What Are Some Things to Consider as Part of the Budget Process?

August 14, 2015

We help a lot of institutions with the creation of their budgets and long-term forecasts. There are many questions that often arise as part of that process. The most common question is, what rate environment should I plan on?

There is no easy answer to this question; the reality is that whichever environment gets incorporated in the budget has a good chance of being wrong.

Fed Chair, Janet Yellen, described this same challenge during a speech in May:

“I am describing the outlook that I see as most likely, but based on many years of making economic projections, I can assure you that any specific projection I write down will turn out to be wrong, perhaps markedly so.” (Source: Janet Yellen just made one of the most surprising admissions you’ll ever hear from an economist, Yahoo Finance, 5/22/15)

The Federal Open Market Committee (FOMC) will meet September 16 and 17 and many anticipate a decision could be made to increase the Federal Funds target rate for the first time in nearly 10 years. However, forecasts have the potential to not come true, which becomes evident when comparing the Federal Funds rate projection from December 2014 versus the most recent projection.

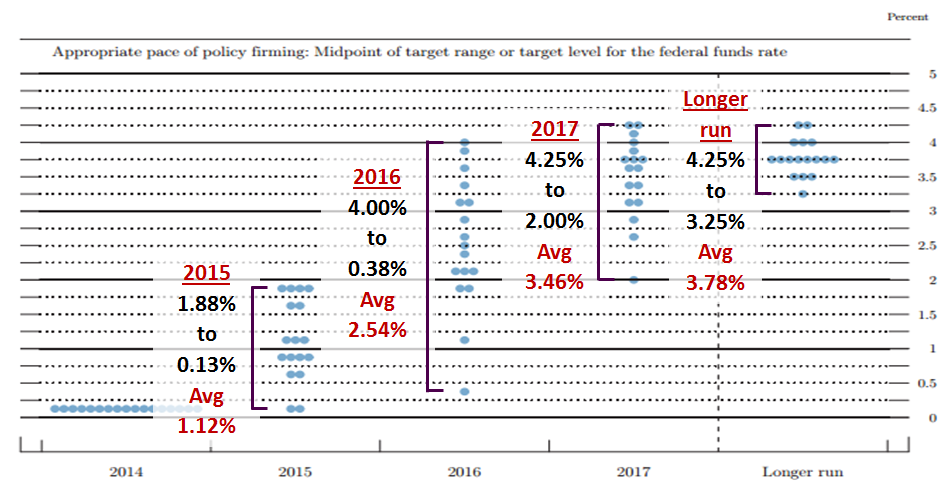

Source: Economic Projections of Federal Reserve Board Members and Federal Reserve Bank Presidents, Federal Reserve, 12/2014

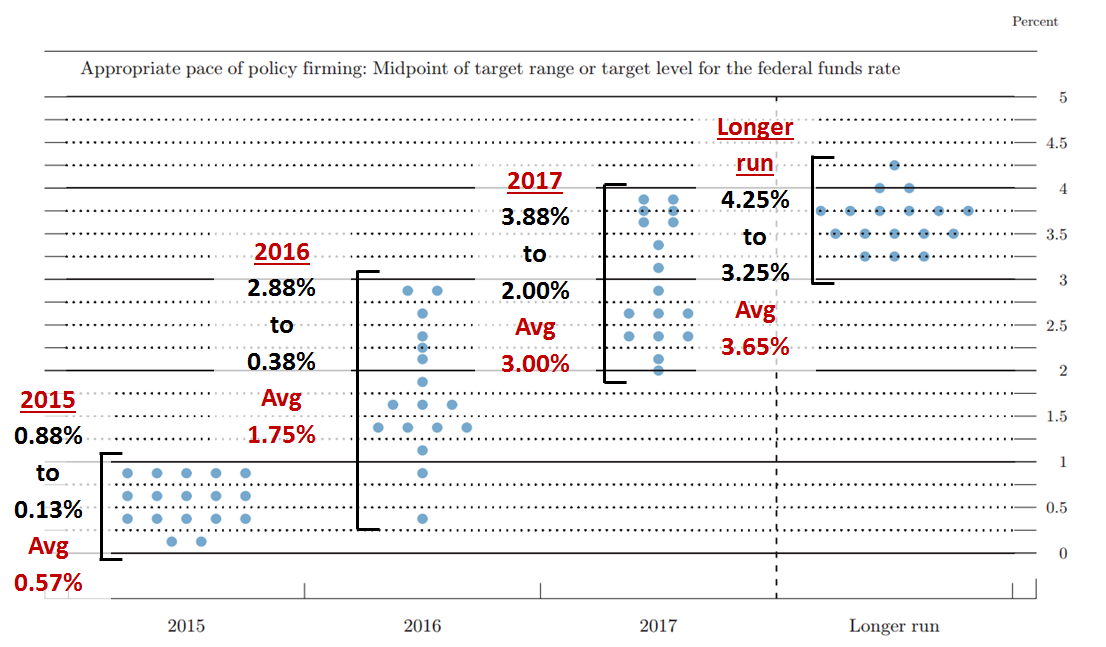

The average expected target range for year-end 2015 and 2016 were 1.12% and 2.54%, respectively. The most recent forecast of Federal Reserve Board Members and Bank Presidents from June 2015 reflects a 2015 and 2016 year-end average that is approximately 0.50% and 1.00% lower than the December 2014 projection.

Source: Economic Projections of Federal Reserve Board Members and Federal Reserve Bank Presidents, Federal Reserve, 6/2015

The danger in relying on rate forecasts or projections is the potential for not understanding the risk of rates remaining at the same level they are today. As many management teams begin the planning process and budgeting for next year, a key consideration should be testing the impact on the budget of rates not moving as forecast. In fact, a combination of a base prediction along with a range of expectations around that base path can help uncover potential strains to the margin.

Beyond the rate environment, some other common budget questions have to do with growth. Whatever the credit union may plan in the future, it can be valuable to test the potential of those assumptions being wrong. With advanced modeling capabilities, the time it takes to run each of the following tests should be minimal.

Some example tests:

- Loan growth has been great for many this year, what if it is slower than expectations going forward?

- What if, in order to get expected growth, the amount paid for dealer reserves or the yield charged for loans is lower than planned?

- Loan loss has been very good for many recently, what if it increases to a more normal level?

- What if non-interest income is materially lower than expected, either due to changes in payments systems, regulations, or other demographic reasons?

Note that the unique exposures of your institution might need very different questions. Our recommendation throughout the budgeting process is to not spend so much time trying to prove that you know what will happen in the future, but rather make sure to focus on reasonable expectations and then test the exposure to the institution if those expectations do not come true.