Putting Member Rate Advantages Into Perspective

June 26, 2018

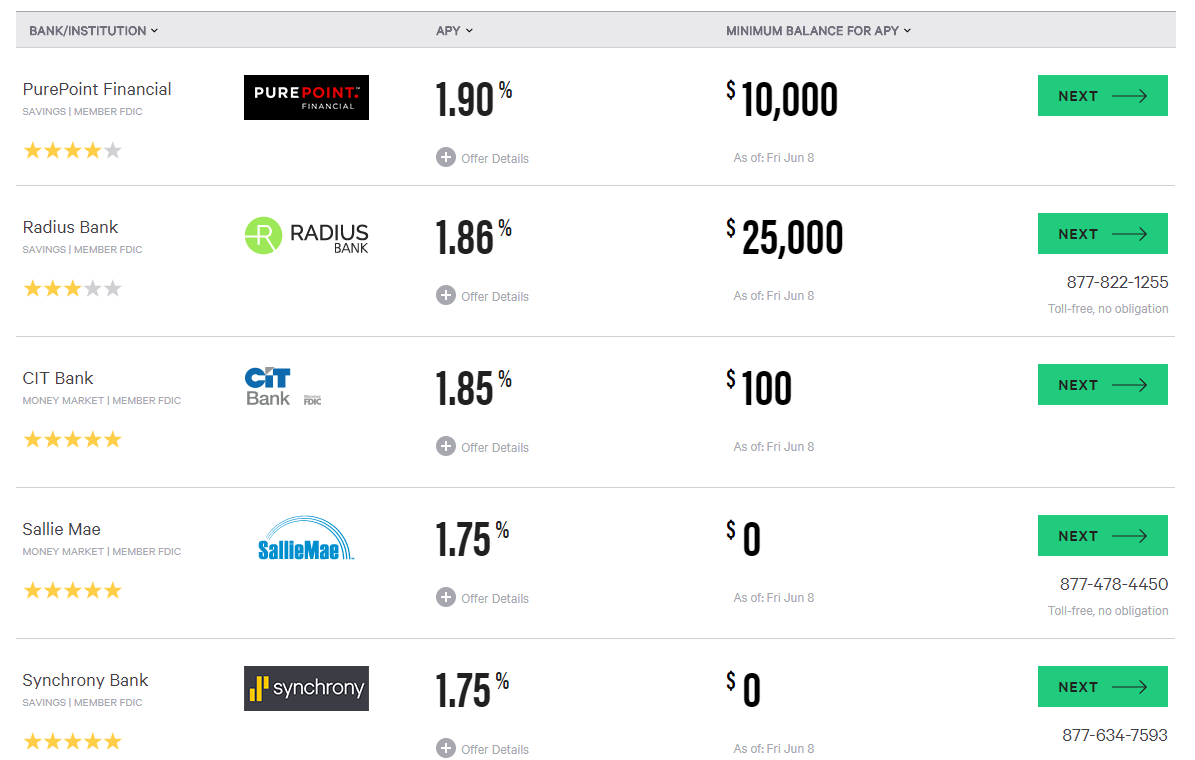

The environment is quickly changing and so are members’ savings alternatives. Technology has made it such that competition is no longer limited to the institution down the street. A simple online search reveals there are financial institutions all over the country with money market rates close to 2.00%:

Source: Savings Accounts & Rates. Retrieved from https://www.bankrate.com/banking/savings/rates/, June 8, 2018.

Source: Savings Accounts & Rates. Retrieved from https://www.bankrate.com/banking/savings/rates/, June 8, 2018.

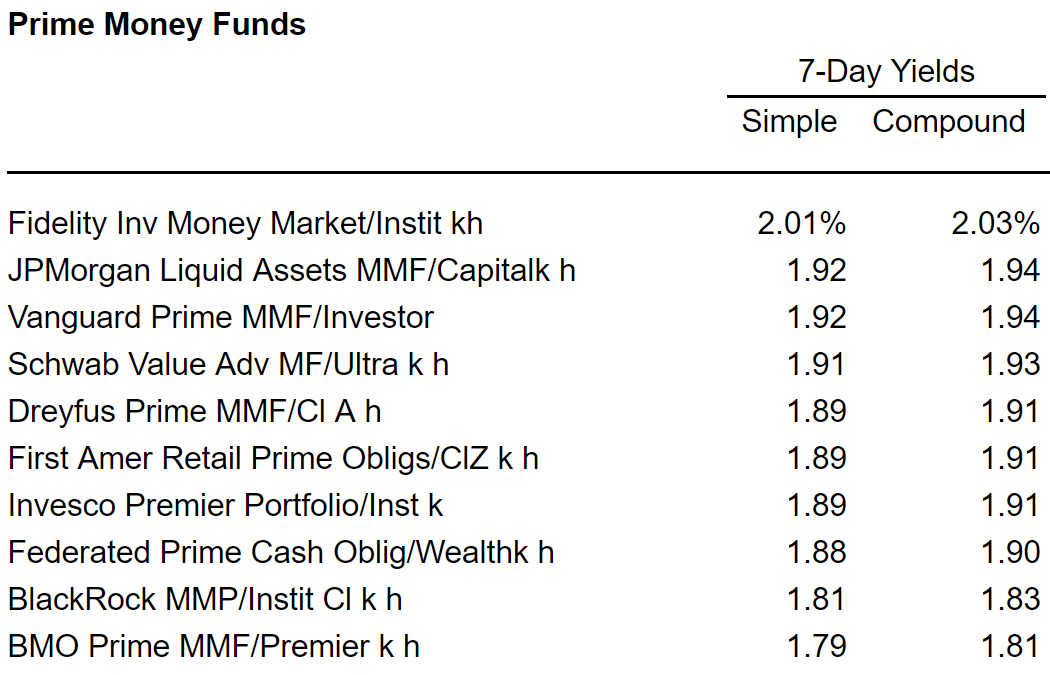

And it’s not just other financial institutions with these rates; uninsured money market mutual funds also have non-maturity deposit yields close to 2.00%:

Source: Top Retail Money Fund Yields. Retrieved from http://www.barrons.com/public/page/9_0204-trmfy.html, June 8, 2018.

Source: Top Retail Money Fund Yields. Retrieved from http://www.barrons.com/public/page/9_0204-trmfy.html, June 8, 2018.

With members gaining material advantages to moving their savings dollars between financial institutions or uninsured money market mutual funds, why aren’t many currently doing so? There are various reasons why a member may not be taking advantage of the higher yield opportunity, but one could be that they simply haven’t crunched the numbers.

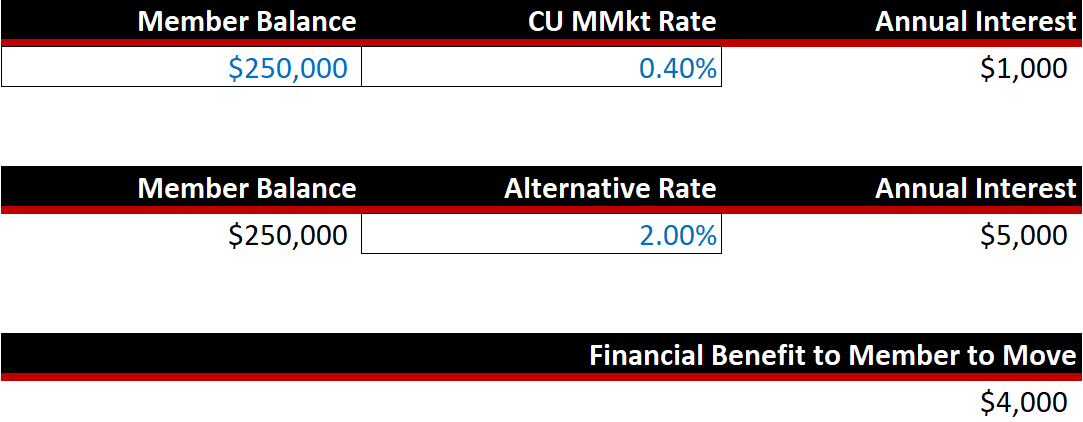

Consider a member that has $250K in a money market account. There are different credit union money market rates out there but in the following example, let’s compare a potential rate of 0.40% to the 2.00% alternatives pictured above.

This simple calculation shows that the member is leaving $4,000 of interest on the table. Seeing the missed opportunity from a dollars perspective may be part of the reason why many members are not currently taking advantage of the changing environment. The actual dollars are more meaningful than just seeing that there is a 1.60% advantage to move.

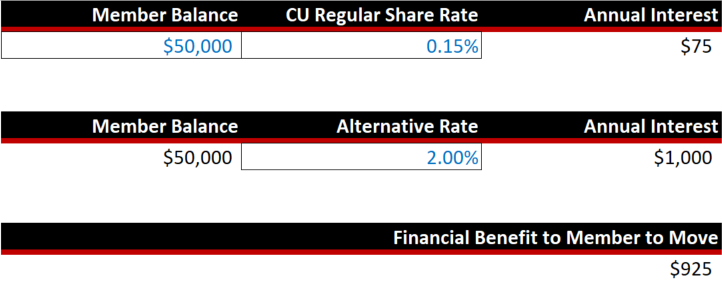

While the average member deposit balance has typically increased over the years, not everyone has $250K in savings. What about a member with potentially $50K in a regular share account?

The takeaway from these examples should not be that credit unions need to increase their deposit rates or match the highest rates in the marketplace. However, the examples are a healthy reminder that the current environment is quickly changing and members will periodically do things that are in their best interest.

As a result, it is important credit unions start thinking creatively about sustainable deposit retention and acquisition strategies. Rate is important to the membership but the traditional strategy of attracting deposits strictly through rate may not be feasible from an affordability standpoint. If you are considering certificate promos to attract deposits, don’t forget to consider their marginal cost as discussed in our blog post Hidden Cost of Addressing Liquidity Needs.