Hidden Cost of Addressing Liquidity Needs

September 7, 2017

Loan growth is a good thing, but when it outpaces deposit growth, liquidity pressures start to build. If your credit union is experiencing this situation, there are several liquidity options to consider—each of which comes with its own unique trade-offs. Here we look at two of them.

Third-Party Borrowings

Third-party borrowings are a common source of liquidity. If you choose to address your liquidity needs through borrowing, the structure will depend on your specific needs. Do you take a bullet or amortizing structure? A fixed- or variable-rate borrowing? While a longer-term, fixed-rate borrowing costs more than a short-term variable-rate one, it may make sense depending on your needs and objectives. The same needs and objectives should be applied when considering bullet versus amortizing term borrowings.

Beyond the interest cost of the borrowings, on the day you borrow, your asset size increases and net worth ratio declines. The amount you borrow affects this, so think about the impact to your net worth ratio before pulling the trigger on any borrowings.

Certificate of Deposit Promotions

Another approach some credit unions take is to run certificate of deposit (CD) promotions. In the following example:

Assume a credit union wants to raise $20 million by running a CD promotion at 1.75%. If they are successful and bring in $20 million of new money, the promotion costs them an interest expense of 1.75%.

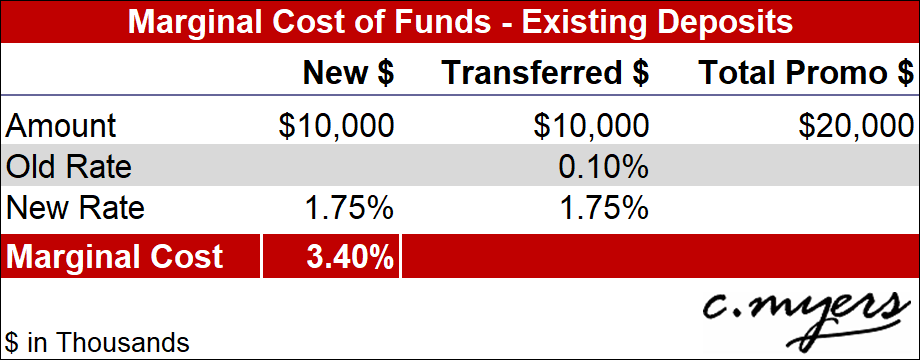

What may happen, however, is that the credit union achieves their targeted dollar amount in the promotion, when in reality some of this money is cannibalized from their existing deposits. In this next example, let’s assume the credit union gets $20 million, but half of the funds move from regular shares to the promotion.

Here is the hidden cost: the credit union achieves $20 million, but brings in only $10 million of new money. The increase in interest expense of the dollars moved from regular shares at 0.10% to the promotion at 1.75% must be factored in—considered part of the cost to acquire $10 million of new money. This is known as the marginal cost of funds. The marginal cost of funds will vary, depending on the amount of cannibalization and the rate the funds were formerly earning, but in this case the credit union should view the CD promotion as costing 3.40% rather than 1.75%. When evaluating the promotion in this light, decision-makers are more informed and understand what the actual costs may be.

Regardless of your liquidity situation and how you chose to address it (whether through borrowing, CD promotions, or any of the many other options available to you), it is critical that you do your analysis, understand the trade-offs, and document your short- and long-term objectives.

For more articles about liquidity, click here.