How to Combat a Credit Card Acquisition Plateau

August 21, 2019

If you are not seeing an increase in credit card acquisitions, you may want to take a look at the ease and timeliness of your online credit card application process.

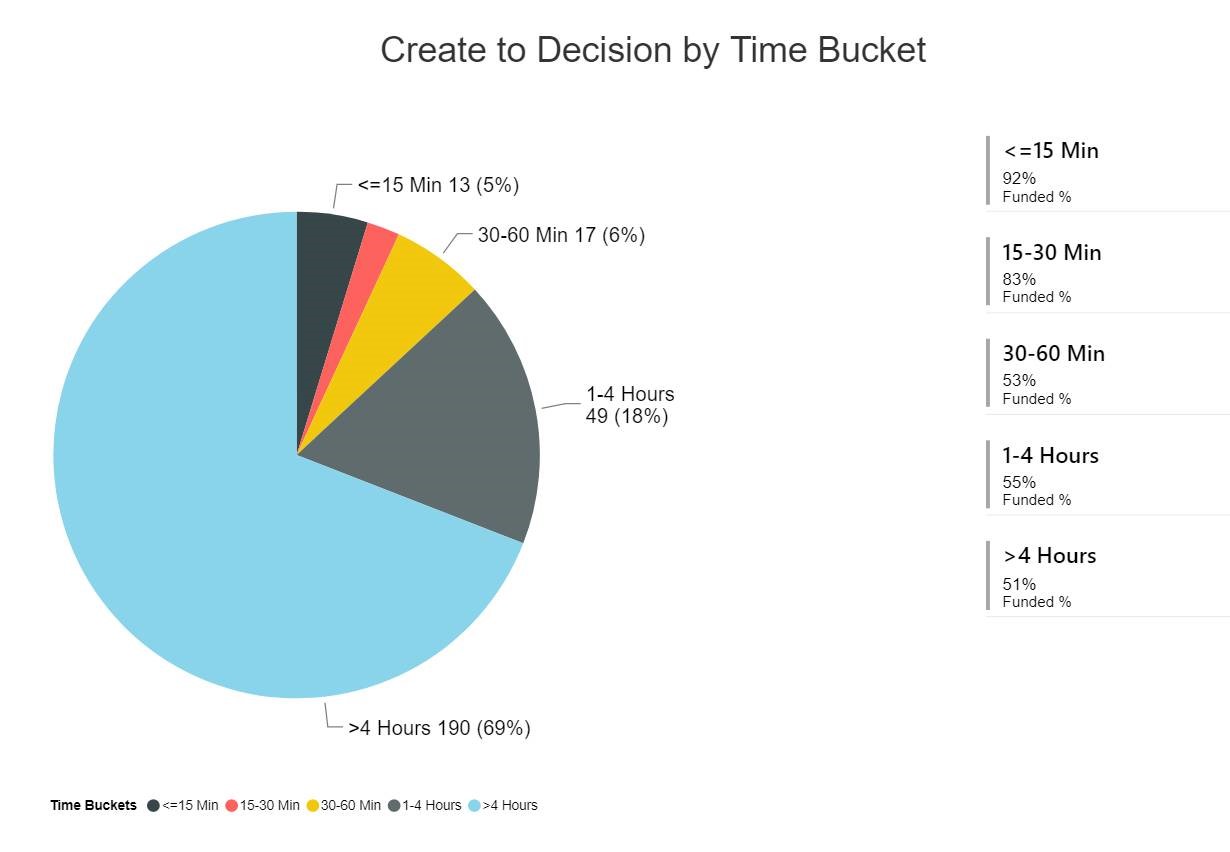

In Example A, we see that 69% of this credit union’s credit card applications are taking over 4 hours from the time the member applies until the card is approved or declined. As a comparison, we completed Amazon’s credit card application process and in 42 seconds we found ourselves approved and ready to use $5,000.

Example A

Example A

For this credit union, decisions in less than 15 minutes result in a funding ratio north of 90%. Even decisions in 15-30 minutes result in over 80% of applications funded. But once the time to decision goes beyond 30 minutes, the funding ratio drops materially to the low 50s.

The data crystallized the need to deliver a quicker, easier, and more competitive online experience. Decision-makers at this credit union dove in and examined the online application experience from beginning to end with the goal of reducing decision time frames to less than 30 minutes. After digging in, they came to the realization that when their new loan origination system was implemented three years earlier, they kept many of their old business practices and business rules, so the lift in loans they thought they would get never materialized.

The conclusion reached is not so different from what we see in other credit unions. So often, with new software the focus is on the technology and not on how to think differently about the process as a whole. Rather than simply replicating the old process with new technology, redesign the process from the member’s perspective. New technology can help deliver a better member experience when its capabilities are optimized with updated processes, business practices, and rules.