Is ARM Refinancing Set to Increase?

April 26, 2018

Last week we posted a blog on the evolving mortgage landscape, focusing on changing consumer behaviors and expectations. This blog addresses a more specific aspect of mortgage lending, the likelihood that due to increases in mortgage rates, financial institutions will see an increase in existing adjustable rate mortgages (ARM) that refinance, as well as an increase in ARM applications.

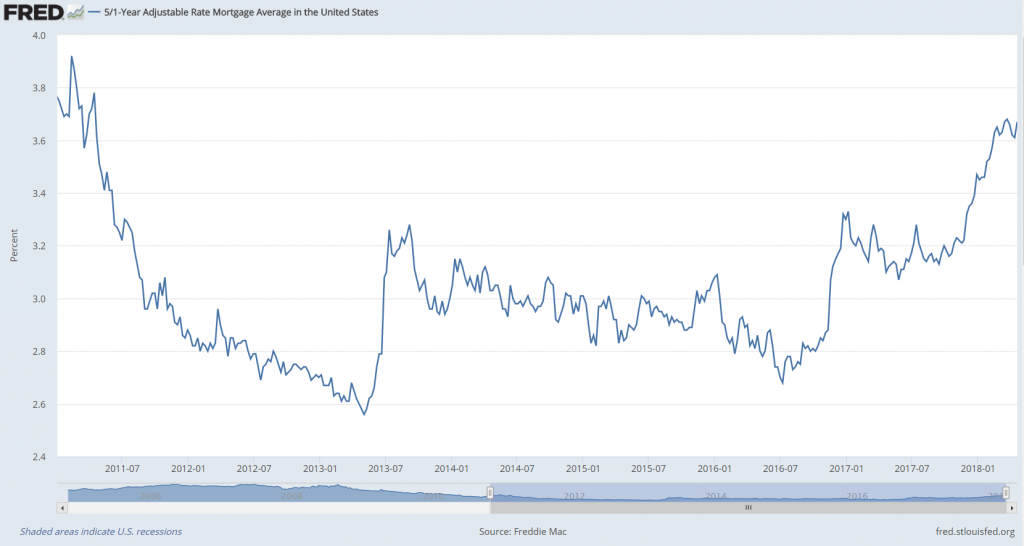

Consider that the typical ARMs price off of either LIBOR or Treasury rates. The 1-year Treasury for instance has increased roughly 160 bps in the last 18 months, and many ARMs are now positioned to reprice to the 4% – 5% range, and those rates would price up further again in a year if the rise in market rates continued. The FRED graph below shows a new 5/1 ARM is around 3.7% right now, and provides a consumer the certainty their rate is locked in for 5 years. A conventional 30-year fixed mortgage is priced around 4.5%. Given projections for rates to continue increasing in 2018, refinancing now, even into a newly issued ARM, could make sense for many consumers and offer some peace of mind.

5/1-Year Adjustable Rate Mortgage Average in the United States

As we enter the 2nd quarter of 2018, the Mortgage Bankers Association has projected a 5% increase in purchase mortgage activity, but a 27% decrease in refinanced loans in 2018.1 While overall refis are projected to be lower this year, it is possible there will be an increase in the number of ARMs that get refinanced into either fixed rate loans, or into a new ARM. And, as mortgage rates have risen, there has been an increase in applications for new ARM loans over the last year as members seek ways to keep their payments more affordable. Note that in the first week of March this year, almost 7% of mortgage applications were for ARMs, compared to 5% 2 months earlier.2

Some of the credit unions we work with are seeing an increase in payoff amount requests on ARM loans while others are already starting to see a spike in ARM refinancing.

Is your credit union ready to capitalize on this potential opportunity? Consider:

- If your credit union has quite a few ARMs on the books already, how you will market refinancing to those current ARM holders? Chances are they are thinking about it, and seeing articles and advertisements from your competitors. If your credit union can reach them early, there is a better chance your institution is the one the ARM holders will choose if they decide to do something.

- Even if you don’t make or have many ARMs, consider whether or not your credit union should get aggressive in advertising toward current ARM holders. If so, be clear on what you have to offer them. Do you have the products they would want and the ability to deliver?

- If members begin to show a preference in refinancing into a fixed loan, does your credit union offer the fixed rate products they would want?

- Consider testing scenarios in your A/LM model to understand the impact that a shift from ARMs to fixed rate mortgages (or newly issued ARMs) could have. If balances shift from ARMs to fixed rate loans, this will increase interest rate risk at a time when risk is already increasing for some credit unions as rates have begun to move upwards.

- If you are expecting an increase in fixed rate mortgages held on your balance sheet, does your institution need to create room from an interest rate perspective to potentially hold more fixed rate loans? Are you equipped to sell them if there is no risk appetite to keep them?

It may be too early to really understand how big an impact this shift in the rate environment will have on mortgage balances and consumer preferences. However, thinking through the strategic implications and modeling out different possibilities will help your credit union be prepared for what happens next.

1Homeowners Ditch Refinancings as Mortgage Rates Rise, WSJ, 3/26/18.

2Adjustable-Rate Mortgage Applications Have Lower Fraud Risk, National Mortgage News, 4/02/18.