Is Today’s Investment Strategy Balancing Future Strategic Needs?

December 17, 2020

5 minute read – As many leadership teams are in the process of revamping lending to be more consumer friendly and productive in a digital world, investment portfolios are often being asked to play a bigger role while lending builds the desired momentum.

In an environment where many are trying to eke out every bit of ROA possible, marginal ROA can help institutions find opportunities to enhance the investment portfolio.

But, as much as earnings pressures may potentially build, it will be important for the investment portfolio to balance not only what is happening today, but also the future strategic needs of the leadership team.

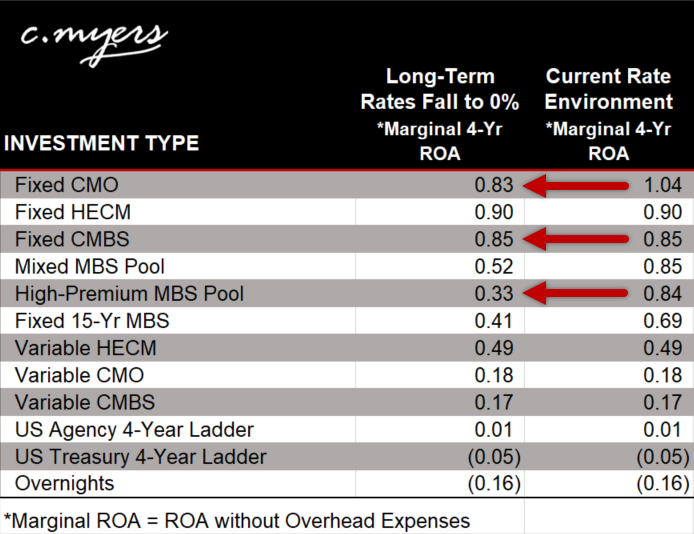

For example, consider a team that is expecting continued economic uncertainty. They are not only concerned about the possibility of rates staying flat for years to come, but also the potential exposures from long-term Treasury rates falling down to 0%. To better understand their investment options, marginal ROAs for various investment types are tested in advance to recognize potential financial outcomes if rates stay the same or fall.

If the team were only concerned about maximizing current marginal ROA, the decision is an easy one. However, concerned with potential refinancing and contraction risk from its mortgage loan portfolio, the group is being mindful of potential challenges to the entire financial structure should rates fall.

Taking a closer look, the Fixed CMOs have the highest marginal ROA in the current rate environment, but the Fixed CMBSs outperform it in a falling rate scenario. In this example, the Fixed CMBSs have better protection against prepayments, reducing the downside risk in a falling rate environment.

What if the investment decision then came down between the Fixed CMBSs and the High-Premium MBS Pool? Both have similar marginal ROAs in the current rate environment but experience materially different behavior if rates fall. While the High-Premium MBS Pool has a fixed coupon rate, the marginal ROA decreases from 0.84% to 0.33% when rates fall, due to additional premium amortization along with the accelerated cash flows.

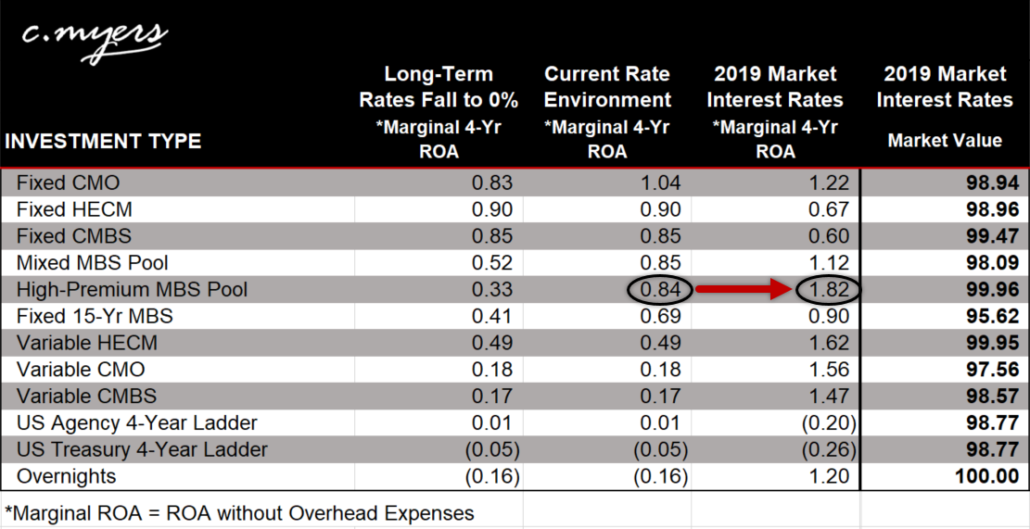

While probably not a good fit for this particular team, the objective here is not to suggest high-premium investments are always bad. What if, instead of strategically positioning for falling rates, the team wanted to prepare for market interest rates increasing back to 2019 levels?

The example in the table above reflects that the High-Premium MBS Pool has the highest marginal ROA if rates increase to roughly 2%, where they were the majority of 2019. Within the range of tested rates, the High-Premium MBS Pool’s marginal ROA fluctuates nearly 150 basis points, from 0.33% to 1.82%. High-premium investments can have a lot of yield volatility but also might be a good fit depending on the overall strategy.

Strategically positioning the investment portfolio is not only about considering different rate environments. It can also be very beneficial to consider when the leadership team might need funds to support lending. While slower loan growth might be expected over the next year, what if the lending machine picks back up more quickly than expected? Being potentially locked into longer-term investments, it is important to understand potential changes in value should you need to sell securities in an unfavorable rate environment.

The current rate environment and other unusual external forces pose unique risk versus return trade-offs that require careful consideration when strategically positioning the investment portfolio. The goal with the examples above is not to advocate a particular investment type, but rather to encourage a more strategic view of the investment portfolio. This type of thinking and analysis can help support future strategic and financial flexibility as the impacts of external forces take shape. Take the time now to test, strategize, and form a clear picture of how the investment portfolio can help, not only today, but for years to come.