Linking Revenue Opportunities with Appetite for Risk

August 10, 2022

|

|

3 minute read – With inflationary pressure and rapidly changing interest rates creating a lot of earnings uncertainty, leadership teams are laser-focused on increasing revenue streams to help support the bottom line. As important revenue opportunities are explored, frequently refreshing and assessing where to potentially take more risk will be key.

3 minute read – With inflationary pressure and rapidly changing interest rates creating a lot of earnings uncertainty, leadership teams are laser-focused on increasing revenue streams to help support the bottom line. As important revenue opportunities are explored, frequently refreshing and assessing where to potentially take more risk will be key.

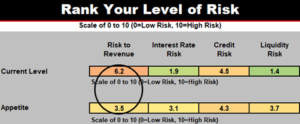

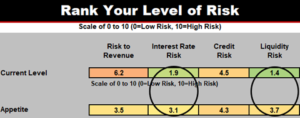

A helpful exercise is to survey decision-makers individually on the level of risk they perceive the institution is currently taking in specific areas and their desired level or appetite for risk in those same areas. A rank of 10 indicates a high level of risk and a rank of 0 means low risk.

As individual responses are averaged, clarity and alignment will begin to take shape for the leadership team. A next-level discussion is to dig into the range of individual responses to gain a better understanding of each individual’s perspective.

In the example table below, the average risk rank for Risk to Revenue is currently at 6.2 out of 10. This is the highest risk rank, meaning it is the top concern for this group. Comparing this to the average of 3.5 on appetite for risk is an indicator that the team wants to lower their Risk to Revenue.

So where is there potential opportunity to do so? Are there other areas of the business or structure that could be leveraged to decrease the pressures facing revenue?

As seen in the table below, the team’s appetite for credit risk is almost the same as the current level of risk. However, both interest rate and liquidity risk reflect an appetite to take more risk. These results often stimulate thought-provoking discussions around questions like how much, and in what range of rates.

With greater clarity, different departments can take action and begin implementing tactics to take advantage of the opportunities. For example, Finance might decide to deploy short-term liquidity into longer-term investments to increase revenue, since there is appetite for more interest rate risk. This may mean there is room to portfolio mortgages, instead of selling, to steady the revenue stream over time.

Consciously choosing to take more risk in specific areas is one avenue for increasing revenue streams. Of course, policy limits must be taken into account, along with a combined view of other risks the institution has accepted. Frequently performing risk level assessments like the exercise above, while also quantifying risks in aggregate against capital, can help decision-makers feel more comfortable with their choices.

Note, the table above is an excerpt of the categories that you will want to consider. It is good to have the categories cover the different parts of your business model, as this can help bring more clarity to your team.

For more resources, our Strategic Capital Requirement tool can be found here.