Strategy and Risk Management – Is Leadership in Sync?

January 21, 2016

Understanding and prioritizing strategy has never been more complex, especially as new disruption continues within the industry. Beyond delivering valued products and services profitably to members while remaining safe and sound, decision-makers face new threats to remaining relevant as non-traditional competitors create inroads into financial services. With limited resources, success can depend on choosing the right path.

Creating an optimal strategic focus requires decision-makers to share a common understanding of threats to the business, and a clear assessment as to which of those threats warrant attention and resources. This is where linking risk management practices to strategic planning can provide effective guidance.

Consider the following simple, yet powerful, exercise with your team:

- Begin with a high-level review of the financial results and risk reporting you prepare and review every month or quarter: monthly financials, key ratios, A/LM results, credit policies, etc.

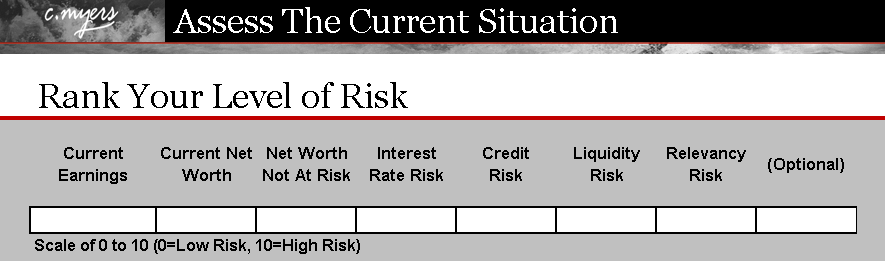

- Identify critical risk areas (see the example below), starting with elements from financial and risk reporting, then allowing the group to add to the list as necessary.

Note: We are using relevancy as a broad category to describe the myriad of new competitive pressures and changing member expectations. This should be customized for your credit union’s uniqueness.

- As a group, rank each risk on a scale of 0-10 (0=Low Risk, 10=High Risk).

THE VALUE

Here’s where this exercise can create significant value, as decision-makers begin to link results with their gut feeling and appetite for risk. What is your level of risk? Where does it exist? Where would you most want to see improvement? For some, these discussions may identify:

- A lack of understanding of a specific risk (an opportunity for training)

- Difficulty comparing and ranking different risks (an opportunity to share different perspectives)

- Differing opinions (a need to achieve consensus)

Each of these outcomes can create opportunities for the credit union such as:

- Taking strategic discussions to the next level

- Advancing risk management

- Refining focus and allocation of resources

In addition to aligning strategic planning with risk assessments and management, consider the benefit of knowing that the leadership team shares a deeper, common understanding of the risks facing the credit union and the reasons driving strategic priorities.

As the credit union industry changes and faces new competitive pressures, linking strategic planning and risk management could be key to ensuring ongoing success.