Testing a Negative Rate Scenario? Consider These Questions First

April 8, 2016

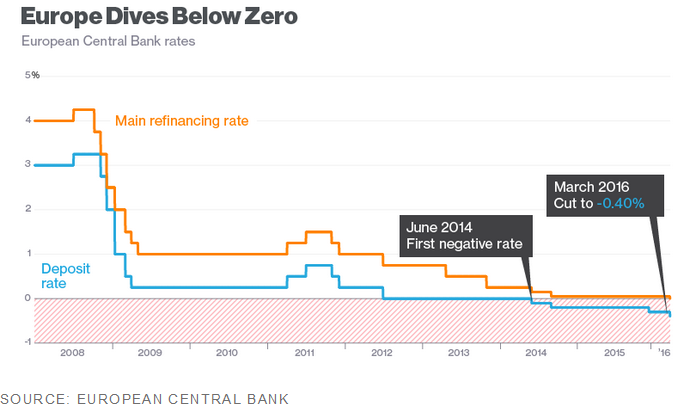

There has been a lot of buzz recently about the potential for negative interest rates to hit U.S. financial markets at some point. Short-term rates have been negative in Europe since June 2014, and the Bank of Japan made the move in January of this year.

Before you test this scenario from an asset/liability management perspective, there are several strategic questions that should be evaluated. Consider the following:

- How would loan rates change? Would your credit union’s floor rates on certain loan categories stay the same – meaning even if market rates drop, the loan rates will not decrease further, as the credit union would want to be compensated for liquidity, credit risk, or other concerns?

- How might loan demand be impacted? This question could be difficult to answer because loan demand is often multifaceted, driven by factors other than just the current level of rates, such as the overall strength of the economy or the direction in which housing values are moving.

- Could deposit rates drop further, or is there a scenario where the credit union would charge members a fee to hold deposits? If so, how might your members respond? If a “negative rate” comes in the form of fees, and if members have deposits at 3 or 4 different institutions, would they pay fees at multiple institutions or consolidate their balances to minimize the fee impact? How could this impact liquidity and liquidity planning?

- If members are charged for their deposit balances, would they be more likely to use those funds to pay down loan balances, resulting in a drop in loan-to-assets?

- Would important sources of non-interest income be impacted, such as NSF, ODP, or interchange income?

- What are some changes your biggest competitors might make? How would this impact your credit union’s response to negative rates?

There are many additional questions that could be considered. The value in discussing these types of scenarios is not that every single question is asked and answered, but that key stakeholders are thinking strategically about events that could materially impact the future of their credit union. Even if this specific scenario never plays out, thinking through how the credit union might respond and practicing the process can be worthwhile, and can then better inform any asset/liability management modeling you consider.