Keys to a Clear & Effective Objectives Statement for Your RFP Process

March 13, 2019

Among the many financial institutions that have implemented new loan origination systems (LOS), core systems, or other systems, a number of them find they’re really not getting what they wanted out of the new technology. Having heard so many implementation stories, we wanted to share a few of the lessons learned and, hopefully, save you some trouble.

One of three things we talk about in our published c. notes is to create a clear objectives statement.

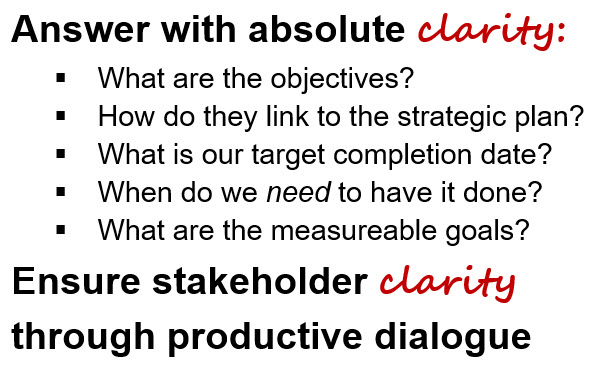

Creating a clear objectives statement is not just an exercise in wordsmithing; it’s really about getting all the stakeholders to share the same vision. Problems occur when everyone thinks they’re on the same page, but they’re not. Institutions that have been successful in uniting everyone in the vision engaged in the productive dialogue necessary to agree on a clear objectives statement.

The beauty of establishing a clear and effective objectives statement is that it can and should be used diligently as a filter for the thousands of decisions to be made. It can help cut through the confusion and provide guidance throughout the entire selection and implementation process.

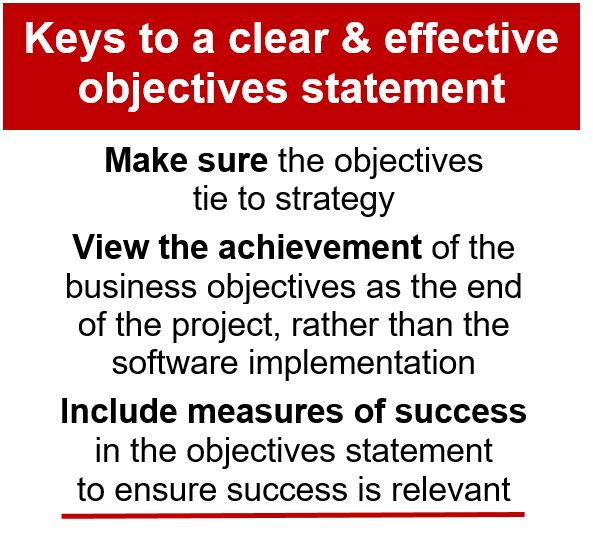

Of course, the objectives should tie to the strategy. If your strategy is to be an ultra-efficient master of lending or to create a fast, friendly member experience, the objectives of the implementation should support it.

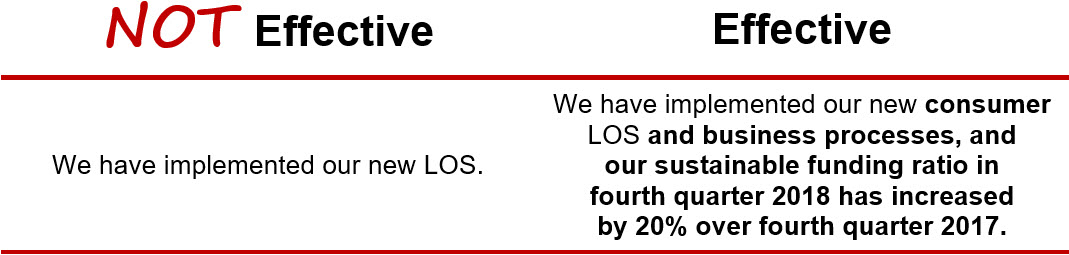

An effective objectives statement is NOT…the software is installed and tested, and staff is trained and using the system.

The crux of the matter is that there is a reason for implementing new technology. It’s not simply to have the new technology or your staff using it. What is your reason? What do you want to get out of the new business processes that are supported by the new system? How will success be defined? How is it going to help the institution achieve its goals and execute the strategy?

If the reason for the new system is to book more loans, the implementation isn’t successful until more loans are being booked. The implementation is only complete when the objectives are met. This means that if the objectives aren’t being met, more work needs to be done until they are. The following objectives statement examples are of an LOS implementation for an institution wanting to be an ultra-efficient master of lending:

The second objectives statement supports the strategy of being an ultra-efficient master of lending and has defined measures of success that ensure the real reasons for undertaking the new LOS are realized.

This kind of clarity does not occur in a vacuum. Stakeholders need to come together in productive conversations to reach the necessary level of understanding and agreement. Note: Sometimes new technology is required for reasons not initially strategic, such as the need to address new compliance requirements, or for a system being phased out. But even “have to” projects often present choices in the solutions that can help support strategy. Rather than just solving the problem at hand, frame the possible solutions within the greater strategy.

Note: Sometimes new technology is required for reasons not initially strategic, such as the need to address new compliance requirements, or for a system being phased out. But even “have to” projects often present choices in the solutions that can help support strategy. Rather than just solving the problem at hand, frame the possible solutions within the greater strategy.