3 minute read – The list of pressures on revenue and earnings seems to grow by the day. There are many different drivers of inflation right now, such as food prices, supply chain issues, and wage growth, each of which brings their own unique impacts. Rising rates, recession concerns, and tightening liquidity bring additional pressures like margin compression and credit risk. Not to be forgotten in all of this is CECL, which goes into effect at the start of next year.

With the many changes in the environment, it is important for leaders to step back and understand potential short-term impacts to revenue and earnings vs. long-term business model sustainability.

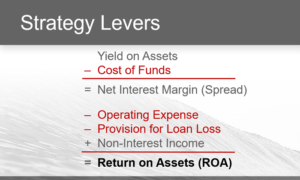

While in-depth analysis and modeling are helpful, leaders can start high-level and think in terms of the 5 Strategy Levers of ROA.

Walking through the different pressures and concerns, leaders should discuss and quantify at a high level the potential impact to each lever and the resulting bottom-line impacts. This will help paint a picture for leaders to evaluate whether the earnings pressure is a shorter-term hiccup, or a longer-term business model issue.

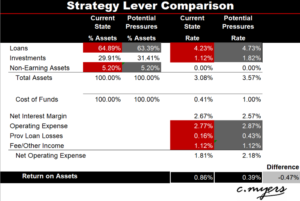

Below is an example of how that might go. The columns highlighted in red show the current strategy lever numbers. The columns highlighted in gray show the results of the discussion of the different pressures.

In this example, leaders might conclude that the margin compression is painful but short-term while they wait for the existing loans to be replaced, but that slow loan volumes and higher operating expenses are likely to continue, requiring no real change in strategy but a renewed focus on loan growth. Alternatively, they may decide to revisit their deposit pricing strategy of always being in the top 3 in their market.

Other pressures that could be explored are the costs of different funding sources to address tightening liquidity, increased credit risk due to a recession, or reductions in non-interest income due to regulation and competition. The key is having the discussion and understanding the possible impact to ROA.

Once this is done, leaders can then step back and determine if the ROA impacts indicate a longer-term business model issue. Questions to think through are:

- Is this a timing issue due to environmental changes or a weakness that has been exposed in our financial structure?

- Do we need to change our strategy as a result of what we’re seeing?

- Are the economic engines driving the business model still viable long-term?

Walking through this process can help leaders have more clarity, especially when there is so much uncertainty in this environment. This can also help leaders determine where their focus needs to be and what their next course of action should be.