Posts

Technology: How Much Is Right For Your Credit Union?

Consumer Behavior and Technology Blog PostsMobile Banking And Strategic Resource Allocation

Consumer Behavior and Technology, Strategic Planning Blog PostsThe Credit Union Times recently released an article titled Mobile Banking Report: Credit Unions Lagging Banks. In the article, Mary Monahan of Javelin Strategy & Research cautions that institutions that lack mobile banking risk losing valuable customers to those that offer it. She enforces that many credit unions still do not offer mobile banking apps and that is what users want with a particular emphasis on the younger generation.

There is certainly an argument to be made that the younger generation is faster (not necessarily more prone) to adopt new technologies. Consider that 45% of those ages 64 to 72 use home banking, compared to 57% of those 18-32 according to a 2009 Pew study; the margin is pretty slim. The “Silent Generation” may not have been the first to adopt home banking, but technology often catches up with all generations. Beyond age, a number of other demographic and behavioral factors will play a role in usage and adoption rate within your credit union’s unique market.

The question remains, however, are most credit unions positioned to compete with the technology of the nation’s largest financial institutions? And the more important questions: Is mobile banking necessary for your unique credit union right now? If not, when?

A credit union will benefit tremendously by having a deep understanding of its business model (including target market(s), value propositions, core competencies and sources of profitability) when contemplating any new product or service. In our strategic planning work with credit unions, we encourage credit union leaders to create Decision Filters focused on the credit union’s unique business model to help allocate finite resources. Few if any businesses can afford to be all things to all people—and with margins that continue to be squeezed by sluggish loan demand and extended low interest rates—strategic allocation of resources is critical.

Source: Mobile Banking Report: Credit Unions Lagging Banks, CU Times, 2/7/12

The New Word of Mouth: Revolutionizing How Younger Members Find You

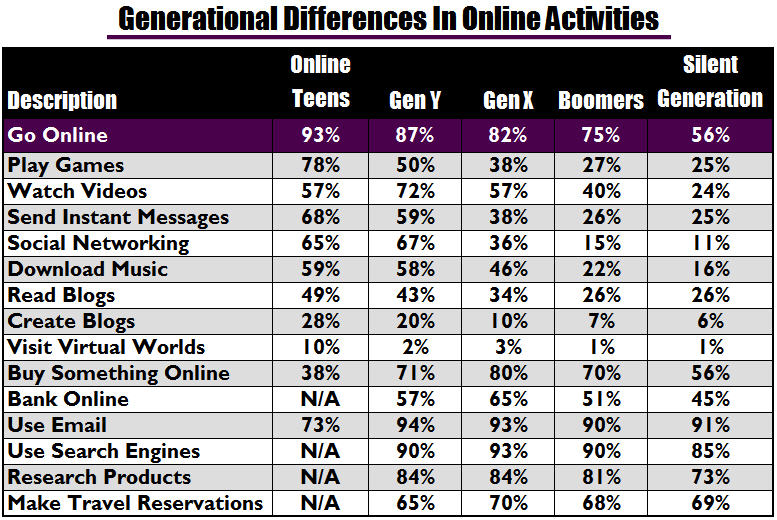

Consumer Behavior and Technology, Strategic Planning Blog PostsNobody will argue that the way we search for information over the last 10 years has changed dramatically. Gone are the days of bulky Yellow Pages and encyclopedias; if someone—especially the younger generation—wants information, they turn to search engines. According to the Pew Internet & American Life Project (January 2009), 87% of Gen Y use the internet, 90% of which use search engines to find information.

A new spin on the way search engines provide relevant results is underway. Bing.com, powered by Microsoft, has partnered with Facebook to let your circle of friends directly influence your search engine results. If a Facebook friend finds a link that they “like,” it will appear at the top of your results.

What does this mean for credit unions? Every day, sharing information and recommendations becomes easier and more efficient. While the ramifications of this partnership are largely unknown, it is likely that the member experience and loyalty you create will become even more critical to attracting new, younger members. What do you do that would motivate a member to “like” your site?

The Internet—Strategic Delivery Channel Issues And Differentiation

Consumer Behavior and Technology, Strategic Planning Blog PostsEvolving consumer behavior and internet usage trends may have an even more significant impact on the fundamental way credit unions strategically manage their business model and create differentiation in the future—and these trends aren’t necessarily isolated to a particular generation. Consider the following statistics from the Pew Internet & American Life Project, January 2009:

Today, with many credit unions working hard to allow their members to do everything online, the industry seems uncertain as to how the role of traditional brick and mortar branches may change in the future. Some ask: Do we keep building them? Do we build smaller, storefront branches, kiosks or install more full-service ATMs? What kind of members are using branches vs. those using home banking? How do I cross-sell if I push my members toward home banking?

Internet-Based Financial Institutions

Adding complexity to the delivery channel issue is the growing popularity of internet-based financial institutions (financial institutions with only an online presence, such as ING or, more recently, Ally Bank). An article published by the American Bankers Association cited that nearly 40% of internet households have a relationship with an internet-based financial institution—compared to only 20% as of 2007. Supporting this trend is the broadening availability of mobile internet access with the growing popularity of the smartphone. Despite current economic woes, smartphone sales actually increased 13% year-over-year in the 3rd quarter of 2009—representing the fastest growing segment of the mobile market, according to Gartner Inc.

Cross-Industry Perspectives

In another context, consumers spent 11% more than they did in 2008 on “Cyber-Monday,” according to Coremetrics Inc., a Web analytics company that tracks shopper behavior. (Cyber-Monday is a term coined in recent years to describe the first Monday after Thanksgiving.) According to Forrester Research, online shopping this holiday season may grow by as much as 50%. “The shift to online shopping, fueled by deal seekers in the recession, may be coming at the expense of sales at traditional stores later in the holiday season, Forrester says.” (Source: ‘Cyber Monday’ Sales Appear Strong, WSJ, 12/1/09)

Strategic Thinking

As consumers increasingly use technology, looking for better deals and enhanced convenience (especially in tough economic times), the trend toward using online delivery channels, internet-based financial institutions and online shopping is likely to continue. But remember, back in the 1970s when ATMs were a novelty, many assumed that they would replace branches and tellers. Of course, they didn’t. As a matter of fact, from 2002 to 2007, banks alone have constructed over 10,000 branches according to the Associated Press. Nevertheless, consumers’ consistent increase in using online commerce has brought to the forefront some questions that credit unions and other financial institutions need to answer as part of their strategic thinking:

- How do we strategically deploy our finite resources in order to appropriately position our delivery channels for our target market over the next several years?

- If a growing portion of the population is becoming more comfortable using internet-based financial institutions, what differentiation can we create or improve upon for our distinct target market to get our share of their wallet?

These are difficult questions, but seeking out answers should not be avoided. Moreover, each credit union’s answers will be unique, as there are different delivery channel strategies depending on the behaviors, backgrounds and demographics of various target markets. We encourage credit unions to approach the questions seriously in strategic planning sessions and discussions, especially in uncertain economic times when operating expenses are so critical to success.

602-840-0606

Toll-Free: 800-238-7475

contact@cmyers.com