Keep Your Economic Engine Running

April 4, 2018

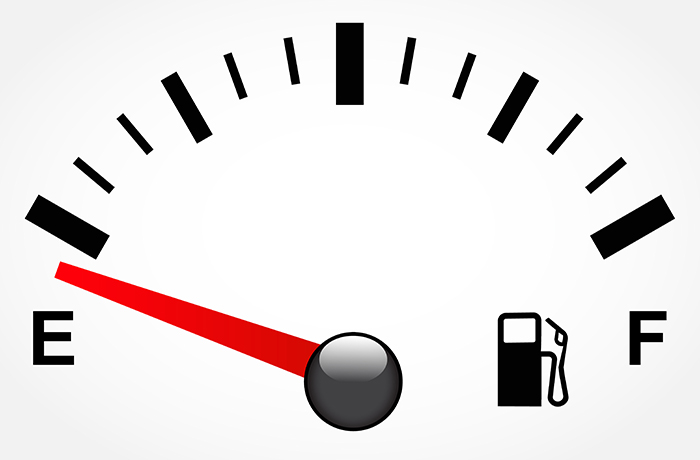

Credit unions have been laser focused on fine-tuning their main economic engine – lending – and many have been very successful. Loan demand is strong and liquidity is tightening. After years of attention to the engine, it’s time to put that same level of focus on the fuel. Without affordable sources of funding, that big, beautiful engine could sputter and stall.

More and more institutions are finding themselves tight on funding. Even if you have plenty of liquidity today, irrational pricing increases, triggered by tightening liquidity, mean you could have to raise rates significantly just to hold onto the deposits you have. Just like rising gas prices can take a bite out of your budget, having to pay premium prices for liquidity can take a chunk out of profitability. Now is the time to think about where affordable funding will come from, before you’re forced to throttle back on your lending engine.

This makes a great strategic thinking exercise. To help prepare, think through:

- What could we do?

- What are we willing to do?

- What can we do today to prepare?

The stage is already set. Liquidity is tight and getting tighter. Deposit rates are just beginning to rise. Consider adding some of the following scenarios to your exercise:

- Competitors increase rates enough to steal away some of your deposits

- Amazon is successful in launching a branded checking account service

- Square Cash, which recently started allowing users to direct deposit their paychecks into their Cash app balances, significantly slows new checking account growth

In thinking through the possible responses, you must go beyond rate alone. What else could you do to appeal to depositors? Is it enough to keep them from going elsewhere? Be brutally honest. What can you do to make your products truly engaging? Should you use rewards, goal setting and tracking, and gamification?

Keeping your lending engine running at top speed will require focus on affordable and ready fuel. Put your credit union in a position to seize future opportunities by thinking through and preparing for the possibilities now so you don’t have to pull back on the throttle later.