Too Much Loan Growth?

Many credit unions have had the good problem of being so successful in lending that liquidity has become a challenge. A blog we wrote in December 2016 identified 6 key questions that decision-makers should evaluate on the issue. This post expands on that topic by looking at several possible liquidity solutions credit unions are considering as they deal with tightening liquidity, and what the A/LM implications of each scenario would be.

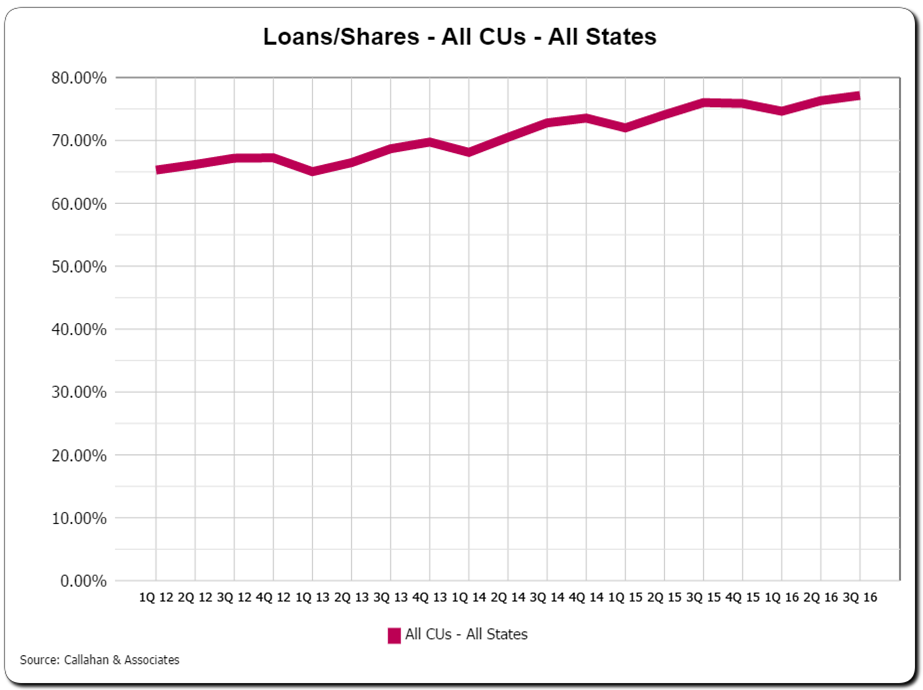

So how did we get here? The average loan-to-share ratio for credit unions has increased by almost 12% over the last 4 years as loan growth has steadily outpaced deposit growth. The average loan-to-share ratio now stands at almost 80%, while many individual credit unions have seen their loan-to-share ratio increase well above that level.

As liquidity has tightened, some credit unions have turned to selling or participating out loans as a way to manage short-falls in funding. However, many of those same credit unions are finding that selling or participating out loans at favorable terms has become increasingly difficult, and that trend could continue. If the economy strengthens, financial institutions would likely see loan demand remain strong, which could further hamper an ability to sell loans. Why would another credit union or bank buy loans from your institution, if they can originate loans on their own?

One solution could be to slow down loan growth by raising rates. However, credit unions are initially reticent about this path if other viable alternatives are available due to fears about getting growth ramped up again, especially for institutions that do a lot of indirect or commercial loan business.

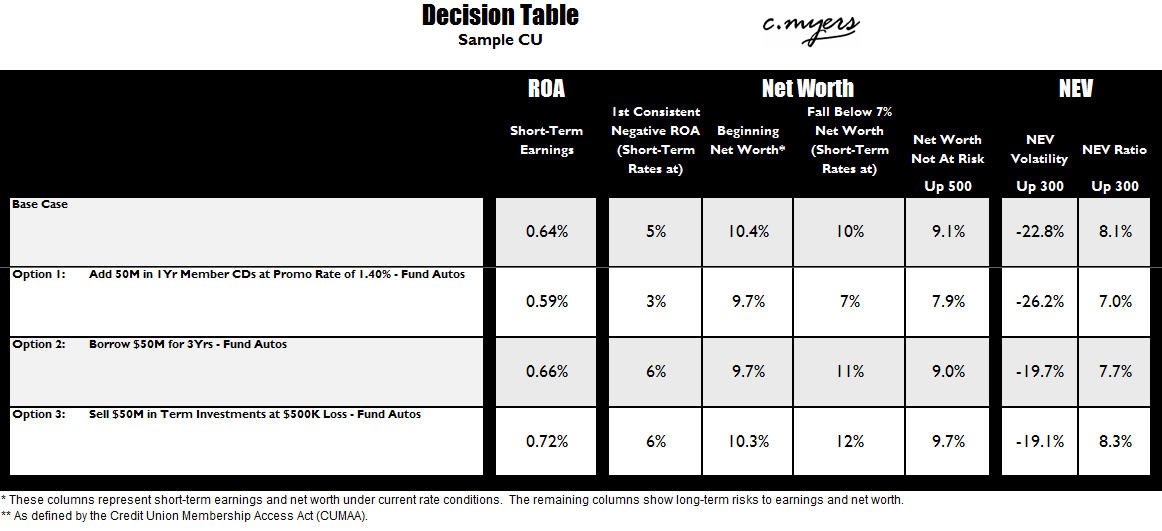

While there are important strategic and budgetary considerations that should be evaluated, the A/LM impact should not be forgotten. Below are examples of liquidity funding scenarios that credit unions are testing with some frequency. In each scenario, the credit union is adding $50M in auto loans, while evaluating 3 distinct funding strategies. Additionally, in these scenarios the credit union has assumed it has the internal capacity to make these loans without the need for increased operating expenses.

Member CD Promo

For many credit unions, the first option to attract liquidity would be to get it from the credit unions’ members. The first option (see Option 1) looks at the impact of solving the liquidity challenge through an aggressive CD promotion (1-year term at 1.4%). A challenge with the member CD solution is the likelihood of cannibalizing lower cost deposits as members take advantage of the higher rate. Additionally, funds acquired through CD promotions could be rate sensitive if opportunities develop for the member to obtain a higher yield. Both of these risks were factored into the modeling. The results show that adding autos and funding with short-term CDs (including transfers from lower-cost deposits) would negatively impact ROA today compared to the base case, as well as increase risks to earnings and net worth if rates rise.

Intermediate-Term Borrowing

The credit union could also evaluate an intermediate-term borrowing strategy (Option 2). While borrowing at a fixed rate for 3 years is more expensive than short-term borrowings, it can help reduce risks to earnings and net worth if rates rise.

If borrowings are utilized, there are other questions to consider. For example:

- What internal borrowing limits might your credit union have in place?

- Are there any regulatory constraints on your planned borrowing strategy, and how much would you have remaining in available lines of credit in the event of a liquidity emergency?

- Would your credit union plan to increase available lines of credit in the future? If so, the type of loans being added would matter. For instance, consumer loans are not as readily collateralized as mortgages.

Selling Investments

The final strategy (Option 3) looks at selling investments to fund the same $50M in loan growth and assumes the investments are sold at a 1% loss. Setting aside the slight decrease in the net worth ratio, the results of this scenario look the most favorable with improvements in ROA and the risk measurements. However, this solution could raise a different set of questions. For example:

- Are the investments that were sold being used as borrowing collateral?

- If they were borrowing collateral, how would this impact future liquidity options and is it a sustainable strategy?

- What kind of gain/loss would there actually be if investments were sold?

Whatever the solution, it is important to look beyond just the next couple of quarters. If loan sales remain challenging or loan growth continues to outpace deposit growth, what is your credit union’s long-term liquidity management strategy? Consider playing this out over the next 12 months, think through the tough strategic questions, consider the impact to your budget/forecast, and make sure you play out the results from an A/LM perspective.

Finally, if it is determined that there are limits to the amount of loans the credit union can book going forward, does the credit union have the tools that allow you to see the complete risk/return picture of your different asset categories to determine which have the most favorable risk/return trade-offs? Armed with that information, your credit union could work to maximize the growth in the most favorable loan categories, while perhaps reducing emphasis on those categories that are less favorable. Our clients have reporting that allows them to comprehensively evaluate the risk/return trade-offs of individual loan categories. We wrote a c. notes on this topic in 2016.