Driverless Car Innovation Drives Impact on Financial Services Industry

It’s not too soon to start thinking about the possible strategic implications of driverless cars and driverless car technology on the financial services industry. Billions of dollars are being invested by numerous companies and sectors to propel the use of driverless technology.

The impacts can be far reaching. To leverage possible opportunities requires advanced critical and strategic thinking. We thought the article 24 Industries Other Than Auto That Driverless Cars Could Turn Upside Down, by CB Insights, would help jump-start your critical thinking.

Remember, all advancements come with tremendous opportunities. Your job is to find and leverage them!

Read more about the mix of technology and the credit union industry in our blog archive.

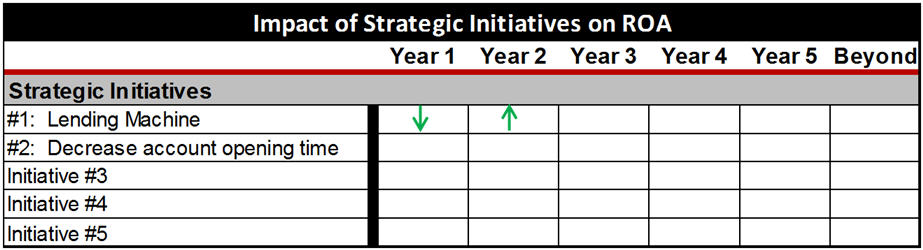

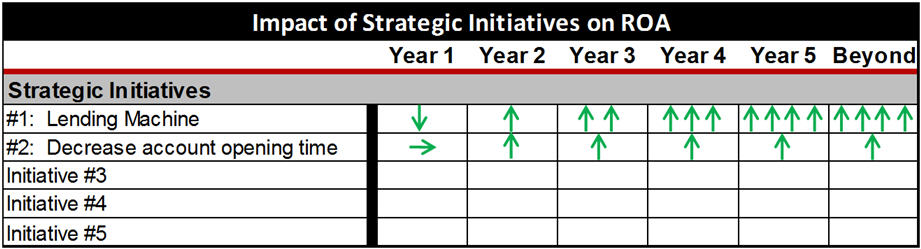

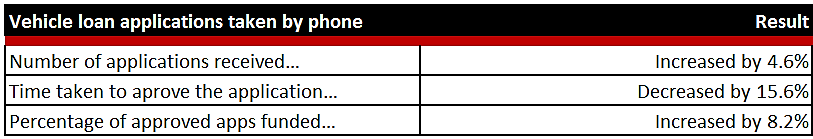

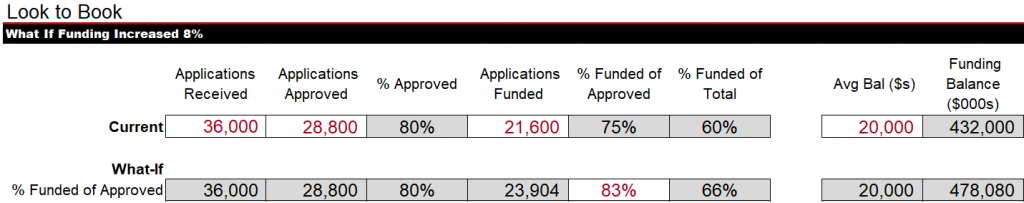

quality member experience, which is part of the strategy. This link between process improvement and the credit union’s highest-level strategy translates to unwavering support from the senior team for the process improvement strategic initiative.

quality member experience, which is part of the strategy. This link between process improvement and the credit union’s highest-level strategy translates to unwavering support from the senior team for the process improvement strategic initiative. credit union wished to improve when engaging c. myers was the vehicle lending process. This piece wasn’t broken—not by a long shot—but in considering the competitive environment, leadership asked themselves some questions:

credit union wished to improve when engaging c. myers was the vehicle lending process. This piece wasn’t broken—not by a long shot—but in considering the competitive environment, leadership asked themselves some questions:

In addition to involving the doers, keys to successful process improvement include having a clear objective, clearly documenting the decisions that are made along with the rationale behind them, creating a game plan to help with execution, and using metrics to monitor the process.

In addition to involving the doers, keys to successful process improvement include having a clear objective, clearly documenting the decisions that are made along with the rationale behind them, creating a game plan to help with execution, and using metrics to monitor the process.

wasn’t an expectation. But both traditional and non-traditional competitors are redefining consumer expectations. Providing an experience that members are excited to share with others requires regular evaluation of what that experience is, in addition to actually providing it.

wasn’t an expectation. But both traditional and non-traditional competitors are redefining consumer expectations. Providing an experience that members are excited to share with others requires regular evaluation of what that experience is, in addition to actually providing it. process improvement, this highly successful credit union is positioning itself to continue delivering exceptional member experiences far into the future—even as the definition of “exceptional member experience” changes over time.

process improvement, this highly successful credit union is positioning itself to continue delivering exceptional member experiences far into the future—even as the definition of “exceptional member experience” changes over time.