Pricing Considerations in a Tight Liquidity Environment

October 4, 2023

|

|

6 minute read – For many C-Suites, discussions around loan and deposit pricing, and funding strategies are now beyond the short-term band-aid.

Leadership teams are expanding their views to grapple with the inevitable – What may the future hold when our shorter-term funding band-aids peel off?

There is no one answer to this question. That is why there needs to be diligent focus on thinking through options and modeling potential financial results. This process enables decision-makers to see, in advance, a range of financial outcomes related to the strategic options they are considering.

As leadership teams work through discussions and financial modeling they typically identify and prioritize their options and the actions they will take. This advanced thinking helps them better articulate what success looks like as they implement their prioritized options. If forecasted results don’t come to fruition in the desired timeframe, they are prepared with more options to put into play.

As you do your financial modeling:

- Don’t forget as you simulate potential financial outcomes, to test rates staying about the same, rates going down, and rates going up. This helps decision-makers see how various options can help or hurt depending on rate movements.

- It can be helpful to remind decision-makers and Boards that there are very few high-impact decisions that help regardless of what rates do.

- Keep in mind that even if rates stay the same, it is highly likely that your Cost of Funds will increase.

Many financial institutions have experienced 10% or more decrease in savings accounts. To make the math easy, let’s assume that the savings accounts had an average rate of 1% and the money moved to CDs paying 5%. All else equal, this shift in deposits would hurt the current ROA by 40 basis points.

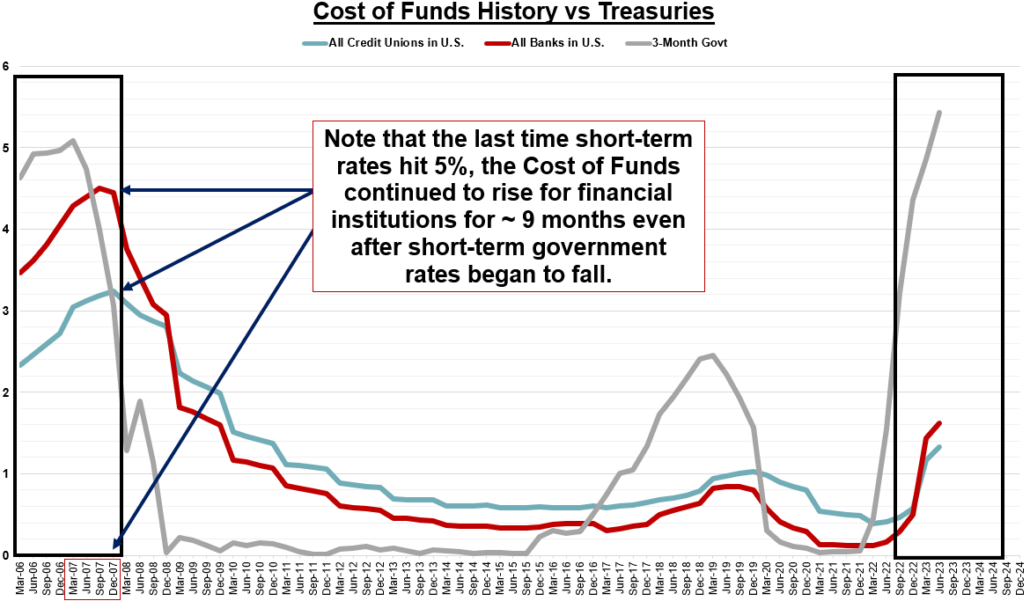

The cost of liquidity has increased dramatically, as evidenced by the chart below that shows the historical Cost of Funds for all U.S. Banks and Credit Unions compared to the 3-Month U.S. Treasury rates dating back to the last time short term rates hit 5% levels.

Note how Cost of Funds continued to rise after short-term market rates stabilized and began to decline. This may require organizations to consider a variety of changes in lending and deposit pricing as well as investment strategy to support liquidity and cash on hand needs. In addition, when evaluating your deposit pricing strategy, it is important to consider the potential impact on your relevancy with customers in the short- and long-term. Liquidity challenges are expected to continue for some time, so it is essential to continue to sharpen your skills in this area.

The following questions are designed to help stimulate the discussions. As always, more questions will be raised as the strategic discussions progress. Ultimately, there is not one solution or one right answer.

Questions to Consider – Not in priority order as this is a non-linear discussion:

- How does your organization define short-, intermediate-, and longer-term?

- It is important for everyone to base their recommendations and timing of action using the same definitions.

- What are your strategic lending objectives and desired positioning in your competitive space?

- Consider how the answers to this question can result in competing priorities over your defined intermediate- and longer-term horizon.

- Make sure to agree, and if so how, to factor in potential increasing credit risk and the implications for loan volumes.

- Have frequent discussions regarding how operational costs to originate loans (including dealer fees) impact loan pricing, and profitability.

- Once you understand the net yield on loans, consider comparing that to available alternative investments and/or loan pool purchases. This can help decision-makers better understand the giveback to your customers should your organization’s loan pricing strategy result in lower net yields.

- If your plan includes selling some of your loan production, be sure to help those involved in pricing decisions to have a clear understanding of the pricing levels necessary to achieve your desired return on sale.

- How much and what type of funding do you need to support your lending and growth objectives?

- How does your deposit strategy impact your non-interest income, fee income, customer stickiness, and customer growth?

- This is also a good time to discuss and reconfirm your target markets and your value proposition for them.

- If your funding needs are lower and your organization can allow some deposits to migrate to other financial institutions’ make sure to have healthy discussions around your level of concern about the potential longer-term implications if those depositors were to never return.

- For your strategic options around deposit and funding strategies, how sustainable and affordable are each of the options? What external forces could severely threaten sustainability and/or affordability?

- For example, what could be the impact on your Cost of Funds if many of your competitors need liquidity such that their pricing becomes irrational?

- What role does your investment portfolio play?

- Discuss what portion should be allocated to support current and future liquidity needs versus investment return.

- It is important to view this in light of lending and deposit objectives as well as emerging external forces.

Many of our clients have found that these types of questions, considerations, and discussions, supported by financial modeling, accelerate their leadership teams’ and Boards’ appreciation for the complexity and interdependence of pricing decisions.

The result is a much more cohesive and strategic approach to pricing decisions versus having to make quick reactive decisions, without having time to absorb the potential intermediate- and longer-term implications.