The Internet—Strategic Delivery Channel Issues And Differentiation

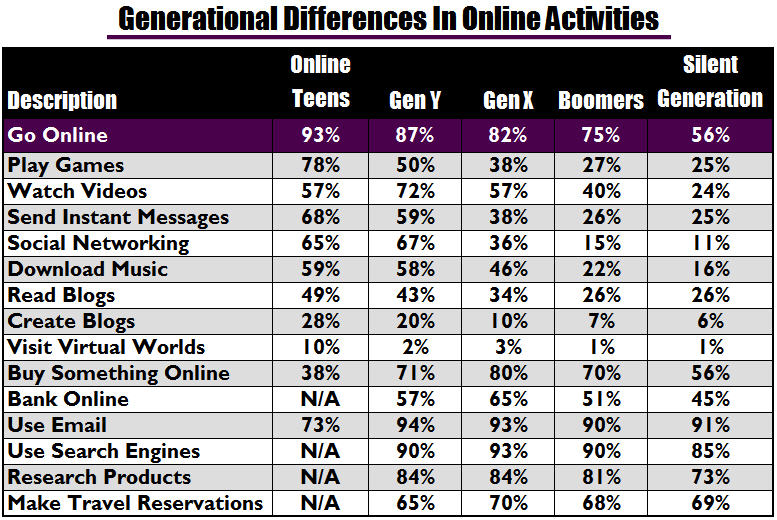

Evolving consumer behavior and internet usage trends may have an even more significant impact on the fundamental way credit unions strategically manage their business model and create differentiation in the future—and these trends aren’t necessarily isolated to a particular generation. Consider the following statistics from the Pew Internet & American Life Project, January 2009:

Today, with many credit unions working hard to allow their members to do everything online, the industry seems uncertain as to how the role of traditional brick and mortar branches may change in the future. Some ask: Do we keep building them? Do we build smaller, storefront branches, kiosks or install more full-service ATMs? What kind of members are using branches vs. those using home banking? How do I cross-sell if I push my members toward home banking?

Internet-Based Financial Institutions

Adding complexity to the delivery channel issue is the growing popularity of internet-based financial institutions (financial institutions with only an online presence, such as ING or, more recently, Ally Bank). An article published by the American Bankers Association cited that nearly 40% of internet households have a relationship with an internet-based financial institution—compared to only 20% as of 2007. Supporting this trend is the broadening availability of mobile internet access with the growing popularity of the smartphone. Despite current economic woes, smartphone sales actually increased 13% year-over-year in the 3rd quarter of 2009—representing the fastest growing segment of the mobile market, according to Gartner Inc.

Cross-Industry Perspectives

In another context, consumers spent 11% more than they did in 2008 on “Cyber-Monday,” according to Coremetrics Inc., a Web analytics company that tracks shopper behavior. (Cyber-Monday is a term coined in recent years to describe the first Monday after Thanksgiving.) According to Forrester Research, online shopping this holiday season may grow by as much as 50%. “The shift to online shopping, fueled by deal seekers in the recession, may be coming at the expense of sales at traditional stores later in the holiday season, Forrester says.” (Source: ‘Cyber Monday’ Sales Appear Strong, WSJ, 12/1/09)

Strategic Thinking

As consumers increasingly use technology, looking for better deals and enhanced convenience (especially in tough economic times), the trend toward using online delivery channels, internet-based financial institutions and online shopping is likely to continue. But remember, back in the 1970s when ATMs were a novelty, many assumed that they would replace branches and tellers. Of course, they didn’t. As a matter of fact, from 2002 to 2007, banks alone have constructed over 10,000 branches according to the Associated Press. Nevertheless, consumers’ consistent increase in using online commerce has brought to the forefront some questions that credit unions and other financial institutions need to answer as part of their strategic thinking:

- How do we strategically deploy our finite resources in order to appropriately position our delivery channels for our target market over the next several years?

- If a growing portion of the population is becoming more comfortable using internet-based financial institutions, what differentiation can we create or improve upon for our distinct target market to get our share of their wallet?

These are difficult questions, but seeking out answers should not be avoided. Moreover, each credit union’s answers will be unique, as there are different delivery channel strategies depending on the behaviors, backgrounds and demographics of various target markets. We encourage credit unions to approach the questions seriously in strategic planning sessions and discussions, especially in uncertain economic times when operating expenses are so critical to success.