Is Secondary Capital a Good Strategic Fit for Your Credit Union?

January 5, 2022

|

|

4 minute read – Many CFOs and leadership teams of eligible credit unions are evaluating whether secondary capital might be a strategic fit for their business models.

Here are two scenarios to consider:

Scenario 1 – We want to continue to grow and expand our markets

Consider a credit union that has robust growth in their current markets and has a strategic plan that includes extensive market expansion, either through digital delivery or physical presence.

In this scenario, secondary capital could be used to support additional growth, while allowing the credit union to maintain an acceptable level of net worth.

In a situation like this, being positioned to add profitable business is critical to the success of the strategy. So, how do you get your arms around how profitable the new business needs to be, especially since profitability can change as the environment changes?

We recommend first framing the answer from a strategic perspective. If the high-level range of answers is acceptable, then more detailed scenarios could be explored taking into account the expenses, income, and the type of growth you are expecting. This will help decision-makers understand how profitability and risk profiles could be impacted as rates change.

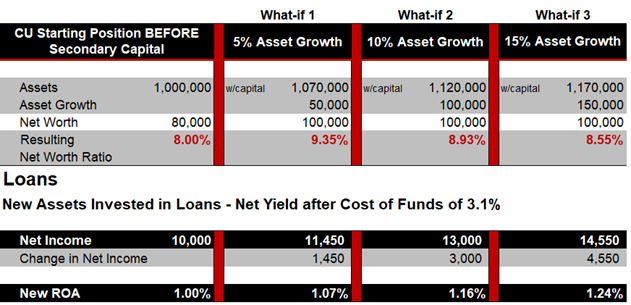

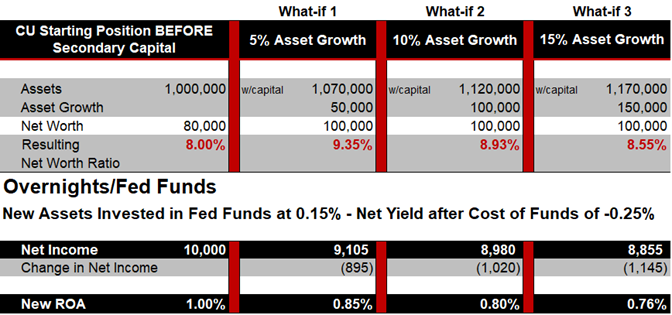

The following example is based on a $1 billion credit union with an 8% net worth ratio and a 1% ROA. The table below assumes that the loans would earn 3.5% after provision, while the cost of funding the asset growth is at 0.40%. While 0.40% as a cost of deposits might seem high in the current rate environment, a credit union planning to grow the balance sheet may need to pay a little more for funding. The $20 million in secondary capital is at an interest rate of 4.0%. The overnight rate is assumed to be 0.15%.

If the credit union is able to loan out the funds, the earnings increase.

A risk though is that the credit union is unable to loan out the funds or generate the expected level of revenue. For example, what if the additional assets end up parked in overnights? In this scenario, overnights would come on at negative net yield after accounting for the cost of funds and decreasing ROA.

Scenario 2 – We need to buy time to rebuild our core net worth ratio

In this case, a credit union may be worried about having a net worth ratio that is lower than desired. In the previous scenario, the credit union was looking to utilize secondary capital to allow for faster growth while keeping net worth within their comfort level. In this case, secondary capital could provide a cushion that would give the credit union time to rebuild their own core net worth.

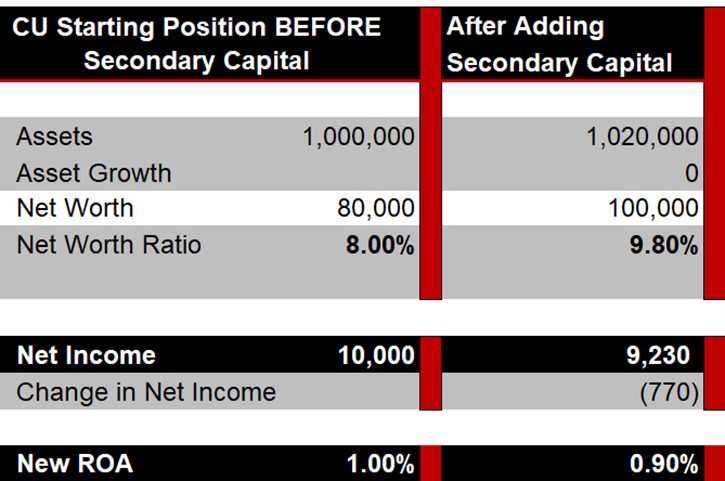

If the same $1 billion credit union with an 8% net worth ratio took on $20M in secondary capital at a cost of 4.0%, this would increase their net worth ratio to 9.80% overnight but reduce earnings 10 bps (assuming the money was placed into investments earning 15 bps). The additional capital materially increases the net worth, but it comes at a cost.

Risks

Secondary capital is long-term subordinated debt, and while the maturity must be at least 5 years at inception for it to count as net worth, at some point the principal must be paid back. One of the main risks is that a credit union is unable to successfully leverage the secondary capital, and has not increased their core net worth sufficiently to be in a strong position to pay it back once repayment starts. In this circumstance, there is no guarantee a credit union would be allowed to renew their secondary capital or take on additional capital. This could potentially create a scenario where at the end of the term the credit union’s net worth situation is worse off than before.

Finally, the secondary capital cannot be paid off early without NCUA approval. The NCUA wants to make sure that the credit union is safe and sound and no longer needs the support of the secondary capital. This means that, depending on the situation, a credit union might determine it is better to pay off the capital early, but be unable to do so.

Conclusion

Secondary capital can be a powerful tool if implemented appropriately. If your institution is considering secondary capital, make sure that key stakeholders have a good understanding of the risk/return trade-offs.