Don’t Hit Cruise Control on Auto Loans

Auto sales, which have been at record levels and hit a peak of 17.8 million units last year according to CU Times, may be reaching a plateau. If your earnings are heavily reliant on sustained and significant production in auto loans, think strategically about the following:

- There are indications of changing behaviors affecting market demand.

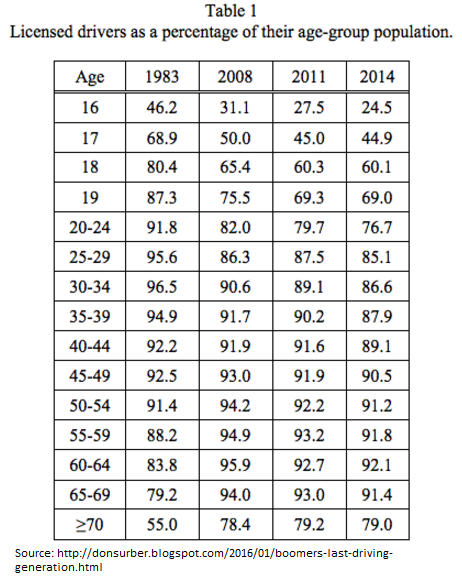

- In 2008, 65.4% of 18 year-olds had a driver’s license. Now, that is down to 60.1% (Source: Yahoo! News).

- In all age groups from 16-69, the percent of Americans with a license has fallen since 2008 (Source: Yahoo! News).

- It is important for decision-makers to think through potential implications if these trends continue. Not only could it impact loan demand, but consider possible reduction in non-interest income as a result of reduced sales of related insurance products, as well as the impact on membership growth, particularly for those credit unions that are heavily reliant on indirect lending.

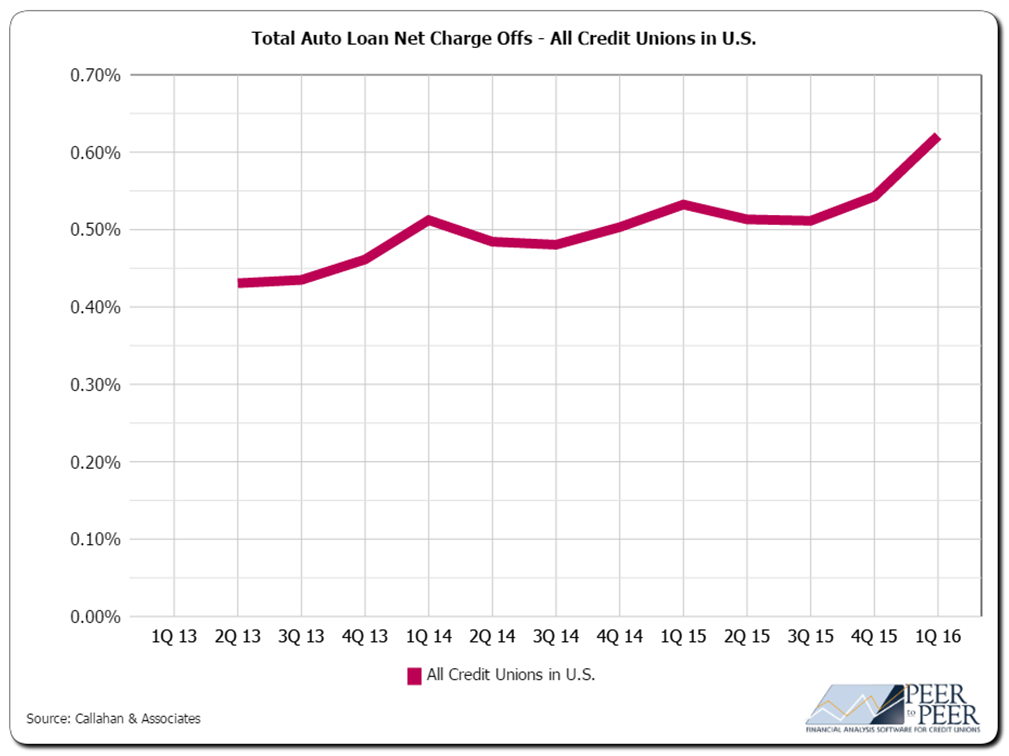

- Credit risk appears to be on the rise. Some of the increase could be by design as more credit unions have strategically taken on more credit risk.

- According to TransUnion, the national auto loan delinquency rate increased from 1.16% in Q4 2014 to 1.24% in Q4 2015 – the highest level since Q4 2010 when auto delinquency hit 1.22% (Source: CU Today).

- According to Callahan & Associates, since 2013 (when this data for autos first became available for autos), credit union auto loan charge-offs are up from 0.43% to 0.62% in 2016, a 44% increase.

- According to American Banker, industry analysts are communicating expectations for used car values to fall significantly in 2016 and 2017, as a large number of leased vehicles come back into the market and create a glut of inventory.

- This could also impact credit risk. But consider the impact it could have on loan production. If the average prices are lower, how many more auto loans would you need to make to have the same loan volume? If it is materially more, what is the impact on operations?

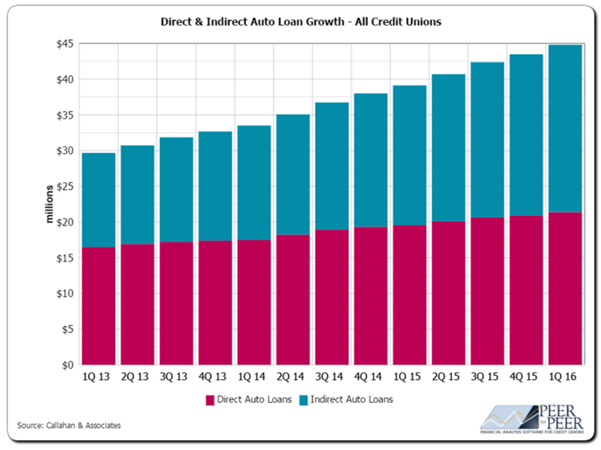

Many credit unions have enjoyed significant growth in autos.

As you strategically evaluate your competitive position with respect to auto lending, don’t lose sight of these three basics:

- Fierce competition for auto loans is a fact. With credit union net interest margins below 3% on average, pricing effectively for risk and profitability is not optional. And this means taking it to bottom-line profitability. Don’t stop at the margin when analyzing pricing.

- Material decline in autos loans can directly impact other strategic initiatives, particularly those that are costly. You have to generate money to spend it!

- Markets change, sometimes quickly. Keep aware of the industry and competition in the market. Identify trends. Listen for concerns. Ensure the ALCO and the board are informed and discussing the potential impacts to the credit union’s booked loans as well as new business efforts, especially if the credit union is highly reliant on continued new production of auto loans.