Investment Strategy: Consider Income Volatility vs. Yield

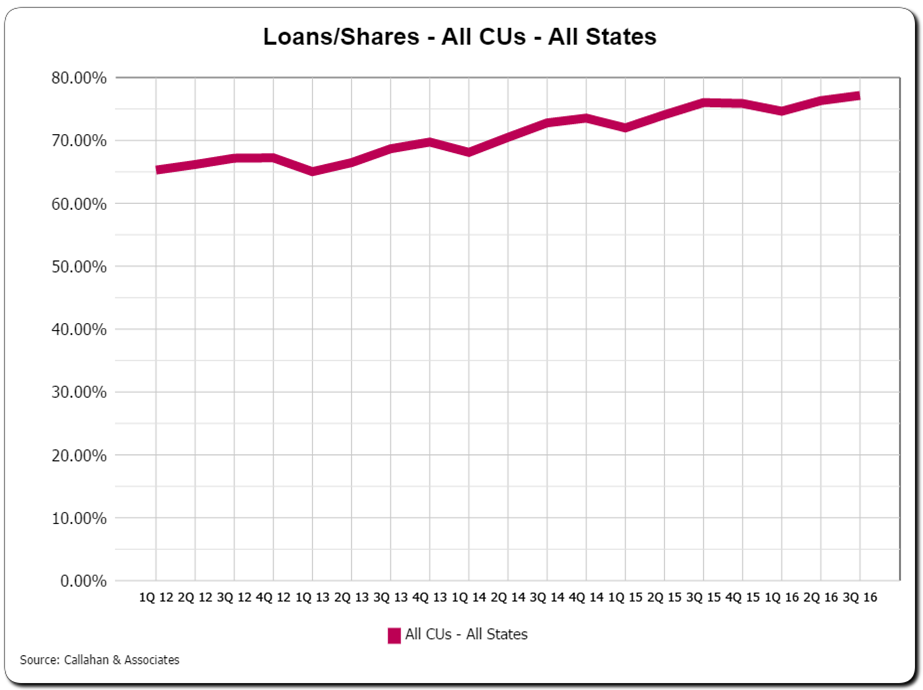

Increase in loan-to-asset ratios along with the potential for higher market interest rates and tighter liquidity heighten the importance of the investment strategy and its role in supporting a credit union’s overall business strategy.

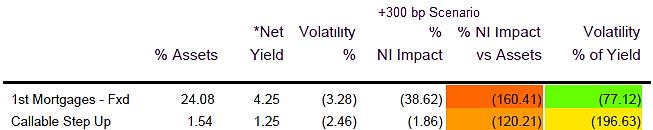

Understanding income volatility versus yield can be valuable in establishing investment strategy. Below we are illustrating the point using two investment strategies with similar yields while exploring volatility in various rate increases. This concept can also be applied to individual investments.

The illustration below complements concepts featured in the February 23rd blog, Don’t Just Focus on Interest Rate Risk – Yield Matters.

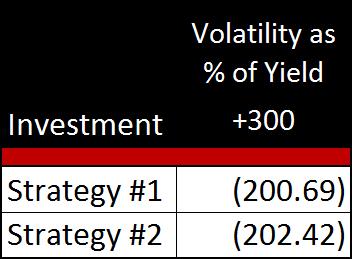

Again both investment strategies have essentially the same yield today. Additionally, they have very similar income volatility as a percent of yield in a +300 rate environment.

At this point, when deciding between the two strategies the credit union would view the decision as a coin flip or slightly tilted to Investment Strategy #1.

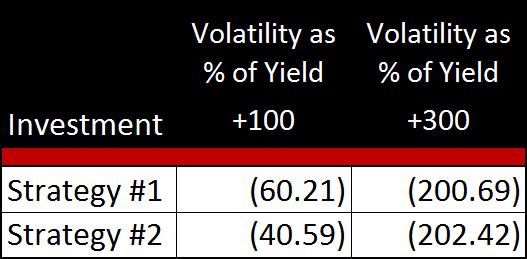

But let’s not stop there. Every credit union has a unique appetite for risk and expectation for rates. Beyond evaluating risk in a +300, if a credit union is focused on a +100 bp increase in rates, then they would also want to evaluate the risk/return relationship in a +100 rate environment.

Considering the risk/return trade-off is similar in a +300, but Investment Strategy #2 has less volatility if rates increase 100 basis points, the credit union would determine that Investment Strategy #2 is a better fit overall.

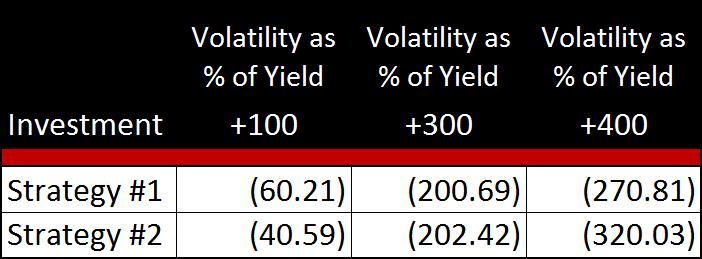

For many credit unions, looking beyond a +300 rate change is an important part of the risk management process, especially considering that a +400 rate environment today could be the +300 rate environment in the near future. Understanding risk and risk/return relationships beyond +300 is good practice.

If the credit union is actively managing risk through +400, the risk/return relationship shows Investment Strategy #1 to be the best fit.

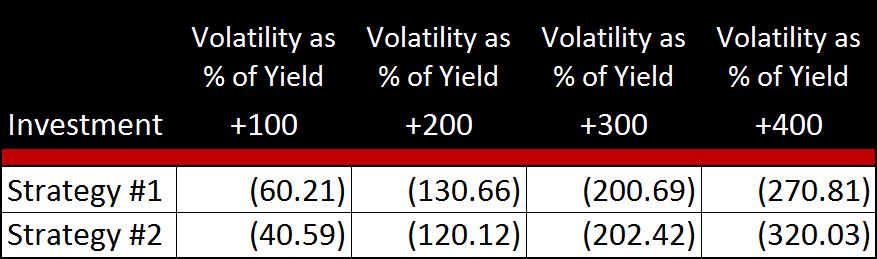

Creating a table that provides the risk/return relationships for a wide range of rate scenarios can provide better clarity in connecting the investment strategy with the credit union’s overall strategy and appetite for risk.

Keep in mind there is no “right” answer. What is important is to help key stakeholders easily see the trade-offs.