basis point (bp) increase in Prime?

The members’ monthly interest payment has increased from $250 to $375, representing a $1,500 increase on an annual basis. Perhaps a conclusion is reached that, sure, our members could handle that increase.

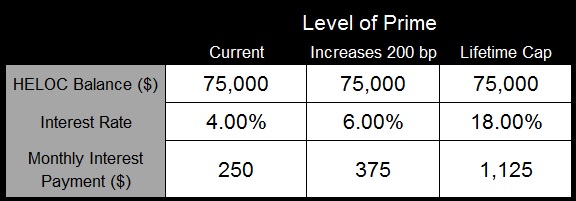

Consider a more dramatic change in Prime. If the lifetime cap on the HELOC portfolio is 18%, determine if you feel the member could handle an increase to that level.

The members’ monthly interest payment has increased from $250 to $1,125, representing a $10,500 increase on an annual basis. At this point many decision-makers might arrive at the conclusion that members can’t absorb an increase in Prime of this magnitude. If there is agreement that the member can handle a 200 bp increase in Prime but can’t handle a 1400 bp increase in Prime, somewhere in the middle is an implied cap on the benefit of having this variable rate product.

Once there is a consensus on how much payment increase the member can handle, the interest rate risk modeling becomes easier. Every HELOC portfolio has the potential to be unique but take a look at the characteristics and consider incorporating a more restrictive periodic cap in you’re A/LM modeling or increasing prepayments to account for this risk.

The value is in the discussion, especially if the credit union is counting on HELOCs offsetting interest rate risk in higher rate environments.