Qualified Mortgages, More Than Just a Compliance Issue…

As of January 10, 2014, the “Ability to Repay and Qualified Mortgage Standards under the Truth in Lending Act (Regulation Z)” went into effect. Beyond the added compliance burden this will have, consider how this rule could impact strategy, interest rate risk and earnings at individual credit unions, and for the financial services industry as a whole.

There are many facets to the regulation, including limits on points and fees, caps on debt-to-income and limits on loan term. An additional requirement is that, on variable-rate mortgages, the originator must verify that the borrower can still make the payment assuming the maximum increase in rate over the first five years. For those credit unions that make and hold significant 1/1, 3/1 or 2/2 ARM, this could have a major impact. Many credit unions make these variable-rate loans in order to offer members another mortgage option, typically at a lower rate. A benefit of this is that it also provides some interest rate risk protection; yet under this new rule, the ability to originate and keep these loans may be severely diminished.

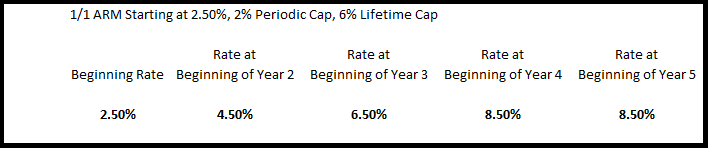

Take the example of a 1/1 ARM originated today with a starting rate of 2.5%, a 2.0% annual periodic cap and a 6.0% lifetime cap over the original rate. Given the requirements of the new Qualified Mortgage rule, the borrower would have to qualify for this loan at a rate of 8.50% (see table below):

Many members who could have previously qualified for a 1/1, 3/1 or 2/2 ARM may no longer qualify under this new rule. Now, while it could be argued that this could have the impact of reducing potential credit risk down the road, it also means that some adjustable rate mortgage products are likely to go away, or change materially. Consider, will credit unions switch to offering exclusively fixed-rate mortgage products or offering ARMs with initial lockouts of five years or longer? Either of these alternatives will add increased interest rate risk. The shift may not dramatically change interest rate risk profiles over 2014, but what happens after several years of a shift like this?

There is no doubt there are many other questions that credit unions should consider. Beyond the shift in risk that may occur, it can also be good to consider the longer-term strategic consequences credit unions could face.