Strategic Planning: The Future of Money?

December 17, 2015

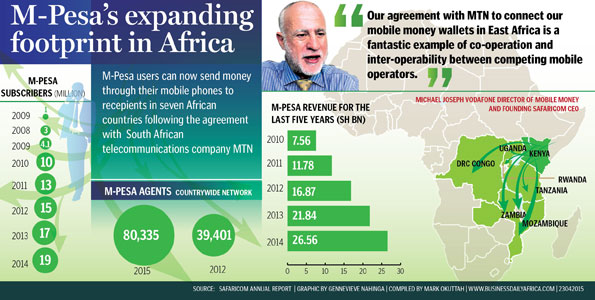

60 Minutes recently aired a segment on M-Pesa, an alternative currency, which is the preferred method for financial transactions in Kenya. In essence, M-Pesa allows cell phones to perform nearly all financial transactions without the use of a bank account or credit card. The full segment, which goes into more detail than this blog, is located here.

60 Minutes recently aired a segment on M-Pesa, an alternative currency, which is the preferred method for financial transactions in Kenya. In essence, M-Pesa allows cell phones to perform nearly all financial transactions without the use of a bank account or credit card. The full segment, which goes into more detail than this blog, is located here.

What makes the M-Pesa model unique from other non-traditional competition is the fact that financial institutions are taken out of the equation. The M-Pesa model is sometimes referred to as “bankless banking.” The 60 Minutes segment refers to the cell phone as a “bank in your pocket,” that allows customers to get a loan, pay bills, buy goods, and withdraw cash using PIN security. A plethora of mobile kiosks allows for easy conversion of cash to virtual currency; the need for branches, ATMs, and tellers is virtually non-existent. Less brick and mortar allows for better rates and lower fees for customers.

No doubt, M-Pesa is an intriguing model but its long-term sustainability remains uncertain. M-Pesa in its exact form may not be the disruptor that changes banking in the United States. However, it is often the next idea (or the one after that) which springboards change.

Credit union planning sessions should include test drives of the future, including a banking environment where non-traditional competition like M-Pesa is a threat. Role playing a scenario like M-Pesa will also allow the credit union to see changes it may need to make today to ensure relevancy in the future.