Strategic Budgeting – Important What-ifs to Test

November 13, 2019

4 minute read – As many institutions are in the middle of their annual budgeting process, it is important to remember the value in approaching the budget from a strategic perspective. The details are important and should not be ignored, but so often in budgeting, analysis paralysis sets in, and business intelligence and connecting with the credit union’s strategy gets ignored.

A past blog post outlined 6 steps that could help take the budgeting process to the next level. Extending the budget beyond a traditional one-year view, as well as understanding the interest rate risk implications of achieving the year-end budget continue to provide valuable business intelligence. But as the near term is becoming increasingly uncertain, the importance of testing strategies and performing what-ifs is greater than ever.

One of the benefits of running thousands of what-ifs for hundreds of institutions each year is that it provides a window into the mindset of decision-makers. While forecasts can vary, the most frequently requested what-ifs from a budgeting perspective are:

- Higher member certificate growth

- Lower loan growth

- Higher operating expenses

- Higher provision for loan loss

Higher Member Certificate Growth

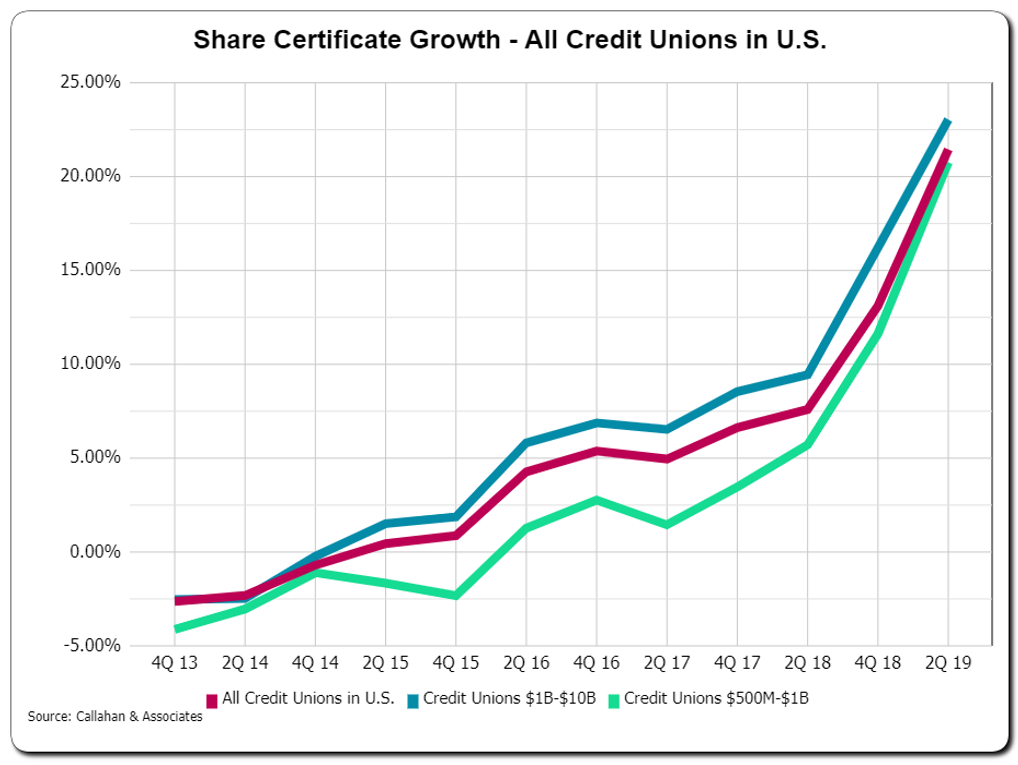

Even though the federal funds rate has been decreasing recently and market interest rates may not increase in 2020, many expect that the cost of funds will increase. The primary reason why is the expected shift in deposit mix, with member certificates being the main source of deposit growth for many. There are still material advantages for members to earn higher rates and many expect the recent growth in member certificates to continue.

Because of the potential impact to the cost of funds, member certificate growth continues to be an area that receives a lot of attention from a what-if and stress test perspective.

Lower Loan Growth

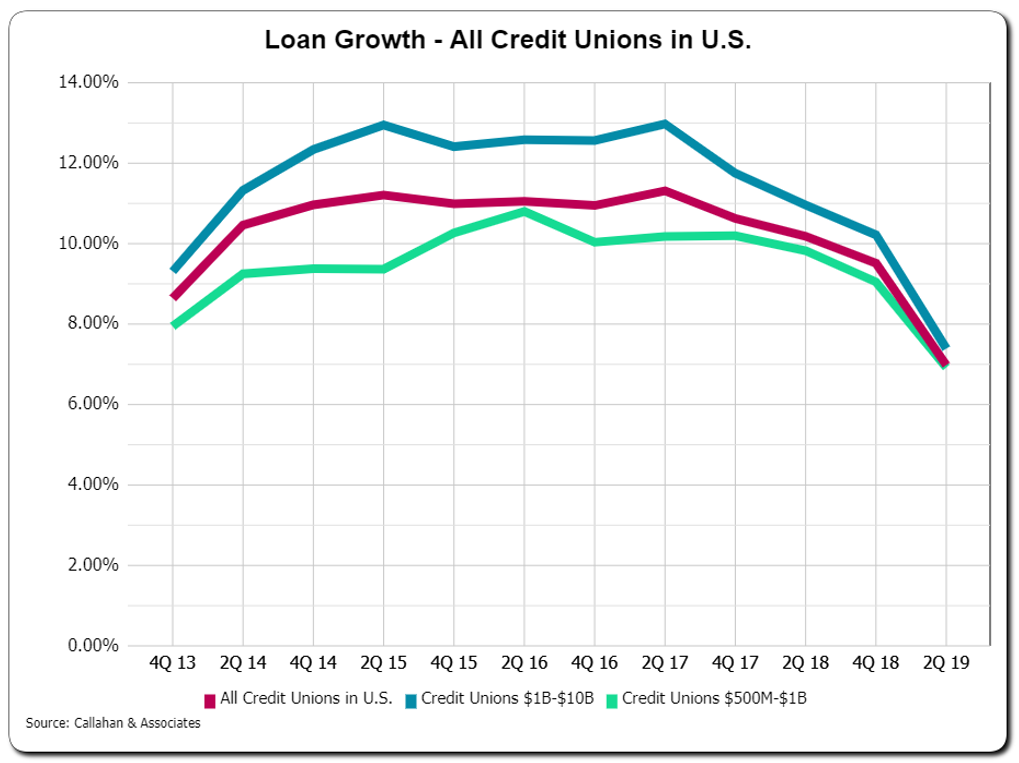

As seen below, the five-year period from 2014 to 2018 has been strong from a loan growth perspective. Looking a little closer, loan growth has decreased the past few quarters leaving many to wonder what 2020 will bring.

Coupling the recent trend of lower loan growth with a potential slowdown in the economy, is resulting in institutions performing a wide range of loan growth what-if scenarios. In addition, many are surprised by the negative impact to ROA from relying more on the investment portfolio in a lower rate environment.

Higher Operating Expenses

As discussed in our blog, Three Financial Tests Credit Unions are Running Today, technology and talent continue to provide significant pressures to the income statement. As a result, more institutions are focused on process improvement and effective execution to offset rising costs in other areas. Helping decision-makers understand the challenges and potential opportunities from different operating expense ratios can best be reflected through what-if scenarios and stress tests.

Higher Provision for Loan Loss (PLL)

Lastly, the ever important PLL. Over the past several years, it has almost been an afterthought in the budgeting process. But as anticipation of a potential slowdown or recession grow, many are performing what-ifs and stress tests surrounding a potentially higher PLL. Every institution is unique with different forecasts based on expectations for the overall economy. That being said, the possibility of higher PLL can be an informative what-if for decision-makers.

Remember This

Using what-ifs allows decision-makers to be more nimble during the budgeting process, and make changes along the way if they determine the risk/return trade-offs of key initiatives are out of their comfort zone. As much as possible, financial institutions should continue to approach budgeting from a strategic perspective, giving enough attention to the detail but providing relevant business intelligence along the way.