Observations From ALM Model Validations: High Starting NEV Ratios

September 25, 2015

When performing model validations, it is common to see a net economic value (NEV) ratio that is considerably higher than the credit union’s current net worth ratio. Understanding NEV and net worth are two completely different concepts; there are reasons why starting with a high NEV ratio in the base environment may not be reasonable.

First, let’s discuss some of the reasons why this can occur:

- Non-maturity deposits are assumed to have long average lives. Given the positive slope of the yield curve, this assumption results in higher discount rates and optimistic market value premiums

- The credit union does not incorporate transaction spread costs when valuing deposits, which overstates the value to the credit union

- Optimistic loan discount rates, that ignore credit and other market risks, results in overly optimistic loan market values

Consider that NEV is intended to show the fair value of a credit union. Therefore, mergers can be used as a reasonableness check of this critical component of modeling. Mergers over the last several years do not support the assertion that an acquiring institution would pay a significant premium to the net worth.

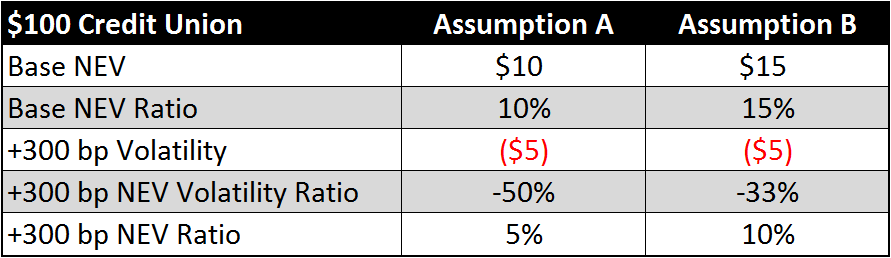

It is important to understand that optimistic base NEV results also impact volatility ratios in various rate shocks. To keep the math simple, consider a $100 credit union performing NEV with two different sets of assumptions. For example purposes, the dollar volatility in a +300 basis point (bp) shock is assumed to be the same while, in reality, the more optimistic assumptions in Assumption B would result in a lower dollar volatility.

Many have said that the reasonableness of the starting NEV doesn’t matter; it is the volatility that should be the focus. Notice that while the two sets of assumptions in this example have the same dollars of volatility in a +300 bp shock, the percent volatility and NEV ratio in a +300 bp shock are dramatically different. The NEV in Assumption A may be considered high risk, while the NEV in Assumption B may be considered low to moderate risk.

If using NEV, credit unions should focus not only on NEV volatility but should also understand what their base NEV ratio is showing and if it is reasonable. If the starting NEV ratio is considerably higher than the net worth ratio, the credit union needs to understand why. If it is not defendable, credit union management should consider making adjustments to assumptions.