Why is NEV Showing More Risk Without Any Balance Sheet Changes?

September 11, 2019

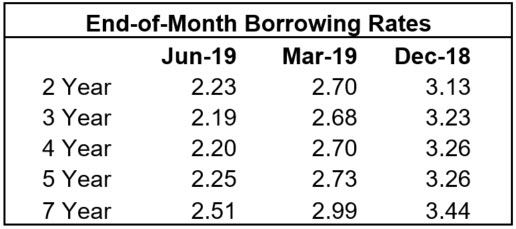

Many financial institutions have been seeing their NEV ratios decline since the end of 2018, even without any meaningful balance sheet changes. Others have shortened their assets and are still seeing their +300 NEV volatility increase. So what could be causing this trend that seems contrary to what one would expect from their balance sheet profile? Primarily, this is due to a decline in borrowing rates. Even if your credit union does not have long-term fixed-rate borrowings, changes in borrowing rates can materially impact the value of your non-maturity deposits. See the below table for some specific points on a borrowing yield curve over the last year:

Deposits are typically valued against borrowing rates (or other curves with similar patterns such as swap curves). A decline in external rates means that non-maturity deposits provide less benefit in the base rate environment, which results in a lower starting NEV ratio, all else being equal. A lower starting NEV, with the same value change in shocks, results in higher volatility (volatility is measured against the current NEV). The lower starting benefit of the deposits also carries over to the shocked values, reducing the resulting NEV ratio in all environments.

NOTE: The changing environment does not impact the results of NCUA NMS NEV simulations, as the deposits are assigned the same current and shocked value regardless of the environment.

It is important for credit union finance teams to communicate how much of the change in results is due to actively changing the balance sheet structure or strategically taking more risk vs. being a function of the rate environment and lower borrowing rates. Being able to articulate and explain to Board members and examiners that an adverse change in the NEV ratio is not due to actively seeking/taking more balance sheet risk, but rather due to changes in the environment is a great first step to ensuring the level of risk is communicated effectively, and that the risk is being understood and appropriately managed. Documenting the reason(s) for the changes in ALCO meetings and minutes can help communicate the “Whys” behind the risk profile changes, not just the ratios or the volatilities.

Whether changes in results are due to the financial structure or the external environment, it is valuable to discuss and model potential changes going forward. We are seeing increased uncertainty regarding the potential growth in loans and deposits that may occur in 2020. Additionally, there are a lot of questions regarding the potential yields and cost of funds. These changes can impact planned earnings and the risk profile. This increases the need to run a range of potential budget paths, along with tests to understand the potential risk profile that would occur at the end of each of those paths.