Managing Operating Expenses When Your ROA is Under Pressure

September 5, 2018

Some financial institutions are feeling margin pressure as deposit rates are starting to rise. Pressure from the evolving competitive landscape is an increasing challenge as well. The squeeze in margin is starting to hit earnings, and is impacting expectations for earnings as we look ahead to 2019 and beyond. So as we enter the fall, it is a good time to take a look at your credit union’s strategy levers and answer the question: If margin pressures continue, what would you do next?

A good starting place in this kind of analysis would be to quantify how much net worth your credit union needs to create confidence in that you have enough insurance to cover an aggregation of risk and still maintain an acceptable level of net worth. Our blog post from November 2017 has more information on this type of aggregate risk analysis.

Once the desired/needed level of net worth is determined, consider how much return on assets (ROA) would be needed to support that level of net worth through a range of different asset growth scenarios. We have a simple yet powerful online tool that connects ROA, net worth and asset growth, and is a great way to help stakeholders visualize how these pieces fit together.

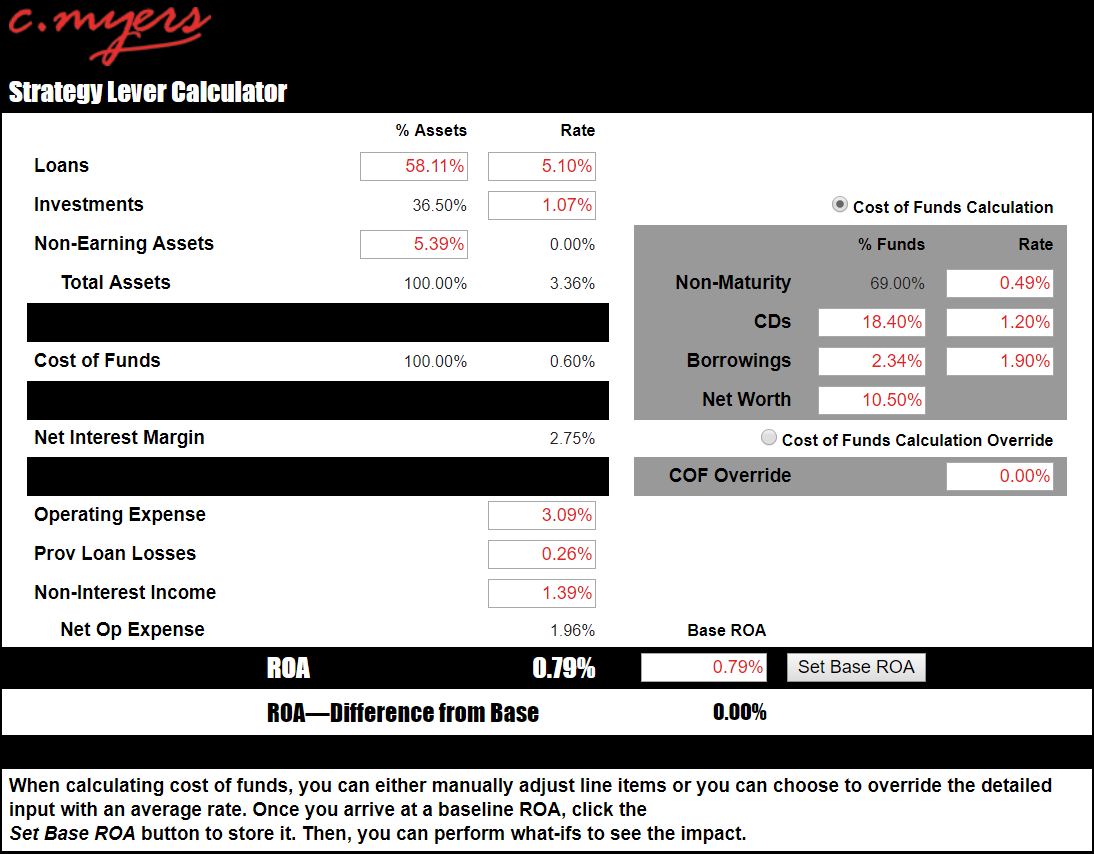

It can be helpful to utilize a strategic tool, like our online Strategy Lever Calculator, to make the conversation more meaningful. If you determine the projected ROA is insufficient to support your credit union’s net worth and growth objectives, what other strategy levers could you pull?

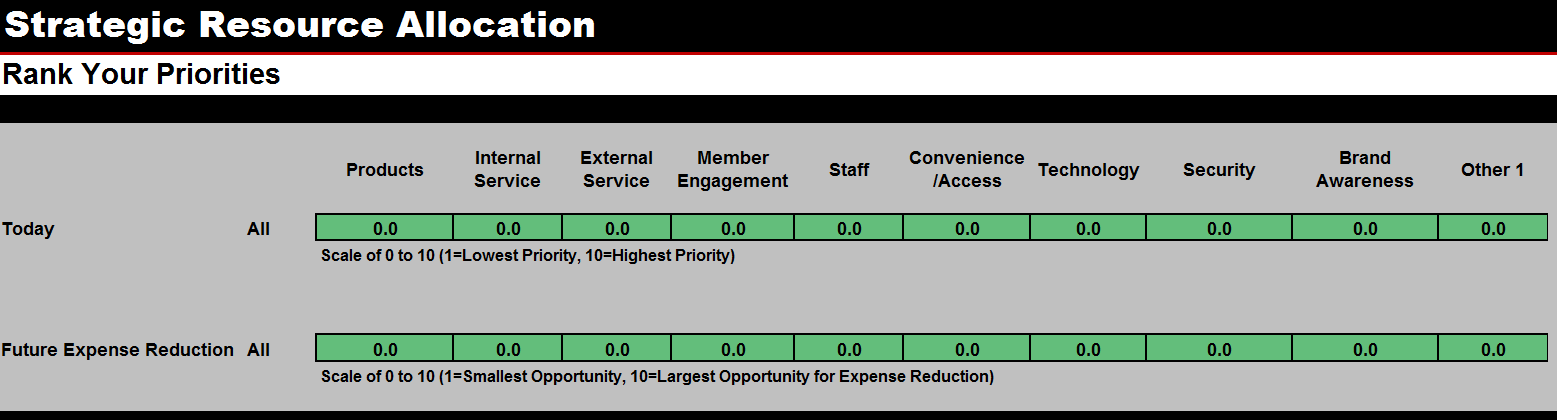

Many credit unions are facing competitive resistance to increasing loan rates or fees, and have begun to put renewed focus on operating expenses. If your focus turns to operating expenses, a good starting point could be to have the credit union board and management identify what they believe the most critical priorities would be from an expense perspective. The following table shows an example exercise the board and management could complete to identify and rank strategic priorities.

Another question could be, where does the credit union have the most opportunity to reduce expenses? Sometimes the most important strategic priorities also represent the greatest opportunity for expense reduction, and this can create a tricky balancing act. For example, attracting and retaining quality staff has become a challenge for many credit unions, but at the same time, compensation and benefits are generally the largest expense line items on a credit union’s income statement. So what do you do? Many credit unions are looking at ways to increase efficiency―to better serve both the internal and external “customer” rather than simply reducing headcount.

Creating greater efficiencies can be a win-win situation because they should lead to higher levels of earnings while simultaneously improving member service/experience. Process improvement and creating a culture of efficiency can be very impactful in managing expenses and bottom-line ROA.

Concerned about the direction of your credit union’s ROA? Consider starting high level, such as asking the questions: Given the risks we have in our financial structure, how much net worth do we need? How much net worth and ROA do we need to support asset growth and strategic goals? As you discuss ways to influence ROA, it is important to look at the big picture and take into consideration how employees, members, and the credit union’s strategic goals could be impacted. Sometimes the lever that could have the largest impact is the least appealing. In those instances, it becomes extra important to understand the trade-offs, think creatively, and make sure that all key decision-makers are on the same page about the potential impacts and alternatives before you move forward.