NEV Does Not Equal NII

July 30, 2015

Some in the industry say that net economic value (NEV) is an indicator of future earnings. Let’s test this out by modeling a credit union taking $30 million of funds that are currently sitting in overnights earning 0.25% and investing them in mortgage-backed securities earning 1.75%. Even without a model, we know that net interest income (NII) will increase; however, as we model the scenario, we will look at both the earnings and the NEV to see how they have changed from the base case.

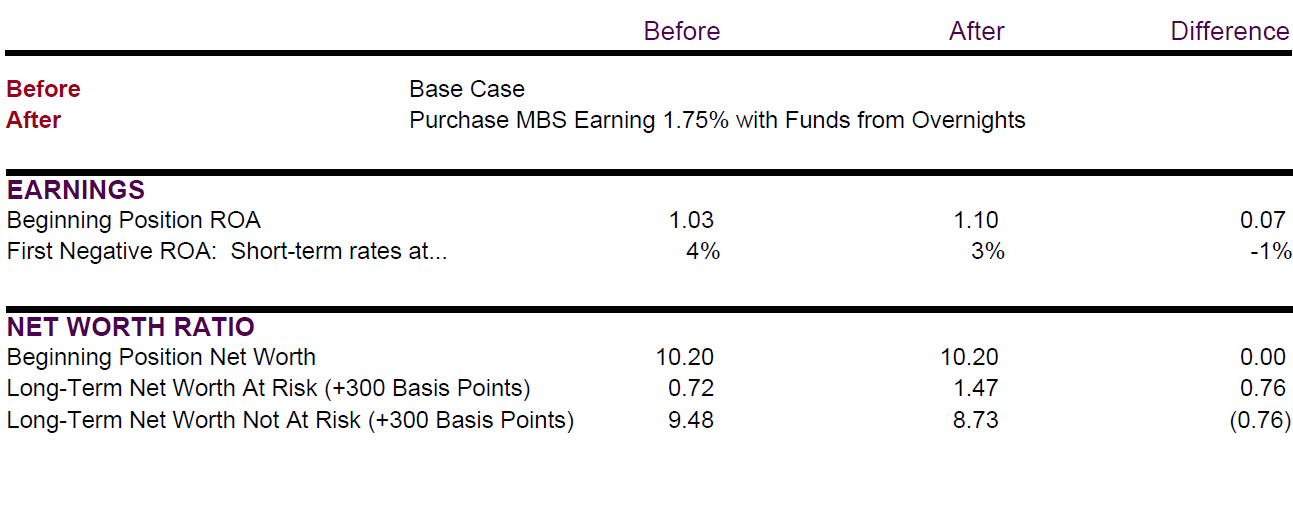

The income simulation results below show that the credit union will be poised for higher earnings if it purchases the MBS and will increase its interest rate risk in a rising rate environment.

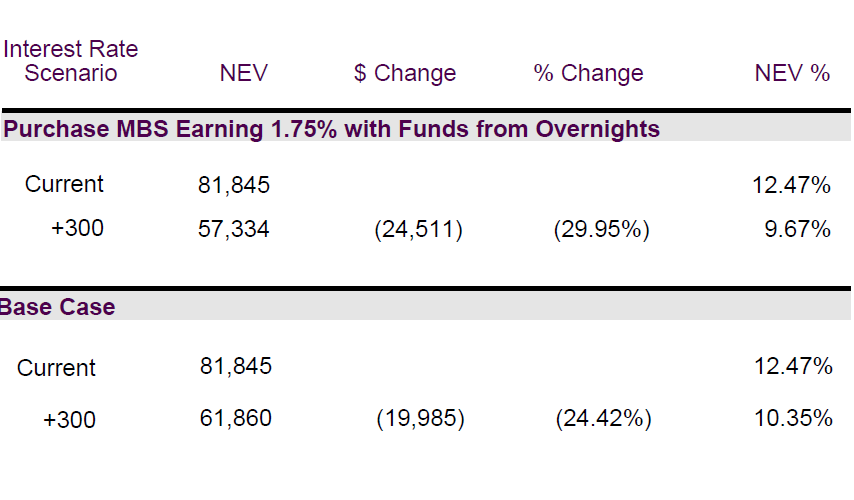

If NEV is an indicator of future earnings then one would likewise expect to see an increase in NEV in the current rate environment. NEV results are shown below:

Notice that the current NEV is unchanged. The credit union would be poised for higher earnings in the current environment if it purchased the MBS, so why didn’t the NEV increase?

Funds sitting in overnights are at par and, on the day the MBS is purchased, its purchase price is its value. In other words, $30 million sitting in overnights is worth $30 million and $30 million of MBS is worth $30 million. Therefore, the current NEV will not change.

The theory that the NEV will represent the future earnings is hard to defend and it misses key aspects of decision-making.

Some have tried to defend this concept by saying that the forward curve will predict future rates; the problem is that it has never done this consistently and has not done this at all over the last decade. If the forward curve were to accurately predict the future, the theory would indicate that the earnings of the overnights will equal the earnings of the MBS in the base rate environment. If decision-makers played this concept out, it would tell you that over time there is no reason not to have all of the credit union assets in overnights. Such a strategy doesn’t make sense.

From a business perspective, understanding the timing of earnings is one of the key questions to answer for decision-making. NEV does not help decision-makers see the timing of the earnings, nor does it answer many of the other key business questions (for more on key business questions, please refer to our c. notes titled Comparison of Interest Rate Risk Methodologies).