Static and Dynamic Methodologies – Critical ALM Modeling Issues That Can’t Be Ignored

7 minute read – As rates have increased materially, and liquidity pressure continues to build, leaders will continue to be faced with high-impact decisions that can have longer term consequences. Reliable and timely financial decision-information is a huge component of a successful decision-making process.

This blog on Static Balance Sheet Analysis (sometimes referred to as Static NII or Net Interest Income) and Dynamic Simulations is part of a series addressing critical ALM modeling issues.

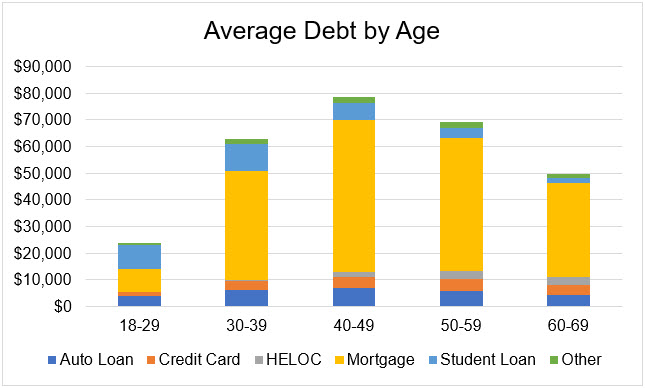

Static Balance Sheet Analysis, by definition, assumes that the balance sheet structure never changes, even if rates change. The static methodology was developed prior to advanced computing power. Unfortunately, it has remained pervasive in modern risk analysis. This simplified methodology is particularly dangerous and misleading in the rate environments decision-makers are facing today, as it can understate risk. For example, many institutions’ ability to attract funding is shrinking and the mix of funding is changing to higher cost sources. This is completely ignored in a Static Balance Sheet simulation.

Problem: Static reflects none of the potential liquidity pressure that has historically occurred when rates rise, ignoring the resulting change in funding mix and its impact on the cost of funds.

Solution 1: First and foremost, make sure the limitations of the Static Balance Sheet Analysis are clear to other decision-makers to avoid unpleasant surprises.

- Caution – It is common for people to think that their ALM model has decay/withdrawal assumptions, so they think the risk is covered. A confusing reality in most models is that those assumptions ONLY apply to their EVE/NEV answers, but NOT their risks to earnings and capital.

- Caution – We have heard some people say that they also do a Dynamic Simulation, so they are covered. A Dynamic Simulation can address some of the risk if it assumes a shift from lower cost deposits to higher cost deposits like certificates. The problem is most Dynamic Simulations don’t factor in that the shift should get worse as rates go higher.

Solution 2: Incorporate a methodology that automatically changes the mix of deposits as rates change.

Problem: There are no fixes to the Static Balance Sheet methodology that also preserve the true definition of static. However, there are some work-arounds if your modeling capabilities or policies are limited to Static Balance Sheet Analysis.

Solution: Create a non-maturity deposit category to represent the non-maturity deposits that could shift to CDs as rate advantages develop. Move some of the starting funds into that account and have it reprice to your new CD rates. (Keep in mind your average balance per account pressure along with the consumer’s advantage to move to CDs)

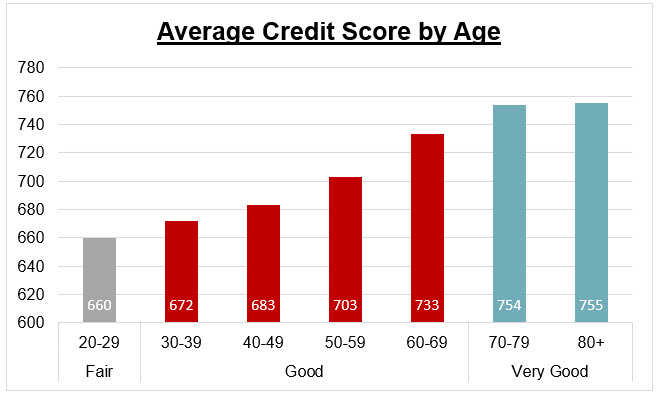

- This doesn’t address the reality that the amount that may move should be expected to change as rates change. Typically, as rates go higher, the difference in pricing between products increases, meaning that the consumer has more of an advantage to move their funds to higher-priced products. For example, more migration is likely to happen if rates increase 300 basis points than if they increase 100 basis points.

- Consider moving the maximum you think will migrate in the highest rate environment to capture additional risk exposure.

- The representation of migrating funds could be included either in your base simulation or as a what-if. We encourage decision-makers to include it in the base simulation if you think it is more realistic that some funds will move to higher-cost products as market rates rise. A starting point for the amount to move could be based on your assumed decay rates.

- Caution – It can seem simpler to move the balance into a current CD account and assume that the term is a year or more, but this fails to capture the volatility that should result from funds migrating from lower rates to higher rates during the simulation, hiding risks from decision-makers.

There are also problems with Dynamic Simulations, many of which are solvable. Here are just a few considerations.

Problem: Similar to the issue with Static Balance Sheet Analysis, many Dynamic Simulation models do not incorporate decay rates when quantifying risks to earnings and capital.

Keeping the same future balance, regardless of market rates, doesn’t appropriately address the exposure and can understate the volatility. It misses the risk that the funding mix can change and the resulting impact to the cost of funds.

Ask Yourself: As discussed in previous blogs, why is it standard practice to apply decay assumptions when doing EVE/NEV and yet this practice is ignored in typical Static and Dynamic Balance Sheet Analysis?

Solution: You will need to make manual adjustments to represent the potential reductions in balances on the lower-priced products and the shift to higher-priced products, if appropriate. While it is not difficult to make this assumption for one environment, most models do not have the ability for the non-maturity balance to automatically change for each rate environment simulated.

Problem: Assumptions regarding new business can hide risks that currently exist or introduce risks that don’t exist. This muddies the waters for decision-makers and can lead to overconfidence in the risk position or unnecessary de-risking.

Solution: Run simulations that isolate existing risk/return, focusing on the potential profit and capital impact in the current structure. A benefit of this is to see the potential timing of risk and what it may take to offset the risk if exposure is too high. This will help decision-makers have more clarity as to the sources of risks and returns before deciding the best course of action.

Problem: Focusing on the relative rate environment and consistency in assumptions is overrated. The rate environment has changed drastically in recent months and assumptions assigned to current and up/down rate environments deserve a thorough review. These types of assumptions can heavily influence the results of risks to earnings, capital, and EVE/NEV.

Solution: Dig deep into your decay rate assumptions to ensure that the actual current rate environment, which changes over time, is being considered. This is a hard, yet critically needed, shift in ALM modeling mindset. This is only one of many examples regarding assumptions that need to be reviewed. This is addressed in detail in our blog on decay rates.

As we said in the beginning, reliable financial decision-information is critical to thriving in this type of environment.

We run thousands of risks to earnings, capital, and EVE/NEV simulations and what-ifs each year, so we understand the considerations facing finance teams today – this blog just scratches the surface. We know that timing is critical and finance teams need to move fast. Please feel free to call us if you have questions on the information provided in this blog.

You may also be interested in: