Lower and Volatile Market Rates are a Catalyst for Improving Lending Efficiency

September 18, 2019

Uncertainty in market rates can be nerve-wracking. It is also a catalyst for really taking control of what you can control. Many credit unions have a very efficient process for indirect lending. Why? Two main reasons. The margins are very thin, and the dealers demand speed.

So while you can’t control market rates, you can control your lending businesses and processes. Relentless focus on making things easy is not optional in this ever-changing, competitive landscape. Apple’s new credit card is intensifying competition. In less than 1 minute, consumers are approved for the card, and it is ready to use!

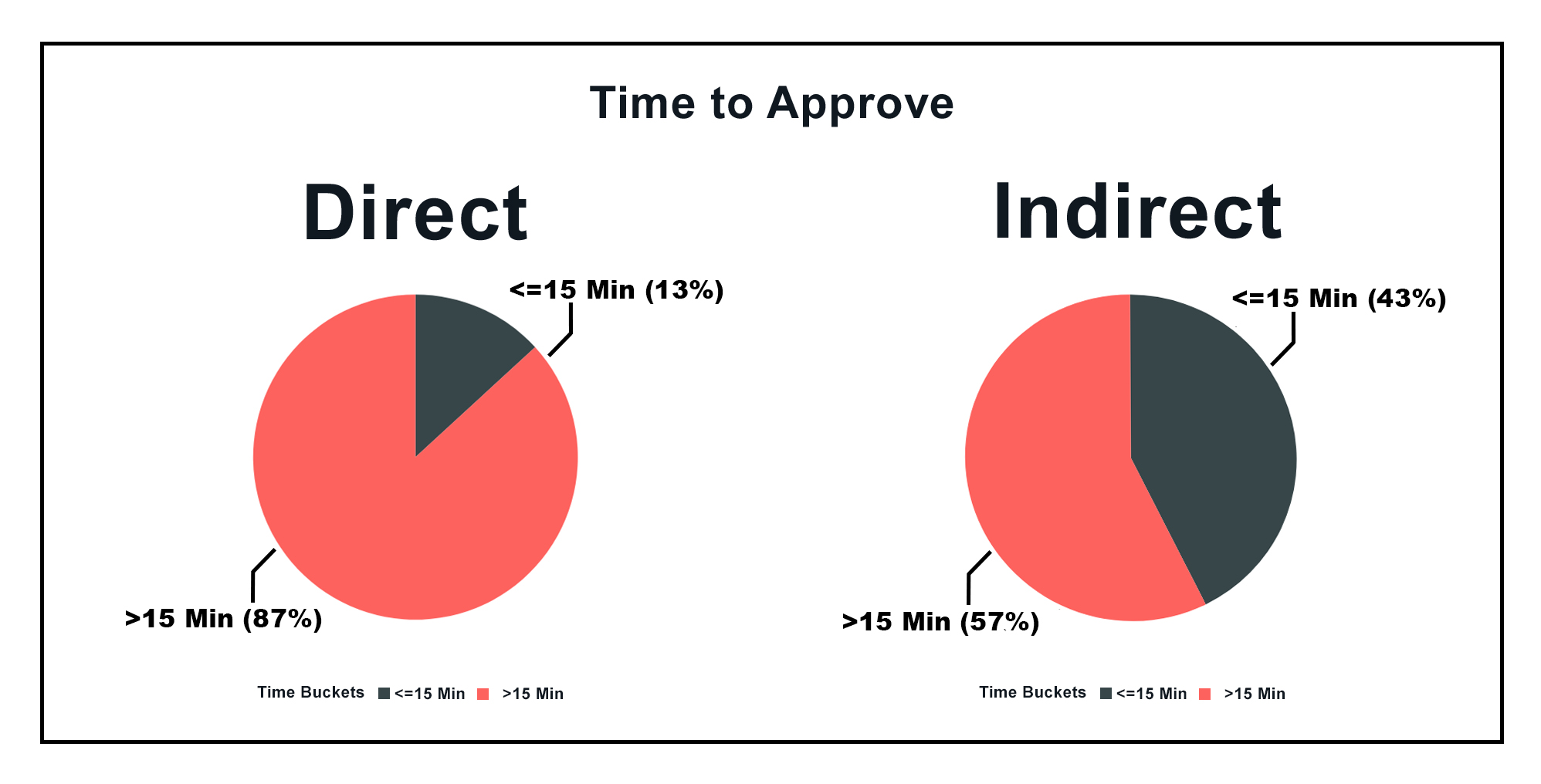

Management teams recognize that they need to dig into their key drivers of revenue, such as auto lending. As they dig in, they often discover the lending data shows that approvals commonly take longer for direct loan applications.

This example illustrates the point by focusing on 2 distinct time buckets – less than 15 minutes and more than 15 minutes. As management teams dig in, we recommend that they slice data into smaller time segments that represent their unique goals and measures of success.

While there are some valid reasons for the time difference in the approval processes, such as, the loan application coming into the system already completed by the dealer, or the usage of automated declines on the indirect channel only, there are other differences in the processes that reveal opportunities for the direct channel.

Here are a few differences that we have uncovered when digging into the lending processes:

- Fewer fields in the indirect loan application

- Less documentation requested for indirect loan approval

- Less documentation required for new members through the indirect membership

- Indirect lending departments are more likely to have a measure on approval times

- Indirect applications are given priority by underwriting

- Underwriting standards are different for indirect

- The dealer is given a decision immediately, while a member may have to wait to hear from the loan officer

When asked why the processes are different, the reasons are often related to speed. For indirect lending, there is more focus on efficiency, which results in speed. Without speed, the dealer will award the loan to another lender. Because of this, speed is more commonly measured and, as the saying goes, what gets measured gets done. Another need for speed stems from the often thin margins in the indirect channel that require an efficient machine to be profitable.

In addition to speed, differences in the processes between channels stem from the desire to remove steps that dealers view as roadblocks. Roadblocks motivate dealers to choose a different lender.

For some quick direct lending efficiency wins, consider putting these learnings into practice:

- Stop asking for documentation that is not absolutely needed. It’s not only dealers who view additional documentation as a roadblock. Members do, too

- Only ask for information on the lending and member applications that is truly necessary

- If underwriting standards are different between channels, reconcile the differences

- Measure approval speed and set a goal

- Prioritize the speed with which the member gets the decision, which is often delayed in the direct channel because loan officers have other duties and tasks that take precedence

Whether you’re a fan of indirect lending or not, you can use the lessons learned to your advantage. The key is applying the mindset of creating an efficient, high volume machine to any lending process. Viewing processes through this lens provides perspective that can help drive efficiency. While speed isn’t everything, it is an important aspect of the consumers’ and employees’ experiences.